Transformity: Difference between revisions

en>Trivialist copyedit |

en>Mr3641 m →Development: changing emergyt to emergy |

||

| Line 1: | Line 1: | ||

= | {{mergefrom|Inflationary gap|date=March 2012}} | ||

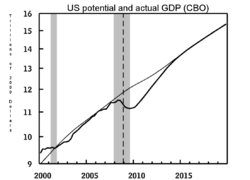

[[Image:Actual potential GDP output gap CBO Jan 09 outlook.png|thumb|250px|Potential (light) and actual (bold) GDP estimates from the Congressional Budget Office. The difference between the two represents the GDP gap.]] | |||

[[Image:2009 Output Gap IMF.png|thumb|250px|IMF estimates of the 2009 output gaps as % of GDP by country]] | |||

The '''[[GDP]] gap''' or the output gap is the difference between [[actual GDP]] or actual output and [[potential GDP]]. The calculation for the output gap is Y–Y* where Y is actual output and Y* is potential output. If this calculation yields a positive number it is called an inflationary gap and indicates the growth of [[aggregate demand]] is outpacing the growth of [[aggregate supply]]—possibly creating [[inflation]]; if the calculation yields a negative number it is called a recessionary gap—possibly signifying [[deflation]].<ref>{{cite book |first=Richard G. |last=Lipsey |first2=Alec |last2=Chrystal |title=Economics |publisher=Oxford University Press |edition=Eleventh |year=2007 |page=423 |isbn=9780199286416 }}</ref> | |||

The percentage GDP gap is the actual GDP minus the potential GDP divided by the potential GDP. | |||

<math>{(GDP_{actual} - GDP_{potential})}\over{GDP_{potential}}</math>. | |||

== | February 2013 data from the Congressional Budget Office showed that the United States had a projected output gap for 2013 of roughly $1 trillion, or nearly 6% of potential GDP.<ref>{{cite web|title=February 2013 Baseline Economic Forecast|url=http://www.cbo.gov/sites/default/files/cbofiles/attachments/43902_EconomicBaselineProjections.xls|publisher=Congressional Budget Office|accessdate=14 November 2013}}</ref> | ||

==Okun's law: the relationship between output and unemployment== | |||

[[Okun's law]] is based on regression analysis of U.S. data that shows a correlation between unemployment and GDP. Okun's law can be stated as: For every 1% increase in [[Unemployment#Cyclical or Keynesian unemployment|cyclical unemployment]] (actual unemployment – [[natural rate of unemployment]]), GDP will decrease by β%. | |||

%Output gap = −β x %Cyclical unemployment | |||

This can also be expressed as: | |||

<math>{{(Y-Y^{*})}\over{Y^{*}}} = -\beta{}(u-\bar{u})</math> | |||

where: | |||

*Y is actual output | |||

*Y* is potential output | |||

*u is actual unemployment | |||

*ū is the natural rate of unemployment | |||

*β is a constant derived from regression to show the link between deviations from natural output and natural unemployment. | |||

==Consequences of a large output gap== | |||

A persistent, large output gap has severe consequences for, among other things, a country's labor market, a country's long-run economic potential, and a country's public finances. First, the longer the output gap persists, the longer the labor market will underperform, as output gaps indicate that workers who would like to work are instead idled because the economy is not producing to capacity. The United States' labor market slack is evident in an October 2013 unemployment rate of 7.3 percent, compared with an average annual rate of 4.6 percent in 2007, before the brunt of the recession struck.<ref>{{cite web|title=Labor Force Statistics from the Current Population Survey|url=http://data.bls.gov/timeseries/LNS14000000|publisher=Bureau of Labor Statistics|accessdate=14 November 2013}}</ref> | |||

Second, the longer a sizable output gap persists, the more damage will be inflicted on an economy’s long-term potential through what economists term “hysteresis effects.” In essence, workers and capital remaining idle for long stretches due to an economy operating below its capacity can cause long-lasting damage to workers and the broader economy.<ref>{{cite web|title=Fiscal Policy in a Depressed Economy|url=http://delong.typepad.com/20120320-conference-draft-final-candidate-delong-summers-brookings-fiscal-policy-in-a-depressed-economy-1.32.pdf|accessdate=14 November 2013|author=Brad DeLong|coauthors=Lawrence Summers}}</ref> For example, the longer jobless workers remain unemployed, the more their skills and professional networks can atrophy, potentially rendering these workers unemployable. For the United States, this concern is especially salient given that the long-term unemployment rate—the share of the unemployed who have been out of work for more than six months—stood at 36.9 percent in September 2013.<ref>{{cite web|title=The Employment Situation—September 2013|url=http://www.bls.gov/news.release/pdf/empsit.pdf|publisher=Bureau of Labor Statistics|accessdate=22 October 2013}}</ref> Also, an underperforming economy can result in reduced investments in areas that pay dividends over the long term, such as education, and research and development. Such reductions are likely to impair an economy’s long-run potential. | |||

Third, a persistent, large output gap can have deleterious effects on a country’s public finances. This is partially because a struggling economy with a weak labor market results in forgone tax revenue, as unemployed or underemployed workers are either paying no income taxes, or paying less in income taxes than they would if fully employed. Additionally, a higher incidence of unemployment increases public spending on safety-net programs (in the United States, these include unemployment insurance, food stamps, Medicaid, and the Temporary Assistance for Needy Families program). Reduced tax revenue and increased public spending both exacerbate budget deficits. Indeed, research has found that for each dollar U.S. gross domestic product moves away from potential output, U.S. cyclical budget deficits increase 37 cents.<ref>{{cite web|title=Cheaper Than You Think: Why Smart Efforts to Spur Jobs Cost Less Than Advertised|url=http://www.epi.org/page/-/pm165/pm165.pdf|publisher=Economic Policy Institute|accessdate=14 November 2013|author=Josh Bivens|coauthors=Kathryn Edwards}}</ref> | |||

==Potential policy responses to the U.S. output gap== | |||

Two proposals put forth by U.S. policymakers in recent years to stimulate the economy (and thereby help close the output gap) are the [[American Jobs Act]] (advanced by President Obama) and the Jobs Through Growth Act (developed by Senate Republicans). | |||

===American Jobs Act=== | |||

The [[American Jobs Act]] reflects the liberal preference for spurring economic growth through stimulating demand, which it would achieve primarily via stimulus spending and reduced taxes on workers.<ref>{{cite web|title=Fact Sheet: The American Jobs Act|url=http://www.whitehouse.gov/the-press-office/2011/09/08/fact-sheet-american-jobs-act|publisher=Office of the White House Press Secretary}}</ref> | |||

In the first year of implementation, Moody’s Analytics estimates the American Jobs Act would create 1.9 million jobs.<ref>{{cite web|title=The American Jobs Act: A Bill Worthy of Its Name|url=http://www.americanprogress.org/issues/labor/report/2011/09/14/10246/the-american-jobs-act/|publisher=Center for American Progress|author=Heather Boushey|coauthors=Gadi Dechter}}</ref> Furthermore, Macroeconomic Advisers, a leading economic forecasting firm, estimates the American Jobs Act would boost GDP by 1.3 percent in its first year, an increase the firm characterizes as “significant.”<ref>{{cite web|title=American Jobs Act: A Significant Boost to GDP and Employment|url=http://macroadvisers.blogspot.com/2011/09/american-jobs-act-significant-boost-to.html|publisher=Macroeconomic Advisers|accessdate=14 November 2013}}</ref> | |||

===Jobs Through Growth Act=== | |||

The Jobs Through Growth Act embodies conservatives’ belief that economic growth is best fostered through supply-side policies such as reducing taxes on the wealthy and cutting regulation, as well as by reducing government spending.<ref>{{cite web|title=Jobs Through Growth Act: The Republican Plan To Put Americans Back To Work|url=http://www.portman.senate.gov/public/index.cfm/files/serve?File_id=46bf4ac7-d376-4aa5-9c57-0cc03ce2ab9f|publisher=Office of Sen. Rob Portman}}</ref> | |||

Setting aside its provision for a balanced budget amendment, the Jobs Through Growth Act would likely have a negligible effect on jobs or GDP in the near term.<ref>{{cite web|title=Man Up: AJ(obs)A vs. J(obs)TGA|url=http://macroadvisers.blogspot.com/2011/10/man-up-ajobsa-vs-jobstga.html|publisher=Macroeconomic Advisers|accessdate=14 November 2013}}</ref> However, if the balanced budget amendment were passed into law, it would result in a drastic reduction in government spending that would exacerbate the output gap.<ref>{{cite web|title=Man Up: AJ(obs)A vs. J(obs)TGA|url=http://macroadvisers.blogspot.com/2011/10/man-up-ajobsa-vs-jobstga.html|publisher=Macroeconomic Advisers|accessdate=14 November 2013}}</ref> | |||

==See also== | |||

* [[Phillips curve]] | |||

* [[ZIRP]] | |||

* [[NAIRU]] | |||

==References== | |||

{{reflist}} | |||

==External links== | |||

* [http://www.cbo.gov/publication/41880] | |||

[[Category:Gross domestic product]] | |||

Latest revision as of 13:03, 1 April 2013

The GDP gap or the output gap is the difference between actual GDP or actual output and potential GDP. The calculation for the output gap is Y–Y* where Y is actual output and Y* is potential output. If this calculation yields a positive number it is called an inflationary gap and indicates the growth of aggregate demand is outpacing the growth of aggregate supply—possibly creating inflation; if the calculation yields a negative number it is called a recessionary gap—possibly signifying deflation.[1]

The percentage GDP gap is the actual GDP minus the potential GDP divided by the potential GDP.

February 2013 data from the Congressional Budget Office showed that the United States had a projected output gap for 2013 of roughly $1 trillion, or nearly 6% of potential GDP.[2]

Okun's law: the relationship between output and unemployment

Okun's law is based on regression analysis of U.S. data that shows a correlation between unemployment and GDP. Okun's law can be stated as: For every 1% increase in cyclical unemployment (actual unemployment – natural rate of unemployment), GDP will decrease by β%.

%Output gap = −β x %Cyclical unemployment

This can also be expressed as:

where:

- Y is actual output

- Y* is potential output

- u is actual unemployment

- ū is the natural rate of unemployment

- β is a constant derived from regression to show the link between deviations from natural output and natural unemployment.

Consequences of a large output gap

A persistent, large output gap has severe consequences for, among other things, a country's labor market, a country's long-run economic potential, and a country's public finances. First, the longer the output gap persists, the longer the labor market will underperform, as output gaps indicate that workers who would like to work are instead idled because the economy is not producing to capacity. The United States' labor market slack is evident in an October 2013 unemployment rate of 7.3 percent, compared with an average annual rate of 4.6 percent in 2007, before the brunt of the recession struck.[3]

Second, the longer a sizable output gap persists, the more damage will be inflicted on an economy’s long-term potential through what economists term “hysteresis effects.” In essence, workers and capital remaining idle for long stretches due to an economy operating below its capacity can cause long-lasting damage to workers and the broader economy.[4] For example, the longer jobless workers remain unemployed, the more their skills and professional networks can atrophy, potentially rendering these workers unemployable. For the United States, this concern is especially salient given that the long-term unemployment rate—the share of the unemployed who have been out of work for more than six months—stood at 36.9 percent in September 2013.[5] Also, an underperforming economy can result in reduced investments in areas that pay dividends over the long term, such as education, and research and development. Such reductions are likely to impair an economy’s long-run potential.

Third, a persistent, large output gap can have deleterious effects on a country’s public finances. This is partially because a struggling economy with a weak labor market results in forgone tax revenue, as unemployed or underemployed workers are either paying no income taxes, or paying less in income taxes than they would if fully employed. Additionally, a higher incidence of unemployment increases public spending on safety-net programs (in the United States, these include unemployment insurance, food stamps, Medicaid, and the Temporary Assistance for Needy Families program). Reduced tax revenue and increased public spending both exacerbate budget deficits. Indeed, research has found that for each dollar U.S. gross domestic product moves away from potential output, U.S. cyclical budget deficits increase 37 cents.[6]

Potential policy responses to the U.S. output gap

Two proposals put forth by U.S. policymakers in recent years to stimulate the economy (and thereby help close the output gap) are the American Jobs Act (advanced by President Obama) and the Jobs Through Growth Act (developed by Senate Republicans).

American Jobs Act

The American Jobs Act reflects the liberal preference for spurring economic growth through stimulating demand, which it would achieve primarily via stimulus spending and reduced taxes on workers.[7]

In the first year of implementation, Moody’s Analytics estimates the American Jobs Act would create 1.9 million jobs.[8] Furthermore, Macroeconomic Advisers, a leading economic forecasting firm, estimates the American Jobs Act would boost GDP by 1.3 percent in its first year, an increase the firm characterizes as “significant.”[9]

Jobs Through Growth Act

The Jobs Through Growth Act embodies conservatives’ belief that economic growth is best fostered through supply-side policies such as reducing taxes on the wealthy and cutting regulation, as well as by reducing government spending.[10]

Setting aside its provision for a balanced budget amendment, the Jobs Through Growth Act would likely have a negligible effect on jobs or GDP in the near term.[11] However, if the balanced budget amendment were passed into law, it would result in a drastic reduction in government spending that would exacerbate the output gap.[12]

See also

References

43 year old Petroleum Engineer Harry from Deep River, usually spends time with hobbies and interests like renting movies, property developers in singapore new condominium and vehicle racing. Constantly enjoys going to destinations like Camino Real de Tierra Adentro.

External links

- ↑ 20 year-old Real Estate Agent Rusty from Saint-Paul, has hobbies and interests which includes monopoly, property developers in singapore and poker. Will soon undertake a contiki trip that may include going to the Lower Valley of the Omo.

My blog: http://www.primaboinca.com/view_profile.php?userid=5889534 - ↑ Template:Cite web

- ↑ Template:Cite web

- ↑ Template:Cite web

- ↑ Template:Cite web

- ↑ Template:Cite web

- ↑ Template:Cite web

- ↑ Template:Cite web

- ↑ Template:Cite web

- ↑ Template:Cite web

- ↑ Template:Cite web

- ↑ Template:Cite web