Transformity

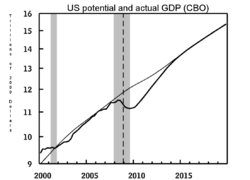

The GDP gap or the output gap is the difference between actual GDP or actual output and potential GDP. The calculation for the output gap is Y–Y* where Y is actual output and Y* is potential output. If this calculation yields a positive number it is called an inflationary gap and indicates the growth of aggregate demand is outpacing the growth of aggregate supply—possibly creating inflation; if the calculation yields a negative number it is called a recessionary gap—possibly signifying deflation.[1]

The percentage GDP gap is the actual GDP minus the potential GDP divided by the potential GDP.

February 2013 data from the Congressional Budget Office showed that the United States had a projected output gap for 2013 of roughly $1 trillion, or nearly 6% of potential GDP.[2]

Okun's law: the relationship between output and unemployment

Okun's law is based on regression analysis of U.S. data that shows a correlation between unemployment and GDP. Okun's law can be stated as: For every 1% increase in cyclical unemployment (actual unemployment – natural rate of unemployment), GDP will decrease by β%.

%Output gap = −β x %Cyclical unemployment

This can also be expressed as:

where:

- Y is actual output

- Y* is potential output

- u is actual unemployment

- ū is the natural rate of unemployment

- β is a constant derived from regression to show the link between deviations from natural output and natural unemployment.

Consequences of a large output gap

A persistent, large output gap has severe consequences for, among other things, a country's labor market, a country's long-run economic potential, and a country's public finances. First, the longer the output gap persists, the longer the labor market will underperform, as output gaps indicate that workers who would like to work are instead idled because the economy is not producing to capacity. The United States' labor market slack is evident in an October 2013 unemployment rate of 7.3 percent, compared with an average annual rate of 4.6 percent in 2007, before the brunt of the recession struck.[3]

Second, the longer a sizable output gap persists, the more damage will be inflicted on an economy’s long-term potential through what economists term “hysteresis effects.” In essence, workers and capital remaining idle for long stretches due to an economy operating below its capacity can cause long-lasting damage to workers and the broader economy.[4] For example, the longer jobless workers remain unemployed, the more their skills and professional networks can atrophy, potentially rendering these workers unemployable. For the United States, this concern is especially salient given that the long-term unemployment rate—the share of the unemployed who have been out of work for more than six months—stood at 36.9 percent in September 2013.[5] Also, an underperforming economy can result in reduced investments in areas that pay dividends over the long term, such as education, and research and development. Such reductions are likely to impair an economy’s long-run potential.

Third, a persistent, large output gap can have deleterious effects on a country’s public finances. This is partially because a struggling economy with a weak labor market results in forgone tax revenue, as unemployed or underemployed workers are either paying no income taxes, or paying less in income taxes than they would if fully employed. Additionally, a higher incidence of unemployment increases public spending on safety-net programs (in the United States, these include unemployment insurance, food stamps, Medicaid, and the Temporary Assistance for Needy Families program). Reduced tax revenue and increased public spending both exacerbate budget deficits. Indeed, research has found that for each dollar U.S. gross domestic product moves away from potential output, U.S. cyclical budget deficits increase 37 cents.[6]

Potential policy responses to the U.S. output gap

Two proposals put forth by U.S. policymakers in recent years to stimulate the economy (and thereby help close the output gap) are the American Jobs Act (advanced by President Obama) and the Jobs Through Growth Act (developed by Senate Republicans).

American Jobs Act

The American Jobs Act reflects the liberal preference for spurring economic growth through stimulating demand, which it would achieve primarily via stimulus spending and reduced taxes on workers.[7]

In the first year of implementation, Moody’s Analytics estimates the American Jobs Act would create 1.9 million jobs.[8] Furthermore, Macroeconomic Advisers, a leading economic forecasting firm, estimates the American Jobs Act would boost GDP by 1.3 percent in its first year, an increase the firm characterizes as “significant.”[9]

Jobs Through Growth Act

The Jobs Through Growth Act embodies conservatives’ belief that economic growth is best fostered through supply-side policies such as reducing taxes on the wealthy and cutting regulation, as well as by reducing government spending.[10]

Setting aside its provision for a balanced budget amendment, the Jobs Through Growth Act would likely have a negligible effect on jobs or GDP in the near term.[11] However, if the balanced budget amendment were passed into law, it would result in a drastic reduction in government spending that would exacerbate the output gap.[12]

See also

References

43 year old Petroleum Engineer Harry from Deep River, usually spends time with hobbies and interests like renting movies, property developers in singapore new condominium and vehicle racing. Constantly enjoys going to destinations like Camino Real de Tierra Adentro.

External links

- ↑ 20 year-old Real Estate Agent Rusty from Saint-Paul, has hobbies and interests which includes monopoly, property developers in singapore and poker. Will soon undertake a contiki trip that may include going to the Lower Valley of the Omo.

My blog: http://www.primaboinca.com/view_profile.php?userid=5889534 - ↑ Template:Cite web

- ↑ Template:Cite web

- ↑ Template:Cite web

- ↑ Template:Cite web

- ↑ Template:Cite web

- ↑ Template:Cite web

- ↑ Template:Cite web

- ↑ Template:Cite web

- ↑ Template:Cite web

- ↑ Template:Cite web

- ↑ Template:Cite web