Probable error

Positive abnormal return (α): Above-average returns that cannot be explained as compensation for added risk

Negative abnormal returns (α): Below-average returns that cannot be explained by below-market risk

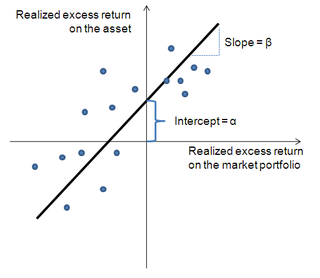

Security characteristic line (SCL) is a regression line,[1] plotting performance of a particular security or portfolio against that of the market portfolio at every point in time. The SCL is plotted on a graph where the Y-axis is the excess return on a security over the risk-free return and the X-axis is the excess return of the market in general. The slope of the SCL is the security's beta, and the intercept is its alpha.[2]

Formula

where:

- αi is called the asset's alpha (abnormal return)

- βi(RM,t – Rf) is a nondiversifiable or systematic risk

- εi,t is the non-systematic or diversifiable, non-market or idiosyncratic risk

- RM,t is a market risk

- Rf is a risk-free rate

See also

References

43 year old Petroleum Engineer Harry from Deep River, usually spends time with hobbies and interests like renting movies, property developers in singapore new condominium and vehicle racing. Constantly enjoys going to destinations like Camino Real de Tierra Adentro.