Chordal problem

Template:Taxation Taxation in Norway is levied by the central government, the county municipality (fylkeskommune) and the municipality (kommune). In 2009 the total tax revenue was 41.0% of the gross domestic product (GDP). Many direct and indirect taxes exist. The most important taxes—in terms of revenue—are income tax and VAT. Most direct taxes are collected by the Norwegian Tax Administration (Skatteetaten) and most indirect taxes are collected by the Norwegian Customs and Excise Authorities (Toll- og avgiftsetaten).

The Norwegian word for tax is skatt, which originates from the Old Norse word skattr.[1]

Taxation in the Constitution

According to the Norwegian Constitution, the Storting is to be the final authority in matters concerning the finances of the State - expenditures as well as revenues. This follows from Article 75a of the Norwegian Constitution:

- It devolves upon the Storting ... to impose taxes, duties, customs and other public charges, which shall not, however, remain operative beyond 31 December of the succeeding year, unless they are expressly renewed by a new Storting;[2]

The Ministry of Finance sets up the Governments tax program, which is included in the fiscal budget proposal. The Budget is submitted to the Storting as Proposition No. 1 to the Storting.[3]

Tax administration

In order to implement the tax program decided by the Storting, the Ministry of Finance is supported by two subordinate agencies and bodies.

The Tax Administration (Skatteetaten) ensures that taxes are set and collected in the correct manner. It issues tax cards, collects advance tax and checks the tax-return forms that are required to be submitted each year. The Tax Administration also determines and monitors national insurance contributions, and value-added tax and are responsible for providing professional guidance and instruction to local tax collection offices that collect direct taxes.[4]

The Customs and Excise Authorities (Toll- og avgiftsetaten) ensures that customs and excise duties are correctly levied and paid on time. In addition, they are responsible for preventing the illegal import and export of goods in Norway. The customs and excise authorities set and collect customs duties, value-added tax on imports and special duties.[5]

Tax level

In 2009, the total tax revenue was 41.0% of the gross domestic product (GDP). Of the OECD member countries Denmark, Sweden, Belgium, Italy, France, Finland and Austria had a higher tax level than Norway in 2009. The tax level in Norway has fluctuated between 40 and 45% of GDP since the 1970s.[6]

The relatively high tax level is a result of the large Norwegian welfare state. Most of the tax revenue is spent on public services such as health services, the operation of hospitals, education and transportation.[7]

Revenue levels are also influenced by the important role played by oil and gas extraction in the Norwegian economy.

Allocation of tax revenues

In 2010, 86% of taxes were paid to the central government, 2% were paid to regional government, while local government received 12% of the total tax revenue.

The main revenue sources for the central government are VAT, tax on income in the petroleum sector, employers’ social security contributions and tax on "ordinary income" from individual taxpayers, while the main revenue source for local and regional authorities is tax on "ordinary income" from individual taxpayers.

The table below provides a general overview of the main groups of taxes and shows which parts of the public sector that receive revenue from each main group.

| Central government | Local government | Regional government | In total | |

|---|---|---|---|---|

| Individual taxpayers | 218.5 | 115.9 | 22.2 | 356.7 |

| Tax on "ordinary income" | 104.5 | 107.4 | 22.2 | 234.2 |

| Surtax | 19.0 | - | - | 19.0 |

| Employee’s and self-employed’s social security contributions | 90.2 | - | - | 90.2 |

| Tax on net wealth | 4.8 | 8.5 | - | 13.3 |

| Businesses (whose taxes are payable the year after the income year) | 59.2 | 1.3 | 0.2 | 60.8 |

| Income tax (including power stations) | 58.9 | 1.3 | 0.2 | 60.4 |

| Tax on net wealth | 0.3 | - | - | 0.3 |

| Property tax | - | 6.6 | - | 6.6 |

| Employers’ social security contributions | 132.0 | - | - | 132.0 |

| Indirect taxes | 290.7 | - | - | 290.7 |

| VAT | 194.4 | - | - | 194.4 |

| Excise duties and customs duties | 96.3 | - | - | 96.3 |

| Petroleum | 181.4 | - | - | 181.4 |

| Tax on income | 177.6 | - | - | 177.6 |

| Extraction tax | 3.8 | - | - | 3.8 |

| Other direct and indirect taxes | 27.8 | 0.5 | - | 28.4 |

| Social security and pension premiums, other central government and social security accounts | 21.0 | - | - | 21.0 |

| Tax on dividends to foreign shareholders | 1.7 | - | - | 1.7 |

| Inheritance and gift tax | 2.2 | - | - | 2.2 |

| Other taxes | 2.9 | 0.5 | - | 3.4 |

| Total direct and indirect taxes | 909.7 | 124.3 | 22.5 | 1 056.5 |

| Of which direct taxes | 619.0 | 124.3 | 22.5 | 765.8 |

Direct taxes

Personal income tax

Norway has, like several other Nordic countries, adopted a dual income tax. Under the dual income tax, income from labour and pensions is taxed at progressive rates, while capital income is taxed at a flat rate.[9]

Employee's and self-employed's social security contributions

Social security contribution (trygdeavgift) is levied on "personal income" (personinntekt). Personal income includes wage income and business income due to active efforts, but generally not capital income, and there is no deductions in labor income and limited right to charge a deduction from business income. The tax rate is 3.0% for pension income, 7.8% for wage income and 11% for other business income.[8]

No social security contribution is paid for income below the "exemption card threshold" (frikortgrense). This threshold is NOK 39 997 in 2010.[10] Then, social security contribution is paid at a levelling rate of 25% (of the income above NOK 39 600) until this gives a higher total tax than using the standard tax rate on all personal income. Then the general rates are used.[8]

| Lower threshold for payment of employee’s social security contribution | NOK 39 600 |

| Levelling rate | 25.0 % |

| Rate | |

| Wage income | 7.8 % |

| Income from self-employment in primary sector | 7.8 % |

| Income from other self-employment | 11.0 % |

| Pension income, etc. | 4.7 % |

Tax on "ordinary income"

Ordinary income (alminnelig inntekt), which consists of all taxable income (wages, pensions, business income, taxable share income and other income) minus deductions (losses, debt interest, etc.), is taxed at a flat rate of 28%. In 2010, the tax on "ordinary income" is split in a local tax (kommunale skattøre) of 12.80%, a regional tax (fylkeskommunale skattøre) of 2.65% and a tax to the central government (fellesskatt) of 12.55%.[11]

Deductions

The current income tax system has two standard deductions: basic allowance (minstefradrag) and personal allowance (personfradrag).

The basic allowance is set as a proportion of the income with upper and lower limits. For wage income, the rate is 36% and the upper limit is NOK 72,800 in 2010. The lower limit is the so-called special wage income allowance (lønnsfradrag), which is NOK 31,800 in 2010. The basic allowance in pension income is slightly lower than the basic allowance in wage income. In 2010, the rate was 26% with a lower limit of NOK 4,000 and an upper limit of NOK 60,950.[8]

The personal allowance is a standard deduction from ordinary income, meaning that it is given in all income (wages, pensions, capital and business income). Single parents and married couples where one spouse has a low income may be taxed in Class 2 and thus given double personal allowance. In 2010, the personal allowance was NOK 42,210 in Class 1 and NOK 84,420 in Class 2.[8]

| Personal allowance | |

| Class 1 | NOK 42,210 |

| Class 2 | NOK 84,420 |

| Basic allowance in wage income | |

| Rate | 36.0 % |

| Lower limit | NOK 4,000 |

| Upper limit | NOK 72,800 |

| Basic allowance in pension income | |

| Rate | 26.0 % |

| Lower limit | NOK 4,000 |

| Upper limit | NOK 60,950 |

| Special wage income allowance | NOK 31,800 |

Ordinary income is a net income concept, meaning that it will be deduction for costs incurred to acquire income. There is therefore a deduction for expenses related to acquisition of income if these are higher than the basic allowance. There is also several other deductions from ordinary income; special allowance for disability, special tax allowance for pensioners, the tax limitation rule for the disabled, seamen’s allowance, fishermen’s allowance, special allowance for self-employed within agriculture, special allowance for high expenses linked to illness, allowance for payments to individual pension schemes, allowance for travel between home and work, allowance for donations to voluntary organisations, allowance for paid union fees, allowance for home investment savings scheme for people under 34 years, parental allowance for documented expenses for childminding and childcare, etc.[8]

The shareholder model (aksjonærmodellen) implies that dividends exceeding a risk-free return on the investment (the cost base of the shares) are taxed as "ordinary income" when distributed to personal shareholders. When added to the 28% company taxation, this gives a total maximum marginal tax rate on dividends of 48.16% (0.28+0.72*0.28).[12] The 2014 corporate tax rate is 27% giving a marginal tax rate on dividents of %46.71.[13]

The part of the dividend that is not exceeding a risk-free return on the investment, is not taxed on the hand of the shareholder, and is thus subject to the 28% company taxation only. If the dividend for one year is less than the calculated risk-free interest, the surplus tax free amount can be carried forward to be offset against dividends distributed a later year, or against any capital gain from the alienation of the same share.[12]

The shielding method for partnerships

The shielding method for partnerships (skjermingsmetoden for deltakerlignede selskaper or deltakermodellen) implies that the partners are subject to 28% taxation upon all income irrespective of distribution, supplemented by 28% additional taxation on distributed profits. In order to compensate for the initial 28% taxation, only 72% of the distributed profit will be taxable. Furthermore, only the distributed profit exceeding a risk-free interest on the capital invested in the partnership will be taxable. The maximum marginal tax rate of distributed income will be 48.16 percent (0.28+0.72*0.28).[12]

The shielding method for self-employed individuals

The shielding method for self-employed individuals (skjermingsmetoden for enkeltpersonforetak or foretaksmodellen) implies that business profits exceeding a risk-free interest on the capital invested is taxed as personal income (the tax base for social security contributions and suretax).[12]

Surtax

The personal income surtax (toppskatt) is, as the employee’s and self-employed’s social security contributions, levied on "personal income". In 2010, the surtax is 9% for income that exceeds NOK 456 400 (the threshold for step 1) and 12% for income that exceeds NOK 741 700 (the threshold for step 2).[8]

| Bracket 1 | |

| Threshold | NOK 456 400 |

| Rate | 9.0 % |

| Bracket 2 | |

| Threshold | NOK 741 700 |

| Rate | 12.0 % |

Employers' social security contribution

Employers in both private and public sector is obliged to pay the employer's social security contribution on labour costs. The employers’ social security contribution are regionally differentiated, so that the tax rate depends on where the business is located. In 2010, the rates vary from 0% to 14.1%.[8]

When the employers' social security contribution is included, the maximum marginal tax rate on labour costs is 54,3%.[8]

Corporate taxation

Corporate taxable profits (ordinary income) are taxes at a flat rate of 28%. The tax base is the sum of operating profit/loss, financial revenues and net capital gains minus tax depreciation. In addition, the profit is taxed on the owner's hand through dividend and capital gain taxation.[12]

The exemption method

The exemption method (Template:Lang-no) implies that limited companies are exempted from tax on dividends and on capital gains from the alienation of shares, correspondingly the right to deduct losses on shares was abolished. Combined with the proposal of a model for taxation of individual shareholders (the shareholders model), dividends and gains on shares will be taxed on extraction from the company sector, and only to the extent such income exceeds a risk-free rate of return.[14]

Taxation of petroleum activities

The taxation of petroleum activities is based on the rules governing ordinary business taxation. There is considerable excess return (resource rent) associated with the extraction of oil and gas. Therefore a special tax of 50% on income from petroleum extraction has been introduced, in addition to the ordinary income tax of 28%. Consequently, the marginal tax rate on the excess return within the petroleum sector is 78%.[15]

Taxation of power plants

The taxation of power plants is based on the rules governing ordinary business taxation. There is considerable excess return (resource rent) associated with the production of hydro power. Therefore a special tax of 30% on income from hydro power plants has been introduced, in addition to the ordinary income tax of 28%. Consequently, the marginal tax rate on the excess return within the power sector is 58%.[16][17]

Taxation of shipping income

Shipping companies shipping income is exempted from income taxation, but they pay a tonnage tax of vessels they own, and in some cases the vessel they hire. The tax is based on vessels net tonnage (tons). This tonnage tax must be paid regardless of whether the vessel has been in operation or not.[18][19]

Tax on net wealth

Wealth tax is levied at both municipal and central government level. The tax base is net wealth less a basic deduction. In 2010, the basic deduction is NOK 700 000 (NOK 1 400 000 for married couples). As a consequence of basic deduction in combination with gentle assessment rules, especially of housing, the wealth tax is of little importance to most tax-paying households. The municipal tax rate is 0.7%, while the national tax rate is 0.4%.[8]

Inheritance and gift tax

The inheritance tax in Norway was abolished in 2014.[20]

Before the abolshment the inheritance and gift tax, had a zero rate for taxable amounts up to NOK 470 000. From this level, the rates ranged from 6% to 15% depending on the status of the beneficiary and the size of the taxable amount.[8]

| Threshold | |

| Level 1 | NOK 470 000 |

| Level 2 | NOK 800 000 |

| Rates | |

| Children and parents | |

| Level 1 | 6.0 % |

| Level 2 | 10.0 % |

| Other beneficiaries | |

| Level 1 | 8.0 % |

| Level 2 | 15.0 % |

Property tax

The municipal councils may choose to impose property taxes in accordance with the Property Tax Law. All property owners may be obliged to pay this tax. The tax is calculated as being between 0.2% and 0.7% of a property's value.[21] In 2009, 299 municipalities had chosen to tax property and 131 municipalities had chosen not to impose property tax.[22]

Indirect taxes

Value added tax

Value added tax (Template:Lang-no) is a tax on consumption that must be paid on domestic sales of goods and services liable for tax in all links in the chain of distribution and on imports. The rates for VAT for 2013 are as follows:

- 25% general rate

- 15% on foodstuffs

- 8% on the supply of passenger transport services and the procurement of such services, on the letting of hotel rooms and holiday homes, and on transport services regarding the ferrying of vehicles as part of the domestic road network. The same rate applies to cultural events, museums, cinema tickets and to the television license.[8]

In principle, all sales of goods and services are liable to VAT. However, some supplies are exempt (without a credit for input tax), which means that such supplies fall entirely outside the scope of the VAT Act. Businesses that only have such supplies cannot register for VAT, and are not entitled to deduct VAT. Financial services, health services, social services and educational services are all outside the scope of the VAT Act.[23]

Some supplies are zero-rated (exempt with a credit for input tax). When a supply is zero-rated, it means that the supply falls within the scope of the VAT Act, but output VAT shall not be calculated as the rate is zero. Newspapers, books and periodicals are zero-rated.[24]

Excise duties

Excise duties (Template:Lang-no) are taxes levied on particular goods and services, of foreign or domestic origin. In addition there are excise duties connected to ownership or change of ownership of certain goods and real property. Revenues mostly derive from the former category.

Excise duties can be on purely fiscal grounds, i.e. that they only intend to raise the state income, but excise duties can also be used as an instrument to correct for external effects, such as related to the use of health and environmentally damaging products.

The most important excise duties in Norway, in terms of revenue, are tax on alcoholic beverages, tax on tobacco goods, motor vehicle registration tax, annual tax on motor vehicles, road use tax on petrol, road use tax on diesel, electricity consumption tax, CO2 tax and stamp duty.[8]

Customs duties

Customs duties (Template:Lang-no) shall be paid upon importation of goods. The "ordinary" rate of the Customs Tariffs applies for goods imported from countries with whom Norway has not entered into a free trade agreement (FTA), and for goods imported from a FTA-party, but not satisfying by the conditions for preferential tariff treatment as set out in these agreements. All products originating in the Least Developed Countries are granted duty-free treatment[25]

The customs duties on agricultural products is an important part of the overall support for Norwegian agriculture. Of manufacturing goods only some clothing and textiles are currently subject to customs duties.

History

Middle Ages

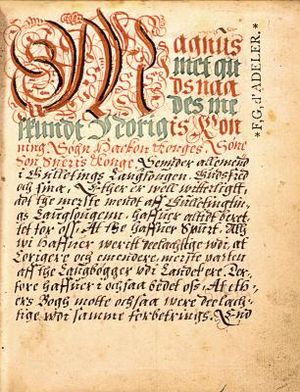

National Archival Services of Norway

Taxation in Norway can be traced back to the petty kingdoms before the unification of Norway. The kings of the petty kingdoms were not permanent residents of one single royal estate, but were moving around in their kingdom, staying for a while at royal estates in each part of it. The peasants in the area where the king stayed, were obliged to provide payment in kind to the king and his entourage. This obligation is called veitsle. This performance of the peasants to their king, has most likely been an important and necessary source of income for the petty kingdoms and made it possible for the king and his entourage to live off the profits from the farming society.[26]Primarily based on the most recent URA personal property value index (PPPI) flash estimates, we know that the PPPI, which represents the overall real property price development, has dipped in 2013Q4. That is the first dip the market has seen within the final 2 years.

To give you some perspective, the entire number of personal properties in Singapore (together with govt condominiums) is 297,689 in 2013Q3. Primarily based on the projection that there will be 19,302 units accomplished in 2014, the rise in residential models works out to be more than 6%. With a lot New Ec Launch Singapore provide, buyers might be spoilt for alternative and this in flip will lead to their reluctance to pay a premium for potential models. The complete textual content of the Copyright Act (Cap sixty three) and different statutes regarding IPR might be found on the Singapore Statutes Online Website online The Group's income jumped forty.1 p.c to $324.5 million from $231.6 million in FY 2013, lifted by increased development income and sales of growth properties in Singapore and China. Actual Estate Shopping for

One factor we've on this nation is a big group of "economists," and "market analysts." What's interesting about this group of real property market-watchers is that there are two very other ways wherein they predict Boomers will affect housing markets over the subsequent decade. Let's check out those two opposites and see how every can change the best way real property investors strategy their markets. The good news is that actual property buyers are prepared for either state of affairs, and there's profit in being ready. I'm excited and searching ahead to the alternatives both or each of these conditions will supply; thank you Boomers! Mapletree to further broaden past Asia Why fortune will favour the brave in Asia's closing real property frontier

The story of the 23.2 home begins with a stack of Douglas fir beams salvaged from varied demolished warehouses owned by the consumer's household for a number of generations. Design and structure innovator Omer Arbel, configured them to type a triangulated roof, which makes up one of the placing features of the home. The transient from the entrepreneur-proprietor was not solely to design a house that integrates antique wood beams, however one which erases the excellence between inside and exterior. Built on a gentle slope on a large rural acreage surrounded by two masses of previous-development forests, the indoors movement seamlessly to the outdoors and, from the within looking, one enjoys unobstructed views of the existing natural panorama which is preserved

First, there are typically extra rental transactions than gross sales transactions, to permit AV to be decided for each property primarily based on comparable properties. Second, movements in sale costs are more unstable than leases. Hence, utilizing rental transactions to derive the AV helps to maintain property tax more steady for property homeowners. If you're buying or trying to lease a property. It's tiring to call up individual property agent, organize appointments, coordinate timing and to go for particular person property viewing. What most individuals do is to have a property agent representing them who will arrange and coordinate the viewings for all the properties out there based mostly on your necessities & most well-liked timing. Rent Property District 12 Rent Property District thirteen

The Annual Worth of a property is mostly derived based mostly on the estimated annual hire that it may well fetch if it have been rented out. In determining the Annual Worth of a property, IRAS will think about the leases of similar properties within the vicinity, dimension and condition of the property, and different relevant components. The Annual Worth of a property is determined in the identical method regardless of whether the property is let-out, proprietor-occupied or vacant. The Annual Worth of land is determined at 5% of the market price of the land. When a constructing is demolished, the Annual Worth of the land is assessed by this method. Property Tax on Residential Properties Buyer Stamp Responsibility on Buy of Properties – Business and residential properties Rent House District 01

Within the event the Bank's valuation is decrease than the acquisition price, the purchaser has to pay the distinction between the purchase value and the Bank's valuation utilizing money. As such, the money required up-front might be increased so it's at all times essential to know the valuation of the property before making any offer. Appoint Lawyer The Bank will prepare for a proper valuation of the property by way of physical inspection The completion statement will present you the balance of the acquisition price that you must pay after deducting any deposit, pro-rated property tax and utility costs, upkeep prices, and different relevant expenses in addition to any fees payable to the agent and the lawyer. Stamp Responsibility Primarily based on the Purchase Price or Market Value, whichever is larger Veitsle was continued when the unified Norwegian kingdom arose. The early national kingdom had in addition other casual tax revenues like finnskatt (and possibly tax revenues from Shetland, Orkney, the Faroes and Hebrides) and trade and travel fees (landaurar).[26]Primarily based on the most recent URA personal property value index (PPPI) flash estimates, we know that the PPPI, which represents the overall real property price development, has dipped in 2013Q4. That is the first dip the market has seen within the final 2 years.

To give you some perspective, the entire number of personal properties in Singapore (together with govt condominiums) is 297,689 in 2013Q3. Primarily based on the projection that there will be 19,302 units accomplished in 2014, the rise in residential models works out to be more than 6%. With a lot New Ec Launch Singapore provide, buyers might be spoilt for alternative and this in flip will lead to their reluctance to pay a premium for potential models. The complete textual content of the Copyright Act (Cap sixty three) and different statutes regarding IPR might be found on the Singapore Statutes Online Website online The Group's income jumped forty.1 p.c to $324.5 million from $231.6 million in FY 2013, lifted by increased development income and sales of growth properties in Singapore and China. Actual Estate Shopping for

One factor we've on this nation is a big group of "economists," and "market analysts." What's interesting about this group of real property market-watchers is that there are two very other ways wherein they predict Boomers will affect housing markets over the subsequent decade. Let's check out those two opposites and see how every can change the best way real property investors strategy their markets. The good news is that actual property buyers are prepared for either state of affairs, and there's profit in being ready. I'm excited and searching ahead to the alternatives both or each of these conditions will supply; thank you Boomers! Mapletree to further broaden past Asia Why fortune will favour the brave in Asia's closing real property frontier

The story of the 23.2 home begins with a stack of Douglas fir beams salvaged from varied demolished warehouses owned by the consumer's household for a number of generations. Design and structure innovator Omer Arbel, configured them to type a triangulated roof, which makes up one of the placing features of the home. The transient from the entrepreneur-proprietor was not solely to design a house that integrates antique wood beams, however one which erases the excellence between inside and exterior. Built on a gentle slope on a large rural acreage surrounded by two masses of previous-development forests, the indoors movement seamlessly to the outdoors and, from the within looking, one enjoys unobstructed views of the existing natural panorama which is preserved

First, there are typically extra rental transactions than gross sales transactions, to permit AV to be decided for each property primarily based on comparable properties. Second, movements in sale costs are more unstable than leases. Hence, utilizing rental transactions to derive the AV helps to maintain property tax more steady for property homeowners. If you're buying or trying to lease a property. It's tiring to call up individual property agent, organize appointments, coordinate timing and to go for particular person property viewing. What most individuals do is to have a property agent representing them who will arrange and coordinate the viewings for all the properties out there based mostly on your necessities & most well-liked timing. Rent Property District 12 Rent Property District thirteen

The Annual Worth of a property is mostly derived based mostly on the estimated annual hire that it may well fetch if it have been rented out. In determining the Annual Worth of a property, IRAS will think about the leases of similar properties within the vicinity, dimension and condition of the property, and different relevant components. The Annual Worth of a property is determined in the identical method regardless of whether the property is let-out, proprietor-occupied or vacant. The Annual Worth of land is determined at 5% of the market price of the land. When a constructing is demolished, the Annual Worth of the land is assessed by this method. Property Tax on Residential Properties Buyer Stamp Responsibility on Buy of Properties – Business and residential properties Rent House District 01

Within the event the Bank's valuation is decrease than the acquisition price, the purchaser has to pay the distinction between the purchase value and the Bank's valuation utilizing money. As such, the money required up-front might be increased so it's at all times essential to know the valuation of the property before making any offer. Appoint Lawyer The Bank will prepare for a proper valuation of the property by way of physical inspection The completion statement will present you the balance of the acquisition price that you must pay after deducting any deposit, pro-rated property tax and utility costs, upkeep prices, and different relevant expenses in addition to any fees payable to the agent and the lawyer. Stamp Responsibility Primarily based on the Purchase Price or Market Value, whichever is larger

The second important tax that emerged during the unification was the leidang. This was originally a defensive scheme where all armed men would meet and fight for their king when peace was threatened, but in Norway the leidang evolved to primarily be a naval defence. The agreement between the king and his people must from the beginning have included a crew arrangement and an outfitting and provisioning system. The most important regular, often annual burden for the population, must have been the dietary performance to the crew of the leidang fleet. The provisioning system soon developed into a regular tax, the leidang tax. The leidang was codified in the provincial laws (Gulating law and Frostating law) and later in Magnus Lagabøte’s landslov.[26]Primarily based on the most recent URA personal property value index (PPPI) flash estimates, we know that the PPPI, which represents the overall real property price development, has dipped in 2013Q4. That is the first dip the market has seen within the final 2 years.

To give you some perspective, the entire number of personal properties in Singapore (together with govt condominiums) is 297,689 in 2013Q3. Primarily based on the projection that there will be 19,302 units accomplished in 2014, the rise in residential models works out to be more than 6%. With a lot New Ec Launch Singapore provide, buyers might be spoilt for alternative and this in flip will lead to their reluctance to pay a premium for potential models. The complete textual content of the Copyright Act (Cap sixty three) and different statutes regarding IPR might be found on the Singapore Statutes Online Website online The Group's income jumped forty.1 p.c to $324.5 million from $231.6 million in FY 2013, lifted by increased development income and sales of growth properties in Singapore and China. Actual Estate Shopping for

One factor we've on this nation is a big group of "economists," and "market analysts." What's interesting about this group of real property market-watchers is that there are two very other ways wherein they predict Boomers will affect housing markets over the subsequent decade. Let's check out those two opposites and see how every can change the best way real property investors strategy their markets. The good news is that actual property buyers are prepared for either state of affairs, and there's profit in being ready. I'm excited and searching ahead to the alternatives both or each of these conditions will supply; thank you Boomers! Mapletree to further broaden past Asia Why fortune will favour the brave in Asia's closing real property frontier

The story of the 23.2 home begins with a stack of Douglas fir beams salvaged from varied demolished warehouses owned by the consumer's household for a number of generations. Design and structure innovator Omer Arbel, configured them to type a triangulated roof, which makes up one of the placing features of the home. The transient from the entrepreneur-proprietor was not solely to design a house that integrates antique wood beams, however one which erases the excellence between inside and exterior. Built on a gentle slope on a large rural acreage surrounded by two masses of previous-development forests, the indoors movement seamlessly to the outdoors and, from the within looking, one enjoys unobstructed views of the existing natural panorama which is preserved

First, there are typically extra rental transactions than gross sales transactions, to permit AV to be decided for each property primarily based on comparable properties. Second, movements in sale costs are more unstable than leases. Hence, utilizing rental transactions to derive the AV helps to maintain property tax more steady for property homeowners. If you're buying or trying to lease a property. It's tiring to call up individual property agent, organize appointments, coordinate timing and to go for particular person property viewing. What most individuals do is to have a property agent representing them who will arrange and coordinate the viewings for all the properties out there based mostly on your necessities & most well-liked timing. Rent Property District 12 Rent Property District thirteen

The Annual Worth of a property is mostly derived based mostly on the estimated annual hire that it may well fetch if it have been rented out. In determining the Annual Worth of a property, IRAS will think about the leases of similar properties within the vicinity, dimension and condition of the property, and different relevant components. The Annual Worth of a property is determined in the identical method regardless of whether the property is let-out, proprietor-occupied or vacant. The Annual Worth of land is determined at 5% of the market price of the land. When a constructing is demolished, the Annual Worth of the land is assessed by this method. Property Tax on Residential Properties Buyer Stamp Responsibility on Buy of Properties – Business and residential properties Rent House District 01

Within the event the Bank's valuation is decrease than the acquisition price, the purchaser has to pay the distinction between the purchase value and the Bank's valuation utilizing money. As such, the money required up-front might be increased so it's at all times essential to know the valuation of the property before making any offer. Appoint Lawyer The Bank will prepare for a proper valuation of the property by way of physical inspection The completion statement will present you the balance of the acquisition price that you must pay after deducting any deposit, pro-rated property tax and utility costs, upkeep prices, and different relevant expenses in addition to any fees payable to the agent and the lawyer. Stamp Responsibility Primarily based on the Purchase Price or Market Value, whichever is larger

It was not just the king who demanded taxes. The church had significant tax revenues in the form of tithe which became law over most of the country in Magnus Erlingson’s days (1163-1184).[27]

The Kalmar Union and the union with Denmark

In the 1500s, the leidang tax was supplemented by additional taxes imposed when the government needed extra revenue, as in wartimes. From 1600 the additional taxes was imposed more frequently and around 1620 the tax became annual. The leilending (tenant farmer) tax was a property tax where farms were divided into three groups depending on the size of the farms (full farms, half farms and “ødegård”). The tax was from 1640's dependent on the land rent. In 1665, Norway got its first land register (Template:Lang-no) with a land rent that reflected the value of the production of the farm. The leilending tax was therefore a tax on the expected returns in agriculture.[28]

In the 17th century customs increased in importance as a revenue source and became the governments’ main source of income in Norway. Both the rates and the number of commodities tariffs were imposed on increased. Until about 1670 the main objective of the customs duty was to provide government revenue, but customs gradually became a trade policy instrument used to protect domestic production against competition from imported goods.[28]

In the 17th century excises were introduced. The oldest excise duty still existing in Norway is the stamp duty which originates from the regulation regarding det stemplede papiir of 16 December 1676.[29]

In 1762 a new personal tax was introduced, the additional tax (ekstraskatten’’), a lump sum tax of one riksdaler’’ for each person above 12 years. The tax triggered a storm of indignation, and after a series complains to the king and regular riots, the Stril War, the tax was reduced and finally abolished in 1772.[30]

19th century

In 1816, a number of old taxes to the state were merged and replaced by a direct land and township tax (Template:Lang-no). The tax amount was divided by 4/5 on villages and 1/5 on the cities. The tax was levied on the land register in the villages and mainly on income and economic activity in cities. The tax was very unpopular among farmers, and it was abolished when the farmer's representatives won a majority in the 1836 election. From 1836 to 1892 there existed no direct taxes to the state.Template:Sfn

Before 1882, municipal expenditures were covered with several types of taxes. Taxes were paid directly to the various funds that were responsible for financing and operating various types of municipal services. In the cities there were two main taxes: the city tax and the poor tax. The City Tax was originally imposed on real estate and businesses, but during the 19th century it evolved into a property tax. In the countryside there were more funds than in cities. The most important was the poor relief fund and the school fund. The taxes to these funds were determined, respectively by the poor commission and the school commission and were assessed on income, wealth and the value of the property. After the municipal self-government was introduced in 1837, the influence of elected representatives in the commissions and the commissions increased, and the taxes were soon under the control of the municipal council.Template:Sfn

In the tax reform of 1882 the system of earmarking the revenue for certain purposes or funds was abolished. Income and wealth tax became mandatory tax bases in addition to the property tax. Income and wealth was estimated discretionary basis by the tax authorities. The gross income was less the costs of acquiring the income was called expected income. It was then given an allowance depending on family responsibilities in order to arrive at taxable income.Template:Sfn

There were no state taxes in the period 1836-1892. The state got its revenue from customs and excise duties. These tax bases, however, was too narrow to cover the growth in government expenditure at the end of the 19th century. Therefore a progressive income and property taxes to the state was introduced in 1892.Template:Sfn

20th century

The tax reform in 1911 did not lead to significant changes in the tax system. The main change was that the tax return was introduced. Prior to the 1911 tax reform tax authorities had estimated taxable income and property. This system was now replaced by the taxpayers themselves reporting data on income and wealth.Template:Sfn

Throughout the 19th century and until World War I, customs were the main source of income for the government. In most of this period customs duties contributed to more than 80% of the governments revenue. Throughout the 20th century, tariffs had less and less financial importance. Excices was also an important source of revenue for the government. In the 19th century alcohol tax and stamp duty were important sources of revenue. Excices became even more important during the World War I when taxes on tobacco and motor vehicles were introduced. A sales tax was introduced in 1935. This was a cumulative tax as originally constituted 1% of the market value of each commercial level. The rate was subsequently increased several times. In 1970, the GST replaced by value added tax (VAT).Template:Sfn

1992 tax reform

In recent times there have been two major tax reforms in Norway. The first, the tax reform of 1992, was a pervasive and principle based reform, inline with the international trend of broader tax base and lower rates. Corporate taxation was designed so that the taxable profit should correspond to the actual budget surplus. This meant, among other things that different industries, forms of ownership, financing methods and investment were treated equally (neutrality) and that revenues and related expenditures were subject to the same tax rate. In the personal income tax, a clearer distinction between labour income and investment income was introduced (split - a dual income tax system). Ordinary income, income less standard deductions and deductible expenses, was taxes at a flat rate of 28%. On personal income, income from work and pensions, there were in addition levied social security contributions and surtax. To avoid that income that was taxed at the corporate level also were taxed at the individual level (double taxation), the imputation tax credit for dividends and treasury system gains was introduced.

2006 tax reform

After the 1992 tax reform the marginal tax rate on labour income was much higher than the marginal tax rate on capital income. For self-employed, it was profitable to convert labour income to capital income (income shifting). In the 2006 tax reform, the income shifting problem was solved by reducing the top marginal tax rate on labour income and introducing a dividend and capital gains tax on return above the normal return of the capital invested (shareholder model). Company shareholders were exempt from dividend and capital gains tax (exemption method), whilst proprietorships and partnerships were taxed at similar principles as the shareholder model.

See also

Notes

43 year old Petroleum Engineer Harry from Deep River, usually spends time with hobbies and interests like renting movies, property developers in singapore new condominium and vehicle racing. Constantly enjoys going to destinations like Camino Real de Tierra Adentro.

References

- One of the biggest reasons investing in a Singapore new launch is an effective things is as a result of it is doable to be lent massive quantities of money at very low interest rates that you should utilize to purchase it. Then, if property values continue to go up, then you'll get a really high return on funding (ROI). Simply make sure you purchase one of the higher properties, reminiscent of the ones at Fernvale the Riverbank or any Singapore landed property Get Earnings by means of Renting

In its statement, the singapore property listing - website link, government claimed that the majority citizens buying their first residence won't be hurt by the new measures. Some concessions can even be prolonged to chose teams of consumers, similar to married couples with a minimum of one Singaporean partner who are purchasing their second property so long as they intend to promote their first residential property. Lower the LTV limit on housing loans granted by monetary establishments regulated by MAS from 70% to 60% for property purchasers who are individuals with a number of outstanding housing loans on the time of the brand new housing purchase. Singapore Property Measures - 30 August 2010 The most popular seek for the number of bedrooms in Singapore is 4, followed by 2 and three. Lush Acres EC @ Sengkang

Discover out more about real estate funding in the area, together with info on international funding incentives and property possession. Many Singaporeans have been investing in property across the causeway in recent years, attracted by comparatively low prices. However, those who need to exit their investments quickly are likely to face significant challenges when trying to sell their property – and could finally be stuck with a property they can't sell. Career improvement programmes, in-house valuation, auctions and administrative help, venture advertising and marketing, skilled talks and traisning are continuously planned for the sales associates to help them obtain better outcomes for his or her shoppers while at Knight Frank Singapore. No change Present Rules

Extending the tax exemption would help. The exemption, which may be as a lot as $2 million per family, covers individuals who negotiate a principal reduction on their existing mortgage, sell their house short (i.e., for lower than the excellent loans), or take part in a foreclosure course of. An extension of theexemption would seem like a common-sense means to assist stabilize the housing market, but the political turmoil around the fiscal-cliff negotiations means widespread sense could not win out. Home Minority Chief Nancy Pelosi (D-Calif.) believes that the mortgage relief provision will be on the table during the grand-cut price talks, in response to communications director Nadeam Elshami. Buying or promoting of blue mild bulbs is unlawful.

A vendor's stamp duty has been launched on industrial property for the primary time, at rates ranging from 5 per cent to 15 per cent. The Authorities might be trying to reassure the market that they aren't in opposition to foreigners and PRs investing in Singapore's property market. They imposed these measures because of extenuating components available in the market." The sale of new dual-key EC models will even be restricted to multi-generational households only. The models have two separate entrances, permitting grandparents, for example, to dwell separately. The vendor's stamp obligation takes effect right this moment and applies to industrial property and plots which might be offered inside three years of the date of buy. JLL named Best Performing Property Brand for second year running

The data offered is for normal info purposes only and isn't supposed to be personalised investment or monetary advice. Motley Fool Singapore contributor Stanley Lim would not personal shares in any corporations talked about. Singapore private home costs increased by 1.eight% within the fourth quarter of 2012, up from 0.6% within the earlier quarter. Resale prices of government-built HDB residences which are usually bought by Singaporeans, elevated by 2.5%, quarter on quarter, the quickest acquire in five quarters. And industrial property, prices are actually double the levels of three years ago. No withholding tax in the event you sell your property. All your local information regarding vital HDB policies, condominium launches, land growth, commercial property and more

There are various methods to go about discovering the precise property. Some local newspapers (together with the Straits Instances ) have categorised property sections and many local property brokers have websites. Now there are some specifics to consider when buying a 'new launch' rental. Intended use of the unit Every sale begins with 10 p.c low cost for finish of season sale; changes to 20 % discount storewide; follows by additional reduction of fiftyand ends with last discount of 70 % or extra. Typically there is even a warehouse sale or transferring out sale with huge mark-down of costs for stock clearance. Deborah Regulation from Expat Realtor shares her property market update, plus prime rental residences and houses at the moment available to lease Esparina EC @ Sengkang - One of the biggest reasons investing in a Singapore new launch is an effective things is as a result of it is doable to be lent massive quantities of money at very low interest rates that you should utilize to purchase it. Then, if property values continue to go up, then you'll get a really high return on funding (ROI). Simply make sure you purchase one of the higher properties, reminiscent of the ones at Fernvale the Riverbank or any Singapore landed property Get Earnings by means of Renting

In its statement, the singapore property listing - website link, government claimed that the majority citizens buying their first residence won't be hurt by the new measures. Some concessions can even be prolonged to chose teams of consumers, similar to married couples with a minimum of one Singaporean partner who are purchasing their second property so long as they intend to promote their first residential property. Lower the LTV limit on housing loans granted by monetary establishments regulated by MAS from 70% to 60% for property purchasers who are individuals with a number of outstanding housing loans on the time of the brand new housing purchase. Singapore Property Measures - 30 August 2010 The most popular seek for the number of bedrooms in Singapore is 4, followed by 2 and three. Lush Acres EC @ Sengkang

Discover out more about real estate funding in the area, together with info on international funding incentives and property possession. Many Singaporeans have been investing in property across the causeway in recent years, attracted by comparatively low prices. However, those who need to exit their investments quickly are likely to face significant challenges when trying to sell their property – and could finally be stuck with a property they can't sell. Career improvement programmes, in-house valuation, auctions and administrative help, venture advertising and marketing, skilled talks and traisning are continuously planned for the sales associates to help them obtain better outcomes for his or her shoppers while at Knight Frank Singapore. No change Present Rules

Extending the tax exemption would help. The exemption, which may be as a lot as $2 million per family, covers individuals who negotiate a principal reduction on their existing mortgage, sell their house short (i.e., for lower than the excellent loans), or take part in a foreclosure course of. An extension of theexemption would seem like a common-sense means to assist stabilize the housing market, but the political turmoil around the fiscal-cliff negotiations means widespread sense could not win out. Home Minority Chief Nancy Pelosi (D-Calif.) believes that the mortgage relief provision will be on the table during the grand-cut price talks, in response to communications director Nadeam Elshami. Buying or promoting of blue mild bulbs is unlawful.

A vendor's stamp duty has been launched on industrial property for the primary time, at rates ranging from 5 per cent to 15 per cent. The Authorities might be trying to reassure the market that they aren't in opposition to foreigners and PRs investing in Singapore's property market. They imposed these measures because of extenuating components available in the market." The sale of new dual-key EC models will even be restricted to multi-generational households only. The models have two separate entrances, permitting grandparents, for example, to dwell separately. The vendor's stamp obligation takes effect right this moment and applies to industrial property and plots which might be offered inside three years of the date of buy. JLL named Best Performing Property Brand for second year running

The data offered is for normal info purposes only and isn't supposed to be personalised investment or monetary advice. Motley Fool Singapore contributor Stanley Lim would not personal shares in any corporations talked about. Singapore private home costs increased by 1.eight% within the fourth quarter of 2012, up from 0.6% within the earlier quarter. Resale prices of government-built HDB residences which are usually bought by Singaporeans, elevated by 2.5%, quarter on quarter, the quickest acquire in five quarters. And industrial property, prices are actually double the levels of three years ago. No withholding tax in the event you sell your property. All your local information regarding vital HDB policies, condominium launches, land growth, commercial property and more

There are various methods to go about discovering the precise property. Some local newspapers (together with the Straits Instances ) have categorised property sections and many local property brokers have websites. Now there are some specifics to consider when buying a 'new launch' rental. Intended use of the unit Every sale begins with 10 p.c low cost for finish of season sale; changes to 20 % discount storewide; follows by additional reduction of fiftyand ends with last discount of 70 % or extra. Typically there is even a warehouse sale or transferring out sale with huge mark-down of costs for stock clearance. Deborah Regulation from Expat Realtor shares her property market update, plus prime rental residences and houses at the moment available to lease Esparina EC @ Sengkang

Further reading

External links

- Norwegian Ministry of Finance

- Norwegian Tax Administration

- Norwegian Customs and Excise Authorities

- Ministry of Finance: Main features of the Government’s tax programme for 2011

- Ministry of Finance: Main features of the Government’s tax programme for 2010

Template:Norway topics Template:Taxation in Europe 30 year-old Entertainer or Range Artist Wesley from Drumheller, really loves vehicle, property developers properties for sale in singapore singapore and horse racing. Finds inspiration by traveling to Works of Antoni Gaudí.

- ↑ Template:Cite web

- ↑ Template:Cite web

- ↑ Template:Cite web

- ↑ Template:Cite web

- ↑ Template:Cite web

- ↑ Template:Cite web

- ↑ Template:Cite web

- ↑ 8.00 8.01 8.02 8.03 8.04 8.05 8.06 8.07 8.08 8.09 8.10 8.11 8.12 8.13 8.14 8.15 8.16 Template:Cite web

- ↑ One of the biggest reasons investing in a Singapore new launch is an effective things is as a result of it is doable to be lent massive quantities of money at very low interest rates that you should utilize to purchase it. Then, if property values continue to go up, then you'll get a really high return on funding (ROI). Simply make sure you purchase one of the higher properties, reminiscent of the ones at Fernvale the Riverbank or any Singapore landed property Get Earnings by means of Renting

In its statement, the singapore property listing - website link, government claimed that the majority citizens buying their first residence won't be hurt by the new measures. Some concessions can even be prolonged to chose teams of consumers, similar to married couples with a minimum of one Singaporean partner who are purchasing their second property so long as they intend to promote their first residential property. Lower the LTV limit on housing loans granted by monetary establishments regulated by MAS from 70% to 60% for property purchasers who are individuals with a number of outstanding housing loans on the time of the brand new housing purchase. Singapore Property Measures - 30 August 2010 The most popular seek for the number of bedrooms in Singapore is 4, followed by 2 and three. Lush Acres EC @ Sengkang

Discover out more about real estate funding in the area, together with info on international funding incentives and property possession. Many Singaporeans have been investing in property across the causeway in recent years, attracted by comparatively low prices. However, those who need to exit their investments quickly are likely to face significant challenges when trying to sell their property – and could finally be stuck with a property they can't sell. Career improvement programmes, in-house valuation, auctions and administrative help, venture advertising and marketing, skilled talks and traisning are continuously planned for the sales associates to help them obtain better outcomes for his or her shoppers while at Knight Frank Singapore. No change Present Rules

Extending the tax exemption would help. The exemption, which may be as a lot as $2 million per family, covers individuals who negotiate a principal reduction on their existing mortgage, sell their house short (i.e., for lower than the excellent loans), or take part in a foreclosure course of. An extension of theexemption would seem like a common-sense means to assist stabilize the housing market, but the political turmoil around the fiscal-cliff negotiations means widespread sense could not win out. Home Minority Chief Nancy Pelosi (D-Calif.) believes that the mortgage relief provision will be on the table during the grand-cut price talks, in response to communications director Nadeam Elshami. Buying or promoting of blue mild bulbs is unlawful.

A vendor's stamp duty has been launched on industrial property for the primary time, at rates ranging from 5 per cent to 15 per cent. The Authorities might be trying to reassure the market that they aren't in opposition to foreigners and PRs investing in Singapore's property market. They imposed these measures because of extenuating components available in the market." The sale of new dual-key EC models will even be restricted to multi-generational households only. The models have two separate entrances, permitting grandparents, for example, to dwell separately. The vendor's stamp obligation takes effect right this moment and applies to industrial property and plots which might be offered inside three years of the date of buy. JLL named Best Performing Property Brand for second year running

The data offered is for normal info purposes only and isn't supposed to be personalised investment or monetary advice. Motley Fool Singapore contributor Stanley Lim would not personal shares in any corporations talked about. Singapore private home costs increased by 1.eight% within the fourth quarter of 2012, up from 0.6% within the earlier quarter. Resale prices of government-built HDB residences which are usually bought by Singaporeans, elevated by 2.5%, quarter on quarter, the quickest acquire in five quarters. And industrial property, prices are actually double the levels of three years ago. No withholding tax in the event you sell your property. All your local information regarding vital HDB policies, condominium launches, land growth, commercial property and more

There are various methods to go about discovering the precise property. Some local newspapers (together with the Straits Instances ) have categorised property sections and many local property brokers have websites. Now there are some specifics to consider when buying a 'new launch' rental. Intended use of the unit Every sale begins with 10 p.c low cost for finish of season sale; changes to 20 % discount storewide; follows by additional reduction of fiftyand ends with last discount of 70 % or extra. Typically there is even a warehouse sale or transferring out sale with huge mark-down of costs for stock clearance. Deborah Regulation from Expat Realtor shares her property market update, plus prime rental residences and houses at the moment available to lease Esparina EC @ Sengkang - ↑ Template:Cite web

- ↑ Template:Cite web

- ↑ 12.0 12.1 12.2 12.3 12.4 Template:Cite web

- ↑ Template:Cite web

- ↑ Template:Cite web

- ↑ Template:Cite web

- ↑ Template:Cite web

- ↑ Template:Cite web

- ↑ Template:Cite web

- ↑ Template:Cite web

- ↑ http://www.skatteetaten.no/no/Tabeller-og-satser/Arveavgift/

- ↑ Template:Cite web

- ↑ Template:Cite web

- ↑ Template:Cite web

- ↑ Template:Cite web

- ↑ Template:Cite web

- ↑ 26.0 26.1 26.2

20 year-old Real Estate Agent Rusty from Saint-Paul, has hobbies and interests which includes monopoly, property developers in singapore and poker. Will soon undertake a contiki trip that may include going to the Lower Valley of the Omo.

My blog: http://www.primaboinca.com/view_profile.php?userid=5889534 - ↑

20 year-old Real Estate Agent Rusty from Saint-Paul, has hobbies and interests which includes monopoly, property developers in singapore and poker. Will soon undertake a contiki trip that may include going to the Lower Valley of the Omo.

My blog: http://www.primaboinca.com/view_profile.php?userid=5889534Template:Page needed - ↑ 28.0 28.1

20 year-old Real Estate Agent Rusty from Saint-Paul, has hobbies and interests which includes monopoly, property developers in singapore and poker. Will soon undertake a contiki trip that may include going to the Lower Valley of the Omo.

My blog: http://www.primaboinca.com/view_profile.php?userid=5889534Template:Page needed - ↑ Template:Cite web

- ↑ 20 year-old Real Estate Agent Rusty from Saint-Paul, has hobbies and interests which includes monopoly, property developers in singapore and poker. Will soon undertake a contiki trip that may include going to the Lower Valley of the Omo.

My blog: http://www.primaboinca.com/view_profile.php?userid=5889534Template:Page needed