Hausdorff maximal principle: Difference between revisions

en>Helpful Pixie Bot m , Reference => References (Build J1) |

en>Widr m Reverted edits by 218.248.44.196 (talk) to last version by Legobot |

||

| Line 1: | Line 1: | ||

{{For|lungs filling with excessive air|Hyperaeration}} | |||

{{Economics sidebar}} | |||

[[File:Inflació utan 1946.jpg|thumb|Sweeping up the banknotes from the street after the [[Hungarian pengő]] was replaced in 1946.]] | |||

:''Certain figures in this article use [[scientific notation]] for readability.'' | |||

In economics, '''hyperinflation''' occurs when a country experiences very high and usually accelerating rates of monetary and price [[inflation]], causing the population to minimize their holdings of money. Under such conditions, the general price level within an economy increases rapidly as the official currency quickly loses real value.<ref>{{cite book | last = O'Sullivan | first = Arthur | authorlink = Arthur O'Sullivan (economist) | coauthors = Steven M. Sheffrin | title = Economics: Principles in action | publisher = Pearson Prentice Hall | year = 2003 | location = Upper Saddle River, New Jersey 07458 | pages = 341, 404 | url = | doi = | id = | isbn = 0-13-063085-3}}</ref> Meanwhile, the real value of economic items generally stay the same with respect to one another, and remain relatively stable in terms of foreign currencies. This includes the economic items that generally constitute the government's expenses. | |||

Unlike regular inflation, where the process of rising prices is protracted and not generally noticeable except by studying past market prices, hyperinflation sees a rapid and continuing increase in prices and in the [[money supply|supply of money]],<ref>[http://www.forbes.com/sites/jerrybowyer/2012/08/09/wheres-the-hyperinflation/ Where's the Hyperinflation?], Forbes.com, 2012</ref> and the cost of goods. | |||

Hyperinflation is often associated with wars, their aftermath, sociopolitical upheavals, or other crises that make it difficult for the government to tax the population, as a sudden and sharp decrease in tax revenue coupled with a strong effort to maintain the status quo can be a direct trigger of hyperinflation. | |||

==Definitions== | |||

In 1956, [[Phillip D. Cagan|Phillip Cagan]] wrote ''The Monetary Dynamics of Hyperinflation'', generally regarded as the first serious study of hyperinflation and its effects. In it, he defined hyperinflation as starting in the month that the monthly inflation rate exceeds 50%, and it ending when the monthly inflation rate drops below 50% and stays that way for at least a year.<ref name="Hyper">[[Phillip D. Cagan|Phillip Cagan]], ''The Monetary Dynamics of Hyperinflation'', in Milton Friedman (Editor), ''Studies in the Quantity Theory of Money'', Chicago: University of Chicago Press (1956).</ref> Economists usually follow [[Phillip D. Cagan|Cagan]]’s description that hyperinflation occurs when the monthly inflation rate exceeds 50%.<ref>{{cite book | last1 = Ragan | first1 = Christopher | last2 = Lipsey | first2 = Richard | title = Macroeconomics | publisher = Pearson Education Canada | year = 2008 | location = Toronto, Ontario, Canada | page =645 | isbn = 0-558-05845-0}}</ref> | |||

The [[International Accounting Standards Board]] does not establish an absolute rate at which hyperinflation is deemed to arise. Instead, it lists factors that indicate the existence of hyperinflation:<ref>{{cite web|url=http://www.iasplus.com/en/standards/standard28 |title=IAS 29 — Financial Reporting in Hyperinflationary Economies |accessdate=2012-04-10 |first=International Accounting Standards |publisher=IASB }}</ref> | |||

* The general population prefers to keep its wealth in non-monetary assets or in a relatively stable foreign currency. Amounts of local currency held are immediately invested to maintain purchasing power | |||

* The general population regards monetary amounts not in terms of the local currency but in terms of a relatively stable foreign currency. Prices may be quoted in that currency; | |||

* Sales and purchases on credit take place at prices that compensate for the expected loss of purchasing power during the credit period, even if the period is short; | |||

* Interest rates, wages, and prices are linked to a price index; and | |||

* The cumulative inflation rate over three years approaches, or exceeds, 100%. | |||

==Causes== | |||

There are a number of theories on the causes of high and/or hyper inflation.<ref>http://howfiatdies.blogspot.com/2013/09/hyperinflation-explained-in-many.html</ref> | |||

=== Supply Shocks === | |||

This theory, based on historical analysis, claims that past hyperinflations were caused by some sort of extreme negative [[supply shock]], often associated with wars or natural disasters.<ref>https://www.gmo.com/America/CMSAttachmentDownload.aspx?target=JUBRxi51IIDV3C26gZvJ6r5NLthcX%2f9Q0ZPBQkExvMSh%2bvK1CMTHyV1xpwPa69Che8Ur%2b3GtnBdlT1z8uTf9QasTtYoks5h9OAqo9c0oc22JsBb%2fSWtTBA%3d%3d</ref> | |||

=== Money Supply === | |||

This theory claims that hyperinflation occurs when there is a continuing (and often accelerating) rapid increase in the amount of money that is not supported by a corresponding growth in the output of goods and services. | |||

The price increases that result from the rapid [[money creation]] creates a vicious circle, requiring ever growing amounts of new money creation to fund government activities. Hence both [[monetary inflation]] and price inflation proceed at a rapid pace. Such rapidly increasing prices cause widespread unwillingness of the local population to hold the local currency as it rapidly loses its buying power. Instead they quickly spend any money they receive, which increases the [[velocity of money]] flow; this in turn causes further acceleration in prices.<ref>{{cite book | last = Parsson | first = Jens | authorlink = Jens O. Parsson | title = Dying of Money (Chapter 17: Velocity) | publisher = Wellspring Press | year = 1974 | location = Boston, MA | pages = 112–119 | url = | doi = | id = | isbn = }}</ref> | |||

This results in an imbalance between the [[supply and demand]] for the money (including currency and bank deposits), causing rapid inflation. Very high inflation rates can result in a loss of confidence in the currency, similar to a [[bank run]]. Usually, the excessive money supply growth results from the government being either unable or unwilling to fully finance the government budget through taxation or borrowing, and instead it finances the government budget deficit through the printing of money.<ref name="z">[https://web.archive.org/web/20080408131232/http://www.fingaz.co.zw/fingaz/2003/October/October2/1365.shtml Hyperinflation: causes, cures] Bernard Mufute, 2003-10-02, “Hyperinflation has its root cause in money growth, which is not supported by growth in the output of goods and services. Usually the excessive money supply growth is caused by financing of the government budget deficit through the printing of money.”</ref> | |||

Governments have sometimes resorted to excessively loose monetary policy, as it allows a government to devalue its debts and reduce (or avoid) a tax increase. Inflation is effectively a [[regressive tax|regressive]] tax on the users of money,<ref name=autogenerated2>http://www.ssc.uwo.ca/economics/econref/workingpapers/researchreports/wp2000/wp2000_1.pdf</ref> but less overt than levied taxes and is therefore harder to understand by ordinary citizens. Inflation can obscure quantitative assessments of the true cost of living, as published price indices only look at data in retrospect, so may increase only months later. [[Monetary inflation]] can become hyperinflation if monetary authorities fail to fund increasing government expenses from [[taxes]], [[government debt]], cost cutting, or by other means, because either | |||

* during the time between recording or levying taxable transactions and collecting the taxes due, the value of the taxes collected falls in real value to a small fraction of the original taxes receivable; or | |||

* government debt issues fail to find buyers except at very deep discounts; or | |||

* a combination of the above. | |||

Theories of hyperinflation generally look for a relationship between [[seigniorage]] and the [[inflation tax]]. In both Cagan's model and the neo-classical models, a tipping point occurs when the increase in money supply or the drop in the monetary base makes it impossible for a government to improve its financial position. Thus when [[fiat money]] is printed, government obligations that are not denominated in money increase in cost by more than the value of the money created. | |||

From this, it might be wondered why any rational government would engage in actions that cause or continue hyperinflation. One reason for such actions is that often the alternative to hyperinflation is either [[Depression (economics)|depression]] or military defeat. The root cause is a matter of more dispute. In both [[classical economics]] and [[monetarism]], it is always the result of the monetary authority irresponsibly borrowing money to pay all its expenses. These models focus on the unrestrained [[seigniorage]] of the monetary authority, and the gains from the [[inflation tax]]. | |||

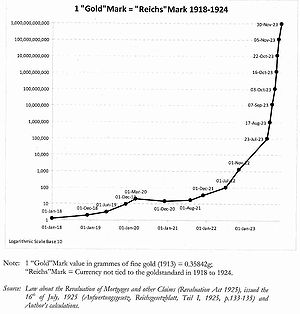

[[File:German Hyperinflation.jpg|right|thumb|The price of gold in Germany, 1 January 1918 – 30 November 1923. Note that the vertical scale is logarithmic.]] | |||

In neo-classical economic theory, hyperinflation is rooted in a deterioration of the [[monetary base]], that is the confidence that there is a store of value which the currency will be able to command later. In this model, the perceived risk of holding currency rises dramatically, and sellers demand increasingly high premiums to accept the currency. This in turn leads to a greater fear that the currency will collapse, causing even higher premiums. One example of this is during periods of warfare, civil war, or intense internal conflict of other kinds: governments need to do whatever is necessary to continue fighting, since the alternative is defeat. Expenses cannot be cut significantly since the main outlay is armaments. Further, a civil war may make it difficult to raise taxes or to collect existing taxes. While in peacetime the deficit is financed by selling bonds, during a war it is typically difficult and expensive to borrow, especially if the war is going poorly for the government in question. The banking authorities, whether central or not, "monetize" the deficit, printing money to pay for the government's efforts to survive. The hyperinflation under the [[Chinese Nationalists]] from 1939 to 1945 is a classic example of a government printing money to pay civil war costs. By the end, currency was flown in over the Himalayas, and then old currency was flown out to be destroyed. | |||

Hyperinflation is regarded as a complex phenomenon and one explanation may not be applicable to all cases. However, in both of these models, whether loss of confidence comes first, or central bank [[seigniorage]], the other phase is ignited. In the case of rapid expansion of the money supply, prices rise rapidly in response to the increased supply of money relative to the supply of goods and services, and in the case of loss of confidence, the monetary authority responds to the risk premiums it has to pay by “running the printing presses.” | |||

Nevertheless the immense acceleration process that occurs during hyperinflation (such as during the German hyperinflation of 1922/23) still remains unclear and unpredictable. The transformation of an inflationary development into the hyperinflation has to be identified as a very complex phenomenon, which could be a further advanced research avenue of the [[complexity economics]] in conjunction with research areas like [[mass hysteria]], [[bandwagon effect]], social brain and [[mirror neurons]].<ref>Wolfgang Chr. Fischer (Editor), [http://eprints.jcu.edu.au/11756/ German Hyperinflation 1922/23 – A Law and Economics Approach], Eul Verlag, Köln, Germany 2010, p.124</ref> | |||

===Models=== | |||

Since hyperinflation is visible as a monetary effect, models of hyperinflation center on the demand for money. Economists see both a rapid increase in the [[money supply]] and an increase in the [[velocity of money]] if the (monetary) inflating is not stopped. Either one, or both of these together are the root causes of inflation and hyperinflation. A dramatic increase in the velocity of money as the cause of hyperinflation is central to the "crisis of confidence" model of hyperinflation, where the risk premium that sellers demand for the paper currency over the nominal value grows rapidly. The second theory is that there is first a radical increase in the amount of circulating medium, which can be called the "monetary model" of hyperinflation. In either model, the second effect then follows from the first — either too little confidence forcing an increase in the money supply, or too much money destroying confidence. | |||

In the ''confidence model'', some event, or series of events, such as defeats in battle, or a run on stocks of the specie which back a currency, removes the belief that the authority issuing the money will remain solvent — whether a bank or a government. Because people do not want to hold notes which may become valueless, they want to spend them. Sellers, realizing that there is a higher risk for the currency, demand a greater and greater premium over the original value. Under this model, the method of ending hyperinflation is to change the backing of the currency, often by issuing a completely new one. War is one commonly cited cause of crisis of confidence, particularly losing in a war, as occurred during Napoleonic Vienna, and capital flight, sometimes because of “contagion” is another. In this view, the increase in the circulating medium is the result of the government attempting to buy time without coming to terms with the root cause of the lack of confidence itself. | |||

In the ''monetary model'', hyperinflation is a [[positive feedback]] cycle of rapid monetary expansion. It has the same cause as all other inflation: money-issuing bodies, central or otherwise, produce currency to pay spiralling costs, often from lax fiscal policy, or the mounting costs of warfare. When businesspeople perceive that the issuer is committed to a policy of rapid currency expansion, they mark up prices to cover the expected decay in the currency's value. The issuer must then accelerate its expansion to cover these prices, which pushes the currency value down even faster than before. According to this model the issuer cannot "win" and the only solution is to abruptly stop expanding the currency. Unfortunately, the end of expansion can cause a severe financial shock to those using the currency as expectations are suddenly adjusted. This policy, combined with reductions of pensions, wages, and government outlays, formed part of the [[Washington consensus]] of the 1990s. | |||

Whatever the cause, hyperinflation involves both the supply and [[velocity of money]]. Which comes first is a matter of debate, and there may be no universal story that applies to all cases. But once the hyperinflation is established, the pattern of increasing the money stock, by whichever agencies are allowed to do so, is universal. Because this practice increases the supply of currency without any matching increase in demand for it, the price of the currency, that is the exchange rate, naturally falls relative to other currencies. Inflation becomes hyperinflation when the increase in money supply turns specific areas of pricing power into a general frenzy of spending quickly before money becomes worthless. The purchasing power of the currency drops so rapidly that holding cash for even a day is an unacceptable loss of purchasing power. As a result, no one holds currency, which increases the velocity of money, and worsens the crisis. | |||

Because rapidly rising prices undermine the role of money as a [[store of value]], people try to spend it on real goods or services as quickly as possible. Thus, the monetary model predicts that the velocity of money will increase as a result of an excessive increase in the money supply. At the point when money velocity and prices rapidly accelerate in a [[Virtuous circle and vicious circle#Example in macroeconomics|vicious circle]], hyperinflation is out of control, because ordinary policy mechanisms, such as increasing reserve requirements, raising interest rates, or cutting government spending will be ineffective and be responded to by shifting away from the rapidly devalued money and towards other means of exchange. | |||

During a period of hyperinflation, bank runs, loans for 24-hour periods, switching to alternate currencies, the return to use of gold or silver or even barter become common. Many of the people who hoard gold today expect hyperinflation, and are hedging against it by holding specie. There may also be extensive [[capital flight]] or flight to a “hard” currency such as the US dollar. This is sometimes met with [[capital controls]], an idea which has swung from standard, to anathema, and back into semi-respectability. All of this constitutes an economy which is operating in an “abnormal” way, which may lead to decreases in real production. If so, that intensifies the hyperinflation, since it means that the amount of goods in "too much money chasing too few goods" formulation is also reduced. This is also part of the vicious circle of hyperinflation. | |||

Once the vicious circle of hyperinflation has been ignited, dramatic policy means are almost always required. Simply raising interest rates is insufficient. Bolivia, for example, underwent a period of hyperinflation in 1985, where prices increased 12,000% in the space of less than a year. The government raised the price of gasoline, which it had been selling at a huge loss to quiet popular discontent, and the hyperinflation came to a halt almost immediately, since it was able to bring in hard currency by selling its oil abroad. The crisis of confidence ended, and people returned deposits to banks. The German hyperinflation (1919-November 1923) was ended by producing a currency based on assets loaned against by banks, called the [[German rentenmark|Rentenmark]]. Hyperinflation often ends when a civil conflict ends with one side winning. | |||

Although [[incomes policies|wage and price controls]] are sometimes used to control or prevent inflation, no episode of hyperinflation has been ended by the use of price controls alone, because price controls that force merchants to sell at prices far below their restocking costs result in shortages that cause prices to rise still further. | |||

[[Nobel Prize in Economics|Nobel prize]] winner [[Milton Friedman]] said "We economists don't know much, but we do know how to create a shortage. If you want to create a shortage of tomatoes, for example, just pass a law that retailers can't sell tomatoes for more than two cents per pound. Instantly you'll have a tomato shortage. It's the same with oil or gas."<ref>"Controls blamed for U.S. energy woes", Los Angeles Times, February 13, 1977, Milton Friedman press conference in Los Angeles.</ref> | |||

==Effects== | |||

Hyperinflation effectively wipes out the purchasing power of private and public savings, distorts the economy in favor of the hoarding of real assets, causes the monetary base, whether [[money|specie]] or hard currency, to flee the country, and makes the afflicted area anathema to investment. | |||

Enactment of price controls to prevent discounting the value of [[paper money]] relative to gold, silver, [[hard currency]], or commodities, fail to force acceptance of a paper money which lacks intrinsic value. If the entity responsible for printing a currency promotes excessive money printing, with other factors contributing a reinforcing effect, hyperinflation usually continues. Hyperinflation is generally associated with [[paper money]], which can easily be used to increase the money supply: add more zeros to the plates and print, or even stamp old notes with new numbers.<ref>[http://blogs.wsj.com/marketbeat/2008/03/06/jefferson-county-memories/ Jefferson County Miracles, Wall Street Journal, March 6, 2008.]</ref> Historically, there have been numerous episodes of hyperinflation in various countries followed by a return to "hard money". Older economies would revert to [[hard currency]] and [[barter (economics)|barter]] when the circulating medium became excessively devalued, generally following a "run" on the [[store of value]]. | |||

Much attention on hyperinflation centers on the effect on savers whose investment becomes worthless. Academic economists seem not to have devoted much study on the (positive) effect on debtors. This may be due to the widespread perception that consistently saving a portion of one's income in monetary investments such as bonds or interest-bearing accounts is almost always a wise policy, and usually beneficial to the society of the savers. By contrast, incurring large or long-term debts (though sometimes unavoidable) is viewed as often resulting from irresponsibility or self-indulgence.{{Citation needed|date=August 2013}} Interest rate changes often cannot keep up with hyperinflation or even high inflation, certainly with contractually fixed interest rates. (For example, in the 1970s in the United Kingdom inflation reached 25% per annum, yet interest rates did not rise above 15% – and then only briefly – and many fixed interest rate loans existed). Contractually there is often no bar to a debtor clearing his long term debt with "hyperinflated-cash" nor could a lender simply somehow suspend the loan. "Early redemption penalties" were (and still are) often based on a penalty of ''x'' months of interest/payment; again no real bar to paying off what had been a large loan. In interwar Germany, for example, much private and corporate debt was effectively wiped out; certainly for those holding fixed interest rate loans. | |||

===Aftermath=== | |||

Hyperinflation is ended with drastic remedies, such as imposing the [[shock therapy (economics)|shock therapy]] of slashing government expenditures or altering the currency basis. One form this may take is [[dollarization]], the use of a foreign currency (not necessarily the [[U.S. dollar]]) as a national unit of currency. An example was dollarization in Ecuador, initiated in September 2000 in response to a 75% loss of value of the [[Ecuadorian sucre]] in early 2000. | |||

Hyperinflation has always been a traumatic experience for the area which suffers it, and the next policy regime almost always enacts policies to prevent its recurrence. Often this means making the central bank very aggressive about maintaining price stability, as was the case with the German [[Bundesbank]] or moving to some hard basis of currency such as a [[currency board]]. Many governments have enacted extremely stiff [[wage and price controls]] in the wake of hyperinflation but this does not prevent further inflating of the money supply by its [[central bank]], and always leads to widespread shortages of consumer goods if the controls are rigidly enforced. | |||

===Currency=== | |||

[[File:Bundesarchiv Bild 102-00104, Inflation, Tapezieren mit Geldscheinen.jpg|right|thumb|upright|[[inflation in the Weimar Republic|Germany, 1923]]: banknotes had lost so much value that they were used as wallpaper.]] | |||

In countries experiencing hyperinflation, the [[central bank]] often prints money in larger and larger denominations as the smaller denomination notes become worthless. This can result in the production of some interesting [[banknote]]s, including those denominated in amounts of 1,000,000,000 or more. | |||

* By late 1923, the [[Weimar Republic]] of Germany was issuing two-trillion Mark banknotes and postage stamps with a face value of fifty billion Mark. The highest value banknote issued by the Weimar government's Reichsbank had a face value of 100 trillion Mark (100,000,000,000,000; 100 million million).<ref>1 billion in the German long scale = 1000 milliard = 1 trillion US scale.</ref><ref>[http://www.sammler.com/coins/inflation.htm Values of the most important German Banknotes of the Inflation Period from 1920 – 1923]</ref> At the height of the inflation, one US dollar was worth 4 trillion German marks. One of the firms printing these notes submitted an invoice for the work to the Reichsbank for 32,776,899,763,734,490,417.05 (3.28 × 10<sup>19</sup>, or 33 [[quintillion]]) Marks.<ref>''The Penniless Billionaires'', Max Shapiro, New York Times Book Co., 1980, page 203, ISBN 0-8129-0923-2 Shipiro comments: "Of course, one must not forget the 5 pfennig!"</ref> | |||

* The largest denomination banknote ever officially issued for circulation was in 1946 by the [[Hungarian National Bank]] for the amount of 100 quintillion [[pengő]] (100,000,000,000,000,000,000, or 10<sup>20</sup>; 100 million million million) [http://bankjegy.szabadsagharcos.org/xxcentury/p136.htm image]. (There was even a banknote worth 10 times more, i.e. 10<sup>21</sup> (1 [[sextillion]]) pengő, printed, but not issued [http://bankjegy.szabadsagharcos.org/xxcentury/p137.htm image].) The banknotes however did not depict the numbers, "hundred million b.-pengő" ("hundred million trillion pengő") and "one milliard b.-pengő" were spelled out instead. This makes the 100,000,000,000,000 [[Zimbabwean dollar]] banknotes the note with the greatest number of zeros shown. | |||

* The Post-World War II hyperinflation of Hungary held the record for the most extreme monthly inflation rate ever — 41,900,000,000,000,000% (4.19 × 10<sup>16</sup>% or 41.9 quadrillion percent) for July 1946, amounting to prices doubling every 15.3 hours. By comparison, recent figures (as of 14 November 2008) estimate Zimbabwe's annual inflation rate at 89.7 [[sextillion]] (10<sup>21</sup>) percent.,<ref name="cato">{{cite web |url=http://www.cato.org/zimbabwe |title=New Hyperinflation Index (HHIZ) Puts Zimbabwe Inflation at 89.7 sextillion percent |author=Hanke, Steve H. |work=[[The Cato Institute]] |date=17 November 2008 |accessdate=17 November 2008 }}</ref> which corresponds to a monthly rate of 79.6 billion percent, and a doubling time of 24.7 hours. In figures, that is 89,700,000,000,000,000,000,000%. | |||

One way to avoid the use of large numbers is by declaring a new unit of currency (an example being, instead of 10,000,000,000 Dollars, a bank might set 1 new dollar = 1,000,000,000 old dollars, so the new note would read "10 new dollars.") An example of this would be Turkey's revaluation of the [[Lira]] on 1 January 2005, when the old [[Turkish lira]] (TRL) was converted to the [[New Turkish lira]] (TRY) at a rate of 1,000,000 old to 1 new Turkish Lira. While this does not lessen the actual value of a currency, it is called [[redenomination]] or [[revaluation]] and also happens over time in countries with standard inflation levels. During hyperinflation, currency inflation happens so quickly that bills reach large numbers before revaluation. | |||

Some banknotes were stamped to indicate changes of denomination. This is because it would take too long to print new notes. By the time new notes were printed, they would be obsolete (that is, they would be of too low a denomination to be useful). | |||

Metallic coins were rapid casualties of hyperinflation, as the scrap value of metal enormously exceeded the face value. Massive amounts of coinage were melted down, usually illicitly, and exported for hard currency. | |||

Governments will often try to disguise the true rate of inflation through a variety of techniques. None of these actions address the root causes of inflation and if discovered, they tend to further undermine trust in the currency, causing further increases in inflation. [[Price controls]] will generally result in shortages and hoarding and extremely high demand for the controlled goods, causing disruptions of [[supply chain]]s. Products available to consumers may diminish or disappear as businesses no longer find it sufficiently profitable (or may be operating at a loss) to continue producing and/or distributing such goods at the legal prices, further exacerbating the shortages. | |||

There are also issues with computerized money-handling systems. In Zimbabwe, during the hyperinflation of the Zimbabwe dollar, many [[automated teller machines]] and payment card machines struggled with [[arithmetic overflow]] errors as customers required many billions and trillions of dollars at one time.<ref>{{cite news| url=http://www.guardian.co.uk/world/2008/jul/31/zimbabwe | location=London | work=The Guardian | first=Mark | last=Tran | title=Zimbabwe knocks 10 zeros off currency amid world's highest inflation | date=31 July 2008}}</ref> | |||

==Examples of hyperinflation== | |||

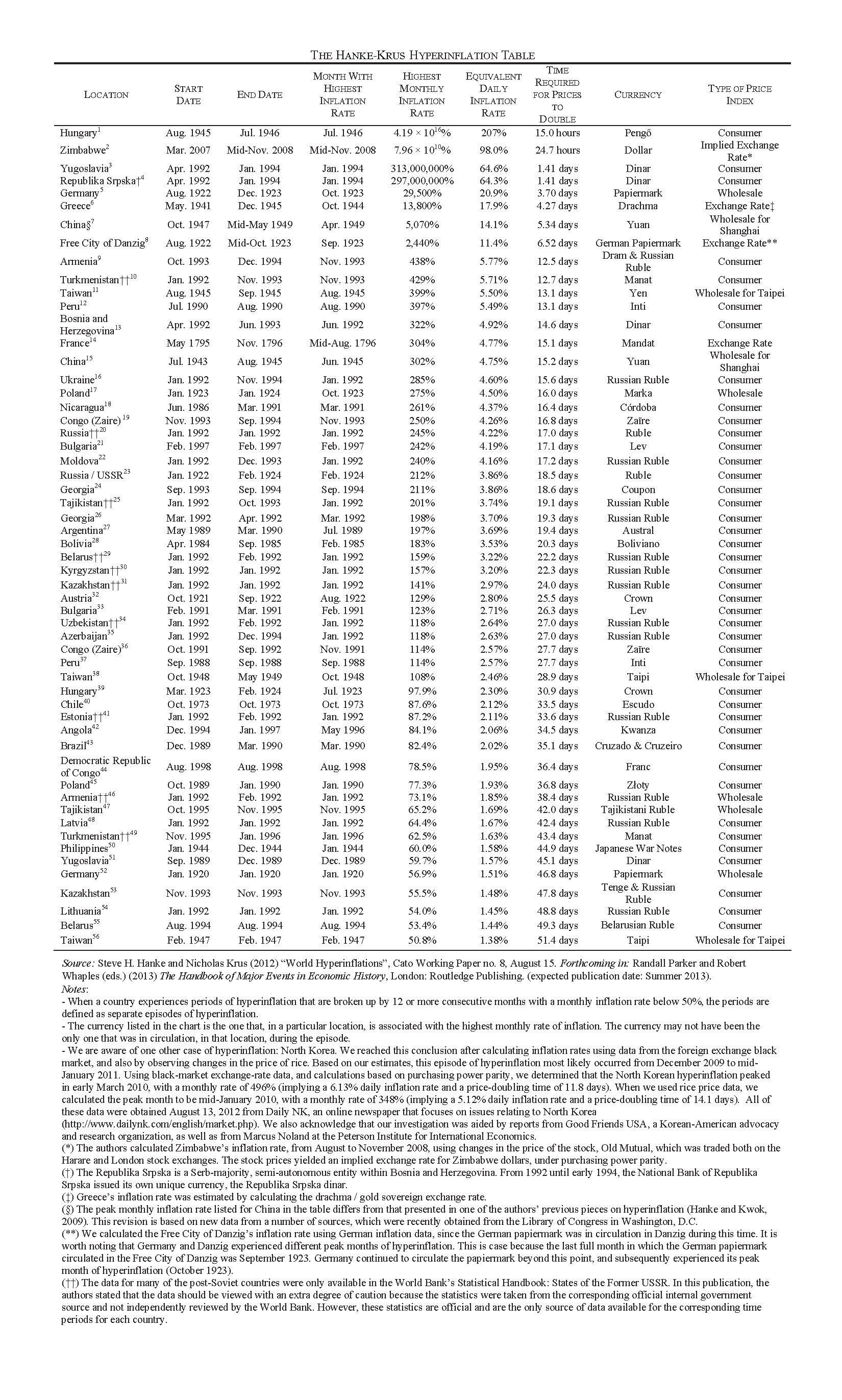

[[File:The Hanke Krus Hyperinflation Table.pdf|right]]{{vague|add a title for this image|date=December 2013}} | |||

===Angola=== | |||

Angola experienced high inflation from 1991 to 1995. It was a result of exchange restrictions following the introduction of the novo kwanza ([[ISO 4217|AON]]) to replace the original [[Angolan kwanza|kwanza]] (AOK) in 1990. At the first months of 1991, the highest denomination was 50 000 AON. By 1994, the highest denomination was 500 000 kwanzas. In the 1995 currency reform, the readjusted kwanza (AOR) replaced the novo kwanza at the ratio of 1 000 AON to 1 AOR, but hyperinflation continued as further denominations of up to 5 000 000 AOR were issued. In the 1999 currency reform, the kwanza (AOA) was reintroduced at the ratio of 1 million AOR to 1 AOA. Currently, the highest denomination banknote is 2 000 AOA and the overall impact of hyperinflation was 1 AOA = 1 billion AOK. | |||

:Start and End Date: Dec. 1994-Jan. 1997 | |||

:Peak Month and Rate of Inflation: May 1996, 84.1%<ref name="elibrary-data.imf.org">IMF. ‘International Financial Statistics (IFS)’, Washington, D.C.: International Monetary Fund, accessed October 2009. http://elibrary-data.imf.org/.</ref> | |||

=== Argentina === | |||

Argentina went through steady inflation from 1975 to 1991. At the beginning of 1975, the highest denomination was 1,000 [[Argentine peso ley|pesos]]. In late 1976, the highest denomination was 5,000 pesos. In early 1979, the highest denomination was 10,000 pesos. By the end of 1981, the highest denomination was 1,000,000 pesos. In the 1983 currency reform, 1 [[Argentine peso argentino|peso argentino]] was exchanged for 10,000 pesos. In the 1985 currency reform, 1 [[Argentine austral|austral]] was exchanged for 1,000 pesos argentinos. In the 1992 currency reform, 1 [[Argentine peso|new peso]] was exchanged for 10,000 australes. The overall impact of hyperinflation: 1 (1992) peso = 100,000,000,000 pre-1983 pesos. Annual inflation hit 12,000%<!--twelve thousand percent--> in 1989.<ref>[http://www.nytimes.com/1989/06/04/weekinreview/the-world-for-argentina-inflation-and-rage-rise-in-tandem.html?src=pm New York Times: THE WORLD; For Argentina, Inflation and Rage Rise in Tandem, 4 June 1989]</ref> | |||

:Start and End Date: May 1989- Mar. 1990 | |||

:Peak Month and Rate of Inflation: Mar. 1990, 197%<ref name="elibrary-data.imf.org"/> | |||

===Armenia=== | |||

Armenia experienced high inflation and hyperinflation from January 1992-December 1994. Its first episode of hyperinflation was due to the use of the [[Russian ruble]] after the [[dissolution of the Soviet Union]]. The second episode was due to an unstable [[Armenian dram]]. | |||

:(1) Start and End Date: Jan. 1992- Feb. 1993 | |||

:(1) Peak Month and Rate of Inflation: Jan. 1992, 73.1% | |||

:(2) Start and End Date: Oct. 1993- Dec. 1994 | |||

:(2) Peak Month and Rate of Inflation: Nov. 1993, 438%<ref name="elibrary-data.imf.org" /> | |||

===Austria=== | |||

In 1922, inflation in Austria reached 1426%, and from 1914 to January 1923, the consumer price index rose by a factor of 11836, with the highest banknote in denominations of 500,000 [[Austro-Hungarian krone|krones]].<ref>[http://www.fee.org/pdf/the-freeman/0604RMEbeling.pdf ]{{dead link|date=October 2012}}</ref> | |||

:Start and End Date: Oct. 1921- Sep. 1922 | |||

:Peak Month and Rate of Inflation: Aug. 1922, 129%<ref name="Sargent, T. J. 1986">Sargent, T. J. (1986) Rational Expectations and Inflation, New York: Harper & Row.</ref> | |||

Political ineptitude in Post WWI Austria comprised political expedience and Socialist benevolence. Thus, essentially all State enterprises ran at a loss and the number of State employees in Vienna, the capital of the post WWI republic was greater than that of the earlier monarchy, even though they served a population base nearly eight times smaller.<ref>{{cite book|author= Adam Fergusson |year=2010|title= When Money Dies – The Nightmare of Deficit Spending, Devaluation, and Hyperinflation in Weimar Germany|editor =|others=|pages=100|publisher= Public Affairs - Perseus Books Group|isbn= 978-1-58648-994-6}}</ref> | |||

Observing the Austrian response to developing hyperinflation, fueled by selfishness and political ineptitude, including the hoarding of food and the speculation in foreign currencies, Owen S. Phillpotts, the Commercial Secretary at the British Legation in Vienna wrote: “The Austrians are like men on a ship who cannot manage it, and are continually signalling for help. While waiting, however, most of them begin to cut rafts, each for himself, out of the sides and decks. The ship has not yet sunk despite the leaks so caused, and those who have acquired stores of wood in this way may use them to cook their food, while the more seamanlike look on cold and hungry. The population lack courage and energy as well as patriotism”.<ref>{{cite book|author= Adam Fergusson |year=2010|title= When Money Dies – The Nightmare of Deficit Spending, Devaluation, and Hyperinflation in Weimar Germany|editor =|others=|pages=92|publisher= Public Affairs - Perseus Books Group|isbn=978-1-58648-994-6}}</ref> | |||

===Azerbaijan=== | |||

Azerbaijan experienced inflation from January 1992 until December 1994. It first circulated the [[Russian ruble]] until August 1992 when it introduced the [[Azerbaijani manat]]. | |||

:Start and End Date: Jan. 1991- Dec. 1994 | |||

:Peak Month and Rate of Inflation: Jan. 1992, 118%<ref>IMF. ‘International Financial Statistics (IFS)’, Washington, D.C.: International Monetary Fund, accessed April 2012. http://elibrary-data.imf.org/.</ref> | |||

===Belarus=== | |||

Belarus experienced steady inflation from 1994 to 2002. In 1993, the highest denomination was 5,000 [[Belarusian ruble|rublei]]. By 1999, it was 5,000,000 rublei. In the 2000 currency reform, the ruble was replaced by the new ruble at an exchange rate of 1 new ruble = 1,000 old rublei. The highest denomination in 2008 was 100,000 rublei, equal to 100,000,000 pre-2000 rublei. | |||

:(1) Start and End Date: Jan. 1992- Feb. 1992 | |||

:(1) Peak Month and Rate of Inflation: Jan. 1992, 159% | |||

:(2) Start and End Date: Aug. 1994- Aug. 1994 | |||

:(2) Peak Month and Rate of Inflation: Aug. 1994, 53.4%<ref>29. World Bank. (1994) Statistical Handbook: States of the Former USSR, Washington, D.C.: World Bank.</ref> | |||

===Bolivia=== | |||

Bolivia experienced its worst inflation between 1984 and 1986. Hyperinflation in Bolivia lasted from April 1984 to September 1985 and was the worst in the history of Latin America. The coalition government of Siles Suazo faced a perfect storm of financial and political challenges upon assuming power in October 1982. With GNP declining (real GNP fell 6.6% in 1982), historically high interest rates and declining commodity prices, international debt became unserviceable and access to international capital markets dried up. Additionally, the coalition government was effectively pressured by the left for social spending while lacking the political base to enact new taxes. Accelerating inflation caused a virtual collapse of the tax system, with taxes declining from 9% of GNP in 1981 to about 1.3% of GNP in the first half of 1985. <ref>{{cite journal | author = Jeffrey Sachs| title = The Bolivian hyperinflation and stabilization| journal = AEA Papers and Proceedings| volume = 77(2)| pages = 279-283| year = 1987}}</ref> Before 1984, the highest denomination was 1,000 [[Bolivian peso]]s. By 1985, the highest denomination was 10 million Bolivian pesos. In 1985, a Bolivian note for 1 million pesos was worth 55 cents in US dollars, one-thousandth of its exchange value of $5,000 less than three years previously.<ref>{{cite book |last=Weatherford |first=Jack |title=The History of Money |publisher=Three Rivers Press |year=1997 |page=194 |isbn=0-609-80172-4}}</ref> In the 1987 currency reform, the Peso Boliviano was replaced by the [[Boliviano]] at a rate of 1,000,000 : 1. | |||

:Start and End Date: Apr. 1984- Sep. 1985 | |||

:Peak Month and Rate of Inflation: Feb. 1985, 183%<ref name="elibrary-data.imf.org"/> | |||

===Bosnia and Herzegovina=== | |||

Bosnia and Herzegovina went through its worst inflation in 1992. In 1992, the highest denomination was 1,000 [[Bosnia and Herzegovina dinar|dinara]]. By 1993, the highest denomination was 100,000,000 dinara. In the [[Republika Srpska]], the highest denomination was 10,000 dinara in 1992 and 10,000,000,000 dinara in 1993. 50,000,000,000 dinara notes were also printed in 1993 but never issued. | |||

:Start and End Date: Apr. 1992- Jun. 1993 | |||

:Peak Month and Rate of Inflation: Jun. 1992, 322%<ref>Kreso, S. (1997) Novac Bosne i Hercegovine: Od BHD do Novog Novca BiH, Sarajevo: Jez.</ref> | |||

===Brazil=== | |||

{{Main|Hyperinflation in Brazil}} | |||

From 1967–1994, the base currency unit was shifted seven times to adjust for inflation in the final years of the [[History of Brazil (1964–1985)|Brazilian military dictatorship]] era. A 1967 [[Brazilian cruzeiro|cruzeiro]] was, in 1994, worth less than one trillionth of a US cent, after adjusting for multiple devaluations and note changes. In that same year, inflation reached a record 2,075.8%. A new currency called [[Brazilian real|real]] was adopted in 1994, and hyperinflation was eventually brought under control.<ref>[http://www.econ.puc-rio.br/gfranco/How%20Brazil%20Beat%20Hyperinflation.htm How Brazil Beat Hyperinflation, by Leslie Evans]</ref> The ''real'' was also the currency in use until 1942; 1 (current) real is the equivalent of 2,750,000,000,000,000,000 of Brazil's first currency (called ''réis'' in Portuguese). | |||

:Start and End Date: Dec. 1989- Mar. 1990 | |||

:Peak Month and Rate of Inflation: Mar. 1990, 82.4%<ref name="elibrary-data.imf.org"/> | |||

===Bulgaria=== | |||

Bulgaria experience hyperinflation only in the month of February 1997. However, it had high inflation for many years proceeding this episode. In order to curb inflation, Bulgaria implemented a [[currency board]] in July of that year. Inflation subsequently dropped almost immediately. | |||

:Start and End Date: Feb. 1997- Feb. 1997 | |||

:Peak Month and Rate of Inflation: Feb. 1997, 123%<ref name="elibrary-data.imf.org"/> | |||

===Chile=== | |||

In 1973, Chile had experienced hyperinflation that had hit 700 percent, at a time when the country, under high protectionist barriers, had no [[Foreign-exchange reserves|foreign reserves]], and [[Depression (economics)|GDP was falling]].<ref name="brauchle">{{cite web|url=http://www.ecaef.org/klex/user/1/41894820_10_10.ppt|title=Applied Theory: The Reforms in Chile|author=Manfred Bräuchle}} [http://webcache.googleusercontent.com/search?q=cache:RlAx0yYt35sJ:www.ecaef.org/klex/user/1/41894820_10_10.ppt+Manfred+Br%C3%A4uchle.+%22Applied+Theory:+The+Reforms+in+Chile&cd=1&hl=en&ct=clnk&gl=us&client=gmail HTML version]</ref> Despite very severe government cuts and attempted monetary targeting under the [[Pinochet]] dictatorship inflation remained extremely high throughout the 1970s. | |||

:Start and End Date: Oct. 1973- Oct. 1973 | |||

:Peak Month and Rate of Inflation: Oct. 1973, 87.6%<ref>IMF. (1973-1974) ‘International Financial Statistics (IFS’), Washington, D.C.: International Monetary Fund.</ref> | |||

===China=== | |||

As the first user of [[fiat currency]], China has had an early history of troubles caused by hyperinflation. The [[Yuan Dynasty]] printed huge amounts of fiat paper money to fund their wars, and the resulting hyperinflation, coupled with other factors, led to its demise at the hands of a revolution. The Republic of China went through the worst inflation 1948–49. In 1947, the highest denomination was 50,000 [[Chinese yuan#First yuan, 1889-1948|yuan]]. By mid-1948, the highest denomination was 180,000,000 yuan. The 1948 currency reform replaced the yuan by the gold yuan at an exchange rate of 1 gold yuan = 3,000,000 yuan. In less than a year, the highest denomination was 10,000,000 gold yuan. In the final days of the civil war, the Silver Yuan was briefly introduced at the rate of 500,000,000 Gold Yuan. Meanwhile the highest denomination issued by a regional bank was 6,000,000,000 yuan (issued by Xinjiang Provincial Bank in 1949). After the [[renminbi]] was instituted by the new communist government, hyperinflation ceased with a revaluation of 1:10,000 old [[First series of the renminbi|Renminbi]] in 1955. The overall impact of inflation was 1 Renminbi = 15,000,000,000,000,000,000 pre-1948 yuan. | |||

:(1) Start and End Date: Jul. 1943- Aug. 1945 | |||

:(1) Peak Month and Rate of Inflation: Jun. 1945, 302% | |||

:(2) Start and End Date: Oct. 1947- Mid. May 1949 | |||

:(2) Peak Month and Rate of Inflation: Apr. 5070%<ref>Chang, K. (1958) The Inflationary Spiral, The Experience in China, 1939-1950, New York: The Technology Press of Massachusetts Institute of Technology and John Wiley and Sons.</ref> | |||

===Estonia=== | |||

Estonia experienced hyperinflation as a result of using the [[Russian ruble]] after the fall of the Soviet Union. However, it was the first post-Soviet union country to implement a currency reform by installing a [[currency board]]. It began circulation of the [[Estonian kroon]] in April 1992, ridding the country of high inflation. | |||

:Start and End Date: Jan. 1992- Feb. 1992 | |||

:Peak Month and Rate of Inflation: Jan. 1992, 87.2%<ref name="World Bank 1993">World Bank. (1993) Statistical Handbook: States of the Former USSR, Washington, D.C.: World Bank.</ref> | |||

===France=== | |||

During the French Revolution and [[French First Republic|first Republic]], the National Assembly issued bonds, some backed by seized church property, called [[Assignats]].<ref>[http://www.thecurrencycollector.com/pdfs/BankNotesoftheFrenchRevolutionPartII.pdf J.E. Sandrock: "Bank notes of the French Revolution" and First Republic]</ref> These evolved into fiat legal tender money, were overprinted and caused hyperinflation. Napoleon replaced them with the franc in 1803, at which time the assignats were basically worthless. Despite the fact that the assignat is normally considered to be the currency of this time, it was actually the mandat the experienced the peak month of hyperinflation. | |||

:Start and End Date: May 1795- Nov. 1796 | |||

:Peak Month and Rate of Inflation: Mid-Aug. 1796, 304%<ref>White, E.N. (1991) ‘Measuring the French Revolution's Inflation: the Tableaux de depreciation,’ Histoire & Mesure, 6 (3): 245 – 274.</ref> | |||

===Free City of Danzig=== | |||

The [[Free City of Danzig]] went through its worst inflation in 1923. In 1922, the highest denomination was 1,000 [[Danzig mark|Mark]]. By 1923, the highest denomination was 10,000,000,000 Mark. | |||

:Start and End Date: Aug. 1922- Mid. Oct. 1923 | |||

:Peak Month and Rate of Inflation: Sep. 1923, 2437%<ref name="Sargent, T. J. 1986"/> | |||

===Georgia=== | |||

Georgia went through its worst inflation in 1994. In 1993, the highest denomination was 100,000 coupons [kuponi]. By 1994, the highest denomination was 1,000,000 coupons. In the 1995 currency reform, a new currency, the [[Georgian lari|lari]], was introduced with 1 lari exchanged for 1,000,000 coupons. | |||

:(1) Start and End Date: Mar. 1992- Apr. 1992 | |||

:(1) Peak Month and Rate of Inflation: Mar. 1992, 198% | |||

:(2) Start and End Date: Sep. 1993- Sep. 1994 | |||

:(2) Peak Month and Rate of Inflation: Sep. 1994, 211%<ref>Wang, J.Y. (1999) ‘The Georgian Hyperinflation and Stabilization’, working paper, International Monetary Fund, May, 99/65.</ref> | |||

===Germany (Weimar Republic)=== | |||

{{Main|Hyperinflation in the Weimar Republic}} | |||

[[File:5milmkbk.jpg|thumbnail|5 Million Mark coin Would have been worth $714.29 in Jan 1923, about 1 thousandth of one cent by Oct 1923.]] | |||

By November 1922 the gold value of money in circulation fell from £300 million before WWI to £20 million. The Reichsbank responded by the unlimited printing of notes, thereby accelerating the devaluation of the mark. In his report to London, Lord D’Abernon wrote: “In the whole course of history, no dog has ever run after its own tail with the speed of the Reichsbank.” <ref>{{cite book|author= Adam Fergusson |year=2010|title= When Money Dies – The Nightmare of Deficit Spending, Devaluation, and Hyperinflation in Weimar Germany|editor =|others=|pages=117|publisher= Public Affairs - Perseus Books Group|isbn= 978-1-58648-994-6}}</ref> <ref>{{cite book|author= Lord D'Abernon |year=1930|title= An Ambassador of Peace, the diary of Viscount D’Abernon , Berlin 1920-1926 (V1-3)|editor =|others=|pages=|publisher= London: Hodder and Stoughton|isbn= }}</ref> Germany went through its worst inflation in 1923. In 1922, the highest denomination was 50,000 [[German Papiermark|Mark]]. By 1923, the highest denomination was 100,000,000,000,000 Mark. In December 1923 the exchange rate was 4,200,000,000,000 Marks to 1 US dollar.<ref name=autogenerated1>[http://mises.org/books/economicsofinflation.pdf Bresciani-Turroni, page 335]</ref> In 1923, the rate of inflation hit 3.25 × 10<sup>6</sup> percent per month (prices double every two days). Beginning on 20 November 1923, 1,000,000,000,000 old Marks were exchanged for 1 [[Rentenmark]] so that 4.2 Rentenmarks were worth 1 US dollar, exactly the same rate the Mark had in 1914.<ref name=autogenerated1/> | |||

:(1) Start and End Date: Jan. 1920- Jan. 1920 | |||

:(1) Peak Month and Rate of Inflation: Jan. 1920, 56.9% | |||

:(2) Start and End Date: Aug. 1922- Dec. 1923 | |||

:(2) Peak Month and Rate of Inflation: Nov. 1923, 29,525%<ref name="Sargent, T. J. 1986"/> | |||

===Greece=== | |||

Greece went through its worst inflation in 1944. In 1942, the highest denomination was 50,000 [[Greek drachma#Modern drachma|drachmai]]. By 1944, the highest denomination was 100,000,000,000 drachmai. In the 1944 currency reform, 1 new drachma was exchanged for 50,000,000,000 drachmai. Another currency reform in 1953 replaced the drachma at an exchange rate of 1 new drachma = 1,000 old drachmai. The overall impact of hyperinflation: 1 (1953) drachma = 50,000,000,000,000 pre 1944 drachmai. The Greek monthly inflation rate reached 8.5 billion percent in October 1944. | |||

:Start and End Date: May 1941- Dec. 1945 | |||

:Peak Month and Rate of Inflation: Nov. 1944, 13,800%<ref>Makinen, G. E. (1986) ‘The Greek Hyperinflation and Stabilization of 1943–1946’, Journal of Economic History, 46 (3): 795–805.</ref> | |||

===Hungary, 1923–24=== | |||

{{see also|Hungarian korona}} | |||

[[File:HUP 100MB 1946 obverse.jpg|right|thumb|The 100 million b.-pengő note was the highest denomination of banknote ever issued, worth 10<sup>20</sup> or 100 quintillion [[Hungarian pengő]] (1946). ''B.-pengő'' was short for "billió pengő", which in English means trillion pengő.]] | |||

The [[Treaty of Trianon]] and political instability between 1919 and 1924 led to a major inflation of Hungary’s currency. In 1921, in an attempt to arrest Post WWI inflation, the national assembly of Hungary passed the Hegedüs reforms, including a 20% levy on bank deposits. This action precipitated a mistrust of banks by the public, especially the peasants, and resulted in a reduction savings and the amount of currency in circulation.<ref>{{cite book|author= Adam Fergusson |year=2010|title= When Money Dies – The Nightmare of Deficit Spending, Devaluation, and Hyperinflation in Weimar Germany|editor =|others=|pages=101|publisher= Public Affairs - Perseus Books Group|isbn= 978-1-58648-994-6}}</ref> Unable to tax adequately, the government resorted to printing money and by 1923 inflation in Hungary had reached 98% per month. | |||

:Start and End Date: Mar. 1923- Feb. 1924 | |||

:Peak Month and Rate of Inflation: Jul. 1923, 97.9%<ref name="Sargent, T.J. 1981">Sargent, T.J. (1981) ‘The Ends of Four Big Inflations’, working paper, Federal Reserve Bank of Minneapolis, 158.</ref> | |||

===Hungary, 1945–46=== | |||

{{Main|Hungarian pengő hyperinflation}} | |||

Hungary went through the worst inflation ever recorded in the world between the end of 1945 and July 1946. In 1944, the highest denomination was 1,000 [[Hungarian pengő|pengő]]. By the end of 1945, it was 10,000,000 pengő. The highest denomination in mid-1946 was 100,000,000,000,000,000,000 pengő. A special currency the adópengő – or tax pengő – was created for tax and postal payments.<ref>[http://heindorffhus.motivsamler.dk/shoebox/frame-HungaryInflation02.htm Hungary: Postal history – Hyperinflation (part 2)]</ref> The value of the adópengő was adjusted each day, by radio announcement. On 1 January 1946 one adópengő equaled one pengő. By late July, one adópengő equaled 2,000,000,000,000,000,000,000 or 2×10<sup>21</sup> (2 [[sextillion]]) pengő. When the pengő was replaced in August 1946 by the [[forint]], the total value of all Hungarian banknotes in circulation amounted to <sup>1</sup>/<sub>1,000</sub> of one US dollar.<ref>{{cite book | title= Postwar: A History of Europe Since 1945 | last = Judt | first = Tony | publisher= Penguin | year= 2006 | isbn=0-14-303775-7 | page = 87 }}</ref> It is the most severe known incident of inflation recorded, peaking at 1.3 × 10<sup>16</sup> percent per month (prices double every 15 hours).<ref name=zwdinf>[http://www.zimbabwesituation.com/nov14_2008.html#Z2 Zimbabwe hyperinflation 'will set world record within six weeks'] Zimbabwe Situation 2008-11-14</ref> The overall impact of hyperinflation: On 18 August 1946, 4{{e|29}} (four hundred [[quadrilliard]] on the [[long scale]] used in Hungary; four hundred [[octillion]] on [[short scale]]) pengő became 1 forint. | |||

:Start and End Date: Aug. 1945- Jul. 1946 | |||

:Peak Month and Rate of Inflation:Jul. 1946, 41.9 quintillion percent<ref>Nogaro, B. (1948) ‘Hungary’s Recent Monetary Crisis and Its Theoretical Meaning’, American Economic Review, 38 (4): 526–42.</ref> | |||

===Kazakhstan=== | |||

Kazakhstan experienced two episodes of hyperinflation. The first was in 1992. A feature that most post-Soviet Union countries experienced. The second episode was in November 1993 with the implementation of the [[Kazakhstani tenge]]. | |||

:(1) Start and End Date: Jan. 1992- Jan. 1992 | |||

:(1) Peak Month and Rate of Inflation: Jan. 1992, 141% | |||

:(2) Start and End Date: Nov. 1993- Nov. 1993 | |||

:(2) Peak Month and Rate of Inflation: 55.5%<ref name="World Bank 1994">World Bank. (1994) Statistical Handbook: States of the Former USSR, Washington, D.C.: World Bank.</ref> | |||

===Kyrgyzstan=== | |||

Kyrgyzstan experienced hyperinflation in Jan. 1992 following the dissolution of the Soviet Union. | |||

:Start and End Date: Jan. 1992- Jan. 1992 | |||

:Peak Month and Rate of Inflation: Jan. 1992, 157%<ref name="World Bank 1994"/> | |||

===Serbian Krajina=== | |||

The [[Republic of Serbian Krajina]] went through its worst inflation in 1993. In 1992, the highest denomination was 50,000 [[Krajina dinar|dinara]]. By 1993, the highest denomination was 50,000,000,000 dinara. Note that this unrecognized country was reincorporated into Croatia in 1995. | |||

===North Korea=== | |||

North Korea most likely experienced hyperinflation from December 2009 to mid-January 2011. Based on the price of rice, North Korea's hyperinflation peaked in mid-January 2010, but according to black market exchange-rate data, and calculations base on purchasing power parity, North Korea experienced its peak month of inflation in early March 2010. However, this data is unofficial and therefore must be treated with a degree of caution.<ref>{{cite web|url=http://www.dailynk.com/english/market.php |title=Brightening the future of Korea |publisher=DailyNK |date= |accessdate=15 October 2012}}</ref> | |||

===Nicaragua=== | |||

Nicaragua went through the worst inflation from 1986 to 1990. From 1943 to April 1971, one US dollar equalled 7 [[Nicaraguan córdoba|córdobas]]. From April 1971-early 1978, one US dollar was worth 10 córdobas. In early 1986, the highest denomination was 10,000 córdobas. By 1987, it was 1,000,000 córdobas. In the 1988 currency reform, 1 new córdoba was exchanged for 10,000 old córdobas. The highest denomination in 1990 was 100,000,000 new córdobas. In the 1991 currency reform, 1 new córdoba was exchanged for 5,000,000 old córdobas. The overall impact of hyperinflation: 1 (1991) córdoba = 50,000,000,000 pre-1988 córdobas. | |||

:Start and End Date: Jun. 1986- Mar. 1991 | |||

:Peak Month and Rate of Inflation: Mar. 1991, 261%<ref name="IMF 2011">IMF. ‘International Financial Statistics (IFS)’, Washington, D.C.: International Monetary Fund, accessed November 2011. http://elibrary-data.imf.org/.</ref> | |||

===Peru=== | |||

Peru experienced its worst inflation from 1988–1990. In the 1985 currency reform, 1 inti was exchanged for 1,000 [[Peruvian sol|soles]]. In 1986, the highest denomination was 1,000 intis. But in September 1988, monthly inflation went to 114%. In August 1990, monthly inflation was 397%. The highest denomination was 5,000,000 intis by 1991. In the 1991 currency reform, 1 nuevo sol was exchanged for 1,000,000 intis. The overall impact of hyperinflation: 1 nuevo sol = 1,000,000,000 (old) soles. | |||

:(1) Start and End Date: Sep. 1988- Sep. 1988 | |||

:(1) Peak Month and Rate of Inflation: Sep. 1988, 114% | |||

:(2) Start and End Date: Jul. 1990- Aug. 1990 | |||

:(2) Peak Month and Rate of Inflation: Aug. 1990, 397%<ref name="IMF 2011"/> | |||

===Philippines=== | |||

The Japanese government occupying the Philippines during the [[World War II]] issued fiat currencies for general circulation. The Japanese-sponsored [[Second Philippine Republic]] government led by [[Jose P. Laurel]] at the same time outlawed possession of other currencies, most especially "guerilla money." The fiat money was dubbed "Mickey Mouse Money" because it is similar to play money and is next to worthless. Survivors of the war often tell tales of bringing suitcase or ''bayong'' (native bags made of woven coconut or [[buri]] leaf strips) overflowing with Japanese-issued bills. In the early times, 75 Mickey Mouse [[Japanese government-issued Philippine fiat peso|pesos]] could buy one duck egg.<ref name="LATimes.com_pera">{{cite news | publisher=[[Los Angeles Times]] | title=A Return to Wartime Philippines | author = Barbara A. Noe | url= http://www.latimes.com/news/local/valley/la-tr-philippines7aug07,0,648886,full.story?coll=la-editions-valley | date= 7 August 2005 | accessdate=2006-11-16}} {{Dead link|date=September 2010|bot=H3llBot}}</ref> In 1944, a box of matches cost more than 100 Mickey Mouse pesos.<ref>[[Teodoro Agoncillo|Agoncillo, Teodoro A.]] & Guerrero, Milagros C., ''History of the Filipino People'', 1986, R.P. Garcia Publishing Company, Quezon City, Philippines</ref> | |||

In 1942, the highest denomination available was 10 pesos. Before the end of the war, because of inflation, the Japanese government was forced to issue 100, 500 and 1000 peso notes. | |||

:Start and End Date: Jan. 1944- Dec. 1944 | |||

:Peak Month and Rate of Inflation: Jan. 1944, 60%<ref>Hartendorp, A. (1958) History of Industry and Trade of the Philippines, Manila: American Chamber of Commerce on the Philippines, Inc.</ref> | |||

===Poland, 1923–1924=== | |||

After Poland’s independence in 1918, the country soon began experiencing extreme inflation. By 1921, prices had already risen 251 times above those of 1914, but in the following three years they rose by 988,223%<ref>{{cite web|url=http://www.scribd.com/doc/31204419/Sometimes-the-Lunatic-Fringe-Do-Get-It-Right-5-1-10 |title=Sometimes the Lunatic Fringe Do Get It Right 5-1-10 |publisher=Scribd.com |date=14 June 2011 |accessdate=15 October 2012}}</ref> with a peak rate in late 1923 of prices doubling every nineteen and a half days.<ref>[http://www.freemarketfoundation.com/Hanke%5CHyperinflation--Mugabe%20versus%20Milosevic.pdf Hyperinflation: Mugabe Versus Milosević]</ref> At independence there was 8 [[Polish marka|marek]] per US dollar, but by 1923 the exchange rate was 6,375,000 marek (mkp) for 1 US dollar. The highest denomination was 10,000,000 mkp. In the 1924 currency reform there was a new currency introduced: 1 [[Polish złoty#Second złoty, 1924-1950|zloty]] = 1,800,000 mkp. | |||

:Start and End Date: Jan. 1923- Jan. 1924 | |||

:Peak Month and Rate of Inflation: Nov. 1923, 275%<ref name="Sargent, T.J. 1981"/> | |||

===Poland, 1989–1990=== | |||

Poland experienced a second hyperinflation between 1989 and 1990. The highest denomination in 1989 was 200,000 [[Polish zloty#Third złoty|zlotych]]. It was 1,000,000 zlotych in 1991 and 2,000,000 zlotych in 1992; the exchange rate was 9500 zlotych for 1 US dollar in January 1990 and 19600 zlotych at the end of August 1992. In the 1994 currency reform, 1 new zloty was exchanged for 10,000 old zlotych and 1 US$ exchange rate was ca. 2.5 zlotych (new). | |||

:Start and End Date: Oct. 1989- Jan. 1990 | |||

:Peak Month and Rate of Inflation: Jan. 1990, 77.3%<ref name="elibrary-data.imf.org"/> | |||

===Republika Srpska=== | |||

[[Republika Srpska]] was a breakaway region of Bosnia. As with Krajina, it pegged its currency, the [[Republika Srpska dinar]], to that of Yugoslavia. Their bills were almost the same as Krajina's, but they issued fewer and did not issue currency after 1993. | |||

:Start and End Date: Apr. 1992- Jan. 1994 | |||

:Peak Month and Rate of Inflation: Jan. 1994, 297 million percent<ref>Vilendecic, S. (2008) Banking in Republika Srpska in the late XX and early XXI century, Banja Luka: Besjeda.</ref> | |||

===Soviet Union / Russian Federation=== | |||

:: ''Main article: [[Hyperinflation in early Soviet Russia]]. See also: [[Soviet ruble]].'' | |||

Between 1921 and 1922, inflation in the [[Soviet Union]] reached 213%. | |||

In 1992, the first year of the post-[[Soviet Union|Soviet]] economic reform, inflation levels went up to 2,520%. In 1993, the annual rate was 840%, and in 1994, 224%. The ruble devalued from about 40 r/$ in 1991 to about 5,000 r/$ in late 1997. In 1998, a denominated ruble was introduced at the exchange rate of 1 new ruble = 1,000 pre-1998 rubles. In the second half of the same year, ruble fell to about 30 r/$ as a result of [[1998 Russian financial crisis|financial crisis]].<ref>[http://www.statista.com/statistics/171867/inflation-rate-in-russia/ Statistics on Inflation Levels in Russia], International Monetary Fund, 2012.</ref> | |||

:(1) Start and End Date: Jan. 1922- Feb. 1924 | |||

:(1) Peak Month and Rate of Inflation: Feb. 1924 | |||

:(2) Start and End Date: Jan. 1992- Jan. 1992, 212% | |||

:(2) Peak Month and Rate of Inflation: Jan. 1992, 245%<ref name="World Bank 1993"/> | |||

===Taiwan=== | |||

As the [[Chinese Civil War]] reached its peak, Taiwan also suffered from the hyperinflation that has ravaged China in late 1940s. Highest denomination issued was a 1,000,000 [[Old Taiwan dollar|Dollar]] Bearer's Cheque. Inflation was finally brought under control at introduction of New Taiwan Dollar in 15 June 1949 at rate of 40,000 old Dollar = 1 New Dollar | |||

:(1) Start and End Date: Aug. 1945- Sep. 1945 | |||

:(1) Peak Month and Rate of Inflation: Aug. 1945, 399% | |||

:(2) Start and End Date: Feb. 1947- Feb. 1947 | |||

:(2) Peak Month and Rate of Inflation: Feb. 1947, 50.8% | |||

:(3) Start and End Date: Oct. 1948- May 1949 | |||

:(3) Peak Month and Rate of Inflation: October. 1948 399%<ref>Liu, F.C. (1970) Essays on Monetary Development in Taiwan, Taipei, Taiwan: China Committee for Publication Aid and Prize Awards.</ref> | |||

===Tajikistan=== | |||

Tajikistan experienced two episodes of hyperinflation. One episode following the break-up of the Soviet Union that lasted longer than many of its neighboring countries. The second episode was in 1995 following the circulation of their new ruble. | |||

:(1) Start and End Date: Jan. 1992- Oct. 1993 | |||

:(1) Peak Month and Rate of Inflation: Jan. 1992, 201% | |||

:(2) Start and End Date: Oct. 1995- Nov. 1995 | |||

:(2) Peak Month and Rate of Inflation: Nov. 1995, 65.2%<ref name="World Bank 1996">World Bank. (1996) Statistical Handbook: States of the Former USSR, Washington, D.C.: World Bank.</ref> | |||

===Turkmenistan=== | |||

Turkmenistan experienced two episodes of hyperinflation as well. Similar to Takjikistan it experienced one episode in 1992 and one in 1995 following the introduction of its currency, the [[Turkmenistan manat|manat]]. | |||

:(1) Start and End Date: Jan. 1992- Nov. 1993 | |||

:(1) Peak Month and Rate of Inflation: Nov. 1993, 429% | |||

:(2) Start and End Date: Nov. 1995- Jan. 1996 | |||

:(2) Peak Month and Rate of Inflation: Jan. 1996, 62.5%<ref name="World Bank 1996"/> | |||

===Ukraine=== | |||

Ukraine experienced its worst inflation between 1992 and 1994. In 1992, the [[Ukrainian karbovanets]] was introduced, which was exchanged with the defunct [[Soviet ruble]] at a rate of 1 UAK = 1 SUR. Before 1993, the highest denomination was 1,000 karbovantsiv. By 1995, it was 1,000,000 karbovantsiv. In 1996, during the transition to the [[Ukrainian hryvnia|Hryvnya]] and the subsequent phase out of the karbovanets, the exchange rate was 100,000 UAK = 1 UAH. By some estimates, inflation for the entire calendar year of 1993 was 10,000% or higher, with retail prices reaching over 100 times their pre-1993 level by the end of the year.<ref>[http://www.mw.ua/2000/2040/54367/ Yuriy Skolotiany, The past and the future of Ukrainian national currency], Interview with Anatoliy Halchynsky, ''[[Mirror Weekly]]'', #33(612), 2—8 September 2006</ref> | |||

[[File:100000-Kupon-1994-front.jpg|thumb|right|A 100,000 [[Ukrainian karbovanets|Ukrainian karbovantsi]] (used between 1992 and 1996).]] In 1996, it was taken out of circulation, and was replaced by the Hryvnya at an exchange rate of 100,000 karbovantsi = 1 [[Ukrainian hryvnia|Hryvnya]] (approx. USD 0.50 at that time, about USD 0.20 as of 2007). | |||

:Start and End Date:Jan. 1992- Nov. 1994 | |||

:Peak Month and Rate of Inflation: Jan. 1992, 285%<ref name="World Bank 1994"/> | |||

===Uzbekistan=== | |||

Like many of the post-Soviet Union countries, Uzbekistan also experienced hyperinflation following the dissolution of the Soviet Union in 1992. | |||

:Start and End Date: Jan. 1992- Feb. 1992 | |||

:Peak Month and Rate of Inflation: Jan. 1992, 118%<ref name="World Bank 1994"/> | |||

===Yugoslavia=== | |||

[[File:500000000000 dinars.jpg|thumb|right|A 500 billion Yugoslav dinar banknote circa 1993, the largest nominal value ever officially printed in Yugoslavia, the final result of hyperinflation.]] | |||

[[Yugoslavia]] went through a period of hyperinflation and subsequent currency reforms from 1989–1994. The highest denomination in 1988 was 50,000 [[Yugoslav dinar|dinars]]. By 1989 it was 2,000,000 dinars. In the 1990 currency reform, 1 new dinar was exchanged for 10,000 old dinars. In the 1992 currency reform, 1 new dinar was exchanged for 10 old dinars. The highest denomination in 1992 was 50,000 dinars. By 1993, it was 10,000,000,000 dinars. In the 1993 currency reform, 1 new dinar was exchanged for 1,000,000 old dinars. However, before the year was over, the highest denomination was 500,000,000,000 dinars. In the 1994 currency reform, 1 new dinar was exchanged for 1,000,000,000 old dinars. In another currency reform a month later, 1 novi dinar was exchanged for 13 million dinars (1 novi dinar = 1 [[German mark]] at the time of exchange). The overall impact of hyperinflation: 1 novi dinar = 1 × 10<sup>27</sup>~1.3 × 10<sup>27</sup> pre 1990 dinars. [[Yugoslavia]]'s rate of inflation hit 5 × 10<sup>15</sup> percent cumulative inflation over the time period 1 October 1993 and 24 January 1994. <!--PLEASE DO NOT ADD A PRICE DOUBLING OF EVERY 16 HOURS. This is a figure over the nearly 4 month period given, not a monthly inflation, please don't confuse it with a monthly inflation and also don't change it to per month since I believe the inflation was higher near the end so it would be misleading--><!--The 313 million percent per month in January 1994 was the correct one--> | |||

:(1) Start and End Date: Sept. 1989- Dec. 1989 | |||

:(1) Peak Month and Rate of Inflation: Dec 1989, 59.7% | |||

:(2) Start and End Date: Apr. 1992- Jan. 1994 | |||

:(2) Peak Month and Rate of Inflation: Jan. 1994, 313 billion percent<ref>Rostowski, J. (1998) Macroeconomics Instability in Post-Communist Countries, New York: Carendon Press.</ref> | |||

===Zaire (now the Democratic Republic of the Congo)=== | |||

Zaire went through a period of inflation between 1989 and 1996. In 1988, the highest denomination was 5,000 [[Zairean zaire|zaires]]. By 1992, it was 5,000,000 zaires. In the 1993 currency reform, 1 nouveau zaire was exchanged for 3,000,000 old zaires. The highest denomination in 1996 was 1,000,000 nouveaux zaires. In 1997, Zaire was renamed the Congo Democratic Republic and changed its currency to francs. 1 franc was exchanged for 100,000 nouveaux zaires. One post-1997 franc was equivalent to 3 × 10<sup>11</sup> pre 1989 zaires. | |||

:(1) Start and End Date: Nov. 1993- Sep. 1994 | |||

:(1) Peak Month and Rate of Inflation: Nov. 1993, 250% | |||

:(2) Start and End Date: Oct. 1991- Sep. 1992 | |||

:(2) Peak Month and Rate of Inflation: Nov. 1992, 114% | |||

:(3) Start and End Date: Aug. 1998- Aug. 1998 | |||

:(3) Peak Month and Rate of Inflation: 78.5%<ref name="elibrary-data.imf.org"/> | |||

=== Zimbabwe === | |||

{{Main|Hyperinflation in Zimbabwe}} | |||

[[File:Zimbabwe $100 trillion 2009 Obverse.jpg|right|thumb|The 100 trillion [[Zimbabwean dollar]] banknote (10<sup>14</sup> dollars), equal to 10<sup>27</sup> (1 [[octillion]]) pre-2006 dollars.]] | |||

Hyperinflation in Zimbabwe was one of the few instances that resulted in the abandonment of the local currency. At independence in 1980, the [[Zimbabwe dollar]] (ZWD) was worth about USD 1.25. Afterwards, however, rampant inflation and the collapse of the economy severely devalued the currency. Inflation was steady before [[Robert Mugabe]] in 1998 began a program of land reforms that primarily focused on taking land from white farmers and redistributing those properties and assets to black farmers, which disrupted food production and caused revenues from export of food to plummet.<ref>[[Land reform in Zimbabwe]]</ref><ref>[http://www.news24.com/News24/Archive/0,,2-1659_1401988,00.html Zimbabwe famine]</ref><ref>Greenspan, Alan. ''The Age of Turbulence: Adventures in a New World''. New York: The Penguin Press. 2007. Page 339.</ref> The result was that to pay its expenditures Mugabe’s government and [[Gideon Gono]]’s [[Reserve Bank of Zimbabwe|Reserve Bank]] printed more and more notes with higher face values. | |||

Hyperinflation began early in the 21st-century, reaching 624% in 2004. It fell back to low triple digits before surging to a new high of 1,730% in 2006. The Reserve Bank of Zimbabwe revalued on 1 August 2006 at a ratio of 1 000 ZWD to each second dollar (ZWN), but year-to-year inflation rose by June 2007 to 11,000% (versus an earlier estimate of 9,000%). Larger denominations were progressively issued: | |||

# 5 May: banknotes or "bearer cheques" for the value of ZWN 100 million and ZWN 250 million.<ref>[http://economictimes.indiatimes.com/Zimbabwe_issues_250_mn_dollar_banknote_to_tackle_price_spiral/articleshow/3015531.cms Zimbabwe issues 250 mn dollar banknote to tackle price spiral- International Business-News-The Economic Times]</ref> | |||

# 15 May: new bearer cheques with a value of ZWN 500 million (then equivalent to about USD 2.50).<ref>[http://news.bbc.co.uk/1/hi/world/africa/7402943.stm BBC NEWS: Zimbabwe bank issues $500m note]</ref> | |||

# 20 May: a new series of notes (“agro cheques”) in denominations of $5 billion, $25 billion and $50 billion. | |||

# 21 July: “agro cheque” for $100 billion.<ref>http://uk.news.yahoo.com/afp/20080719/tbs-zimbabwe-economy-inflation-5268574.html</ref> | |||

Inflation by 16 July officially surged to 2,200,000%<ref>{{cite news| url=http://news.bbc.co.uk/2/hi/business/7509715.stm | work=BBC News | title=Zimbabwe inflation at 2,200,000% | date=16 July 2008 | accessdate=26 March 2010}}</ref> with some analysts estimating figures surpassing 9,000,000 percent.<ref>{{cite web|url=http://www.thezimbabweindependent.com/index.php?option=com_content&view=article&id=20637:inflation-gallops-ahead&catid=28:zimbabwe%20business%20stories&Itemid=59 |title=The Leading Business Weekly |publisher=The Zimbabwe Independent |date= |accessdate=15 October 2012}}</ref> As of 22 July 2008 the value of the ZWN fell to approximately 688 billion per 1 USD, or 688 trillion pre-August 2006 Zimbabwean dollars.<ref>http://www.zimbabweanequities.com/</ref> | |||

{| class="wikitable infobox" | |||

|- | |||

! Date of<br />redenomination !! Currency<br />code !! Value | |||

|- | |||

| style="text-align:center;"|1 August 2006 | |||

| style="text-align:center;"|ZWN | |||

| style="text-align:right;"|1 000 ZWD | |||

|- | |||

| style="text-align:center;"|1 August 2008 | |||

| style="text-align:center;"|ZWR | |||

| style="text-align:right;"|{{10^|10}} ZWN <br /> = {{10^|13}} ZWD | |||

|- | |||

| style="text-align:center;"|2 February 2009 | |||

| style="text-align:center;"|ZWL | |||

| style="text-align:right;"|{{10^|12}} ZWR <br /> = {{10^|22}} ZWN <br /> = {{10^|25}} ZWD | |||

|} | |||

On 1 August 2008, the Zimbabwe dollar was redenominated at the ratio of {{10^|10}} ZWN to each third dollar (ZWR).<ref>{{cite news| url=http://africa.reuters.com/business/news/usnBAN034008.html | work=Reuters}}</ref> On 19 August 2008, official figures announced for June estimated the inflation over 11,250,000%.<ref>{{cite news| url=http://news.bbc.co.uk/2/hi/business/7569894.stm | work=BBC News | title=Zimbabwe inflation rockets higher | date=19 August 2008 | accessdate=26 March 2010}}</ref> Zimbabwe's annual inflation was 231,000,000% in July<ref>[http://news.yahoo.com/s/afp/20081009/wl_africa_afp/zimbabweeconomyinflation ]{{dead link|date=October 2012}}</ref> (prices doubling every 17.3 days). For periods after July 2008, no official inflation statistics were released. Prof. Steve H. Hanke overcame the problem by estimating inflation rates after July 2008 and publishing the Hanke Hyperinflation Index for Zimbabwe.<ref>Steve H. Hanke, "New Hyperinflation Index (HHIZ) Puts Zimbabwe Inflation at 89.7 Sextillion Percent.” Washington, D.C.: Cato Institute. (Retrieved 17 November 2008) <http://www.cato.org/zimbabwe></ref> Prof. Hanke’s HHIZ measure indicated that the inflation peaked at an annual rate of 89.7 sextillion percent (89,700,000,000,000,000,000,000%) in mid-November 2008. The peak monthly rate was 79.6 billion percent, which is equivalent to a 98% daily rate, or around {{gaps|7|base= 10|e=108}} percent yearly rate. At that rate, prices were doubling every 24.7 hours. Note that many of these figures should be considered mostly theoretic, since the hyperinflation did not proceed at that rate a whole year.<ref name=catohanke>Steve H. Hanke and Alex K. F. Kwok, "On the Measurement of Zimbabwe’s Hyperinflation." Cato Journal, Vol. 29, No. 2 (Spring/Summer 2009). <http://www.cato.org/pubs/journal/cj29n2/cj29n2-8.pdf></ref> | |||

At its November 2008 peak, Zimbabwe's rate of inflation approached, but failed to surpass, Hungary's July 1946 world record.<ref name=catohanke/> On 2 February 2009, the dollar was redenominated for the fourth time at the ratio of {{10^|12}} ZWR to 1 ZWL, only three weeks after the $100 trillion banknote was issued on 16 January,<ref>[http://www.africasia.com/services/news/newsitem.php?area=africa&item=090116063500.qczog3x4.php ]{{dead link|date=October 2012}}</ref><ref>{{Cite journal |url=http://news.bbc.co.uk/1/hi/world/africa/7865259.stm |title=Zimbabwe dollar sheds 12 zeros |publisher=BBC News | date=2009-02-02 | accessdate = 2008-02-02 |postscript=<!-- Bot inserted parameter. Either remove it; or change its value to "." for the cite to end in a ".", as necessary. -->{{inconsistent citations}} }}</ref> but hyperinflation waned by then as official inflation rates in USD were announced and foreign transactions were legalised,<ref name=catohanke/> and on 12 April the dollar was abandoned in favour of using only foreign currencies. The overall impact of hyperinflation was 1 ZWL = {{10^|25}} ZWD. | |||

:Start and End Date: Mar. 2007- Mid-Nov. 2008 | |||

:Peak Month and Rate of Inflation:Mid-Nov. 2008, 7.96 billion percent<ref>Hanke, S. H. and Kwok, A. K. F. (2009) ‘On the Measurement of Zimbabwe’s Hyperinflation’, Cato Journal, 29 (2): 353-64.</ref> | |||

==Examples of high inflation== | |||

Some countries experienced very high inflation, but did not reach hyperinflation, as defined as a ''monthly'' inflation rate of 50%. | |||

===Iraq=== | |||

Between 1987 and 1995 the Iraqi Dinar went from an official value of 0.306 Dinars/USD (or $3.26 USD per dinar, though the black market rate is thought to have been substantially lower) to 3000 Dinars/USD due to government printing of 10s of trillions of dinars starting with a base of only 10s of billions. That equates to approximately 315% inflation per year averaged over that eight-year period.<ref>History page at the Central Bank of Iraq http://cbi.iq/index.php?pid=History</ref> | |||

===Mexico=== | |||

In spite of increased oil prices in the late 1970s (Mexico is a producer and exporter), Mexico defaulted on its external debt in 1982. As a result, the country suffered a severe case of capital flight and several years of hyperinflation and [[Mexican peso|peso]] devaluation. On 1 January 1993, Mexico created a new currency, the ''nuevo peso'' ("new peso", or MXN), which chopped three zeros off the old peso, an inflation rate of 100,000% over the several years of the crisis. (One new peso was equal to 1,000 old MXP pesos). | |||

===Roman Egypt=== | |||

In Roman Egypt, where the best documentation on pricing has survived, the price of a measure of wheat was 200 drachmae in 276 AD, and increased to more than 2,000,000 drachmae in 334 AD, roughly 1,000,000% inflation in a span of 58 years.<ref>{{cite web|author=The Life Contributors |url=http://www.businessinsider.com/7-gasoline-thanks-ben-2012-4 |title=Traveling In Europe Has Become Absurdly Expensive—And You Know The Reason Why |publisher=Business Insider |date=17 April 2012 |accessdate=15 October 2012}}</ref> | |||

Although the price increased by a factor of 10,000 over 58 years, the annual rate of inflation was only 17.2% compounded. | |||

===Romania=== | |||

Romania experienced hyperinflation in the 1990s. The highest denomination in 1990 was 100 [[Romanian leu|lei]] and in 1998 was 100,000 lei. By 2000 it was 500,000 lei. In early 2005 it was 1,000,000 lei. In July 2005 the lei was replaced by the new leu at 10,000 old lei = 1 new leu. Inflation in 2005 was 9%.<ref>{{cite web|url=http://www.imf.org/external/pubs/ft/weo/2006/01/data/dbcoutm.cfm?SD=2003&ED=2007&R1=1&R2=1&CS=3&SS=2&OS=C&DD=0&OUT=1&C=968&S=PCPIPCH&RequestTimeout=120&CMP=0&x=57&y=10 |title=Report for Selected Countries and Subjects |publisher=Imf.org |date=29 April 2003 |accessdate=15 October 2012}}</ref> In July 2005 the highest denomination became 500 leu (= 5,000,000 old lei). | |||

===Vietnam=== | |||

Vietnam went under a chaotic and hyperinflation period in late 1980s, with inflation peaking at 774% in 1988, after the country's "price-wage-currency" reform package led by Mr Tran Phuong, then Deputy Prime Minister, had failed bitterly.<ref>{{cite book | last1 = Napier | first1 = Nancy K. | last2 = Vuong | first2 = Quan Hoang | title = What we see, why we worry, why we hope: Vietnam going forward | publisher = Boise State University CCI Press | year = 2013 | location = Boise, ID, USA | page =140 | isbn = 978-0985530587}}</ref> Hyperinflation also characterizes the early stage of economic renovation, usually referred to as Doi Moi, in Vietnam. | |||

===United States=== | |||

During the [[American Revolutionary War|Revolutionary War]], when the [[Continental Congress]] authorized the printing of paper currency called [[continental (currency)|continental currency]], the monthly inflation rate reached a peak of 47 percent in November 1779 (Bernholz 2003: 48). These notes depreciated rapidly, giving rise to the expression "not worth a continental." | |||

A second close encounter occurred during the [[U.S. Civil War]], between January 1861 and April 1865, the [[Lerner Commodity Price Index]] of leading cities in the eastern Confederacy states increased from 100 to over 9,000.<ref>[http://eh.net/encyclopedia/article/weidenmier.finance.confederacy.us Money and Finance in the Confederate States of America, Marc Weidenmier, Claremont McKenna College]</ref> As the Civil War dragged on, the [[Confederate States of America dollar|Confederate dollar]] had less and less value, until it was almost worthless by the last few months of the war. Similarly, the Union government inflated its [[Greenback (money)|greenbacks]], with the monthly rate peaking at 40 percent in March 1864 (Bernholz 2003: 107).<ref name="cato.org">http://www.cato.org/pubs/journal/cj29n2/cj29n2-8.pdf</ref> | |||

==Most severe hyperinflations in world history== | |||

{| class="wikitable" | |||

|- | |||