Ornstein–Uhlenbeck operator: Difference between revisions

No edit summary |

en>Yobot m →References: WP:CHECKWIKI error fixes - Replaced endash with hyphen in sortkey per WP:MCSTJR using AWB (9100) |

||

| Line 1: | Line 1: | ||

== | {{merge|Subprime mortgage crisis#Causes|discuss=Talk:Causes of the United States housing bubble#Merger proposal|date=February 2013}} | ||

{| align="right" | |||

|- | |||

| [[File:EconomistHomePrices20050615.jpg|300px|right|thumb|Inflation-adjusted housing prices in [[Japan]] (1980–2005) compared to home price appreciation the [[United States]], [[Great Britain|Britain]], and [[Australia]] (1995–2005).]] | |||

|- | |||

| | |||

{| style="width:300px; background:ghostwhite; border:1px solid black; padding-left:1.5em; padding-right:1.5em; padding-top:0.75em; padding-bottom:0.75em; margin-left:1.5em; margin-right:0; margin-top:0.75em; margin-bottom:0.75em;" | |||

|- | |||

| | |||

'''Approximate cost to own mortgaged property vs. renting.'''<br /> An approximate formula for the monthly cost of owning a home is obtained by computing the [[Fixed rate mortgage#Monthly payment formula|monthly mortgage]], property tax, and maintenance costs, accounting for the U.S. [[tax deduction]] available for mortgage interest payments and property taxes. | |||

This formula does not include the cost of foregoing the standard deduction (required for taking the tax deduction). Assuming a home cost of ''P'' dollars, yearly interest rate ''r'' fixed over ''N'' years, marginal income tax rate <math>r_{\rm IT}</math>, property tax rate <math>r_{\rm PT}</math> (assumed to be ½–2% of ''P''), and yearly maintenance cost rate <math>r_{\rm M}</math> (assumed to be ½–1% of ''P''), the [[Fixed rate mortgage#Monthly payment formula|monthly cost]] of home ownership is approximately<ref>A derivation for the [[Fixed rate mortgage#Monthly payment formula|monthly cost]] is provided at [[usenet]]'s [http://www.faqs.org/faqs/sci-math-faq/compoundInterest/ sci.math FAQ].</ref> | |||

::<math>\scriptstyle{\scriptstyle{\rm cost}}\approx \Big(\big(\frac{r}{1-(1+r)^{-N}} +r_{\rm PT}\big)</math> | |||

::<math>\scriptstyle{}\qquad{}\times(1-r_{\rm IT})+r_{\rm M}\Big)\times P/12.</math> | |||

For example, the monthly cost of a $250,000 home at 6% interest fixed over 30 years, with 1% property taxes, 0.75% maintenance costs, and a 30% federal income tax rate is approximately $1361 per month. The rental cost for an equivalent home may be less in many U.S. cities as of 2006. Adding a [[down payment]] or home equity to this calculation can significantly reduce the monthly cost of ownership, while significantly reducing the income stream that the downpayment would generate in a long term CD. Including the monthly cost of forgoing the standard deduction ($10,000 for a married couple), the added cost (the reduction in tax savings) of (deduction * tax_rate / 12) would increase the cost to buy a home by $250/mo, to $1611 for a married couple filing jointly in the example above. | |||

|} | |||

|- | |||

| | |||

{| style="width:300px; background:ghostwhite; border:1px solid black; padding-left:1.5em; padding-right:1.5em; padding-top:0.75em; padding-bottom:0.75em; margin-left:1.5em; margin-right:0; margin-top:0.75em; margin-bottom:0.75em;" | |||

|- | |||

|'''Equivalent [[Housing bubble#Housing ownership and rent measures|price-to-earnings (P/E) ratio]] for homes.'''<br /> To compute the [[Housing bubble#Housing ownership and rent measures|P/E ratio]] for the case of a rented house, divide the price of the house by its potential yearly earnings or net income, which is the market rent of the house minus expenses, which include [[property taxes]], [[Maintenance, repair and operations|maintenance]] and fees. This formula is: | |||

:: <math>\textstyle{\scriptstyle{\rm P/E\ ratio}} = \frac{{\rm Price}}{{\rm Rent} - {\rm Expenses}}.</math> | |||

For the example of the $250,000 home considered above, the P/E ratio would be 24 if this home rents for $1250 per month. ''[[Fortune magazine]]'' cites a historic range of 11 or 12 for the simpler [[Housing bubble#Housing ownership and rent measures|price-to-rent ratio]].<ref name="Fortune PR ratio">{{cite news |last=Tully |first=Shawn |title=The New Home Economics |date=2003-12-22 |work=[[Fortune magazine|Fortune]] |url=http://money.cnn.com/magazines/fortune/fortune_archive/2003/12/22/356104/index.htm }}</ref> | |||

|} | |||

|} | |||

Observers and analysts have attributed the reasons for the 2001-2006 '''[[United States housing bubble|housing bubble]]''' and its 2007-10 collapse in the [[United States]] to "everyone from home buyers to [[Wall Street]], [[mortgage broker]]s to [[Alan Greenspan]]".<ref name=factcheck/> Other factors that are named include "[[Mortgage underwriting in the United States|Mortgage underwriters]], [[Investment banking|investment banks]], [[Credit rating agency|rating agencies]], and investors",<ref name=indiviglio/> "low mortgage interest rates, low short-term interest rates, relaxed standards for mortgage loans, and [[irrational exuberance]]"<ref name=holt>[http://www.uvu.edu/woodbury/jbi/volume8/journals/SummaryofthePrimaryCauseoftheHousingBubble.pdf A Summary of the Primary Causes of the Housing Bubble and the Resulting Credit Crisis: A Non-Technical Paper] By JEFF HOLT</ref> Politicians in both the [[Democratic Party (United States)|Democratic]] and [[Republican Party (United States)|Republican]] political parties have been cited for "pushing to keep [[Derivative (finance)|derivatives]] [[Brooksley_Born#Born_and_the_OTC_Derivatives_Market|unregulated]]" and "with rare exceptions" giving [[Fannie Mae]] and [[Freddie Mac]] "unwavering support".<ref name=Devils365>{{cite book|last=McLean|first=Bethany|title=All the Devils Are Here|year=2010, 2011|publisher=Portfolio/Penguin|location=NY|pages=365|url=http://books.google.com/books?id=8tGsDQjEaXoC&pg=PT382&lpg=PT382&dq=all+the+devils+are+here+Fannie+Mae+and+Freddie+Mac+%22unwavering+support&source=bl&ots=k2oiY7Gh5I&sig=KAMs6vMXZ7o9iPQQ2a1BgU-SUTg&hl=en&sa=X&ei=j5IeUfXPHZKPyAGZm4DIBQ&ved=0CDMQ6AEwAA}}</ref> | |||

[[File:U.S. Housing Price Measures - Index and Dollar Price Value.png|thumb|300px|U.S. Median Price of Homes Sold]] | |||

==Government policies== | |||

== | ===Housing tax policy=== | ||

In July 1978, Section 121 allowed for a $100,000 one-time exclusion in capital gains for sellers 55 years or older at the time of sale.<ref name="house.gov">[http://www.house.gov/natcommirs/aicpa7.htm 1. Proposal for Amending I.R.C. §121 and §1034] ''U.S. House of Representatives''</ref> In 1981, the Section 121 exclusion was increased from $100,000 to $125,000.<ref name="house.gov"/> The [[Tax Reform Act of 1986]] eliminated the tax deduction for interest paid on credit cards. As mortgage interest remained deductible, this encouraged the use of home equity through refinancing, second mortgages, and home equity lines of credit (HELOC) by consumers.<ref>[http://www.homefinder.com/content/Blog:Impact_of_1986_Tax_Reform_Act_on_Homeowners_Today Impact of 1986 Tax Reform Act on Homeowners Today] ''HomeFinder.com'', August 5, 2008</ref> | |||

= | The [[Taxpayer Relief Act of 1997]] repealed the Section 121 exclusion and section 1034 rollover rules, and replaced them with a $500,000 married/$250,000 single exclusion of capital gains on the sale of a home, available once every two years.<ref>[http://www.house.gov/natcommirs/aicpa7.htm 1. Proposal for Amending I.R.C. §121 and §1034] 'U.S. House of Representatives''</ref> This made housing the only investment which escaped capital gains. These tax laws encouraged people to buy expensive, fully mortgaged homes, as well as invest in second homes and investment properties, as opposed to investing in stocks, bonds, or other assets.<ref>[http://online.wsj.com/article/SB119794091743935595.html The Clinton Housing Bubble], [[Vernon L. Smith]], ''[[The Wall Street Journal]]'', December 18, 2007</ref><ref>[http://www.nytimes.com/2008/12/19/business/19tax.html?pagewanted=all Tax Break May Have Helped Cause Housing Bubble], Vikas Bajaj and David Leonhardt, ''[[The New York Times]]'', December 18, 2008</ref><ref>http://online.wsj.com/article/SB123897612802791281.html From Bubble to Depression?], Steven Gjerstad and Vernon L. Smith, ''[[Wall Street Journal]]'', April 6, 2009</ref> | ||

===Deregulation=== | |||

{{See also|Financial crisis of 2007-2009#Deregulation}} | |||

Historically, the financial sector was heavily regulated by the [[Glass–Steagall Act]] which separated [[commercial bank|commercial]] and [[investment bank|investment]] banks. It also set strict limits on Banks' interest rates and loans. | |||

Starting in the 1980s, considerable deregulation took place in banking. Banks were deregulated through: | |||

* The [[Depository Institutions Deregulation and Monetary Control Act]] of 1980 (allowing similar banks to merge and set any interest rate). | |||

* The [[Garn–St. Germain Depository Institutions Act]] of 1982 (allowing [[Adjustable-rate mortgages]]). | |||

* The [[Gramm–Leach–Bliley Act]] of 1999 (allowing commercial and investment banks to merge). | |||

This deregulation allowed many risky products to exist (such as [[Adjustable-rate mortgages]]) which contributed to the housing bubble and easy credit.{{Citation needed|date=April 2012}} | |||

== | Several authors single out the banking deregulation by the Gramm–Leach–Bliley Act as significant.<ref>{{cite news| url=http://www.nytimes.com/2011/12/11/books/review/back-to-work-why-we-need-smart-government-for-a-strong-economy-by-bill-clinton-book-review.html?pagewanted=all | work=New York Times | title=What Bill Clinton Would Do | date=2011-12-09 | accessdate=2012-01-27 | first1=Jeff | last1=Madrick}}</ref> [[Nobel Prize]]-winning economist [[Paul Krugman]] has called Senator [[Phil Gramm]] "the father of the financial crisis" due to his sponsorship of the act.<ref>[http://krugman.blogs.nytimes.com/2008/03/29/the-gramm-connection/ The Gramm connection]. [[Paul Krugman]]. ''[[The New York Times]]''. Published March 29, 2008.</ref> [[Nobel Prize]]-winning [[economist]] [[Joseph Stiglitz]] has also argued that GLB helped to create the crisis.<ref>[http://abcnews.go.com/print?id=5835269 Who's Whining Now? Gramm Slammed By Economists]. [[ABC News]]. Sept. 19, 2008.</ref> An article in ''[[The Nation]]'' has made the same argument.<ref>[http://www.thenation.com/doc/20081006/sumner John McCain: Crisis Enabler]. ''[[The Nation]]''. September 21, 2008.</ref> | ||

Economists [[Robert Ekelund]] and [[Mark Thornton]] have also criticized the Act as contributing to the [[2007 subprime mortgage financial crisis|crisis]]. They state that while "in a world regulated by a [[gold standard]], [[full reserve banking|100% reserve banking]], and no [[Federal Deposit Insurance Corporation|FDIC]] deposit insurance" the Financial Services Modernization Act would have made "perfect sense" as a legitimate act of deregulation, but under the present [[Debt-based monetary system|fiat monetary system]] it "amounts to [[corporate welfare]] for financial institutions and a [[moral hazard]] that will make taxpayers pay dearly."<ref>{{cite web | |||

| last = Ekelund | |||

| first = Robert | |||

| coauthors = Thornton, Mark | |||

| publisher = [[Ludwig von Mises Institute]] | |||

| url = http://mises.org/story/3098 | |||

| title = More Awful Truths About Republicans | |||

| date = 2008-09-04 | |||

| accessdate = 2008-09-07}}</ref> | |||

Critics have also noted defacto deregulation through a shift in mortgage [[securitization]] market share from more highly regulated Government Sponsored Enterprises to less regulated investment banks.<ref name = "Simkovic">Michael Simkovic, [http://ssrn.com/abstract=1924831 ''Competition and Crisis in Mortgage Securitization'']</ref> | |||

== | However, many economists, analysts and politicians reject the criticisms of the GLB legislation. Brad DeLong, a former advisor to President Clinton and economist at the University of California, Berkeley and Tyler Cowen of George Mason University have both argued that the Gramm-Leach-Bliley Act softened the impact of the crisis by allowing for mergers and acquisitions of collapsing banks as the crisis unfolded in late 2008.<ref name=factcheck>{{Cite web|url=http://www.factcheck.org/elections-2008/who_caused_the_economic_crisis.html |title=Who Caused the Economic Crisis? |publisher=FactCheck.org |date= |accessdate=2010-01-21}}</ref> "Alice M. Rivlin, who served as a deputy director of the Office of Management and Budget under Bill Clinton, said that GLB was a necessary piece of legislation because the separation of investment and commercial banking 'wasn't working very well.' Even Bill Clinton stated (in 2008): 'I don't see that signing that bill had anything to do with the current crisis'"<ref>Joseph Fried, ''Who Really Drove the Economy Into the Ditch'' (New York: Algora Publishing, 2012) 289-90.</ref> | ||

===Mandated loans=== | |||

Republican Senator [[Marco Rubio]] has stated that the housing crisis was "created by reckless government policies.”<ref name=konczal/><ref>[http://www.washingtonpost.com/blogs/wonkblog/wp/2013/02/12/read-the-republican-response-to-the-state-of-the-union/ full text of Sen. Marco Rubio’s (R-FL) Republican Address to the Nation, as prepared for delivery]</ref> Republican appointee to the [[Financial Crisis Inquiry Commission]] [[Peter J. Wallison]] and coauthor Edward Pinto believed that the housing bubble and crash was due to federal mandates to promote affordable housing. These were applied through the [[Community Reinvestment Act]] and "[[Government sponsored entities#United States|government sponsored entities]]" (GSE's) "[[Fannie Mae]]" (Federal National Mortgage Association) and "[[Freddie Mac]]" (Federal Home Loan Mortgage Corporation).<ref name=dissent/> Journalist Daniel Indiviglio argues the two GSE's played a major role, while not denying the importance of Wall Street and others in the private sector in creating the collapse.<ref name=indiviglio>[http://www.theatlantic.com/business/archive/2010/06/did-fannie-and-freddie-cause-the-housing-bubble/57664/ Did Fannie and Freddie Cause the Housing Bubble?] Daniel Indiviglio June 3, 2010</ref> | |||

= | The Housing and Community Development Act of 1992 established an affordable housing loan purchase mandate for Fannie Mae and Freddie Mac, and that mandate was to be regulated by HUD. Initially, the 1992 legislation required that 30 percent or more of Fannie’s and Freddie’s loan purchases be related to affordable housing. However, HUD was given the power to set future requirements. In 1995 HUD mandated that 40 percent of Fannie and Freddie’s loan purchases would have to support affordable housing. In 1996, HUD directed Freddie and Fannie to provide at least 42% of their mortgage financing to borrowers with income below the median in their area. This target was increased to 50% in 2000 and 52% in 2005. Under the Bush Administration HUD continued to pressure Fannie and Freddie to increase affordable housing purchases – to as high as 56 percent by the year 2008.<ref name=dissent>Peter J. Wallison, “Dissent from the Majority Report of the Financial Crisis Inquiry Commission,” (Washington, DC: American Enterprise Institute, January 2011), 61, www.aei.org.</ref> To satisfy these mandates, Fannie and Freddie eventually announced low-income and minority loan commitments totaling $5 trillion.<ref>Joseph Fried, Who Really Drove the Economy Into the Ditch? (New York, NY: Algora Publishing, 2012), 121.</ref> Critics argue that, to meet these commitments, Fannie and Freddie promoted a loosening of lending standards - industry-wide.<ref>Joseph Fried, Who Really Drove the Economy Into the Ditch? (New York, NY: Algora Publishing, 2012), Chapter 6.</ref> | ||

Regarding the Community Reinvestment Act (CRA), Economist Stan Liebowitz wrote in the ''New York Post'' that a strengthening of the CRA in the 1990s encouraged a loosening of lending standards throughout the banking industry. He also charged the Federal Reserve with ignoring the negative impact of the CRA.<ref name="Liebowitz">Stan Liebowtiz, [http://www.nypost.com/seven/02052008/postopinion/opedcolumnists/the_real_scandal_243911.htm?page=0 The Real Scandal - How feds invited the mortgage mess], [[New York Post]], February 5, 2008</ref> American Enterprise Institute Scholar Edward Pinto noted that, in 2008, Bank of America reported that its CRA portfolio, which constituted only 7 percent of its owned residential mortgages, was responsible for 29 percent of its losses.<ref>Edward Pinto, "Yes, the CRA is Toxic," City Journal, 2009</ref> A Cleveland Plain Dealer investigation found that "The City of Cleveland has aggravated its vexing foreclosure problems and has lost millions in tax dollars by helping people buy homes they could not afford." The newspaper added that these problem mortgages "typically came from local banks fulfilling federal requirements to lend money in poorer neighborhoods."<ref name="cleveland">{{cite web|first=Mark|last=Gillespie|title=How Cleveland Aggravated Its Foreclosure Problem and Lost Millions in Tax Dollars - All to Help People Purchase Homes They Couldn't Afford|url=http://blog.cleveland.com/metro/2009/12/how_cleveland_aggrivated_its_f.html|date=2009-12-13|work=Cleveland Plain Dealer|publisher=Cleveland.com|accessdate=2013-12-10}}</ref><ref>[[Russell Roberts (economist)|Russell Roberts]], [http://online.wsj.com/article/SB122298982558700341.html "How Government Stoked the Mania"], [[Wall Street Journal]], October 3, 2008.</ref> | |||

== | Others argue that "pretty much all the evidence on the housing crisis shows" that Fannie Mae, Freddie Mac, the (CRA) and their affordability goals were not a major reason for the bubble and crash.<ref name=Simkovic /><ref name=konczal>{{cite news|last=Konczal|first=Mike|title=No, Marco Rubio, government did not cause the housing crisis|url=http://www.washingtonpost.com/blogs/wonkblog/wp/2013/02/13/no-marco-rubio-government-did-not-cause-the-housing-crisis/|accessdate=13 February 2013|newspaper=Washington Post|date=13 February 2013}}</ref><ref name="Mcclatchy">{{cite news |title=Private sector loans, not Fannie or Freddie, triggered crisis | ||

|url=http://www.mcclatchydc.com/2008/10/12/53802/private-sector-loans-not-fannie.html#ixzz12xTyWY91A | |||

|date=12/3/2008 |publisher=''[[The McClatchy Company|McClatchy]]''}}</ref> | |||

Law professor David Min argues that view (blaming GSE's and CRA) "is clearly contradicted by the facts", namely that | |||

* Parallel bubble-bust cycles occurred outside of the residential housing markets (for example, in commercial real estate and consumer credit). | |||

* Parallel financial crises struck other countries, which did not have analogous affordable housing policies | |||

* The U.S. government’s market share of home mortgages was actually declining precipitously during the housing bubble of the 2000s.<ref name=Min/> | |||

== | However, according to Peter J. Wallison, other developed countries with "large bubbles during the 1997–2007 period" had "far lower ... losses associated with mortgage delinquencies and defaults" because (according to Wallison), these countries' bubbles were not supported by a huge number of government mandated substandard loans – generally with low or no downpayments" as was the case in the US.<ref name="Wallison 1">{{cite web|author=Peter J. Wallison|title=Dissent from the Majority Report of the Financial Crisis Inquiry Commission|publisher=American Enterprise Institute|date=January 2011|url=http://www.aei.org|accessdate=2012-11-20}}</ref> | ||

Other analysis calls into question the validity of comparing the residential loan crisis to the commercial loan crisis. After researching the default of commercial loans during the financial crisis, Xudong An and Anthony B. Sanders reported (in December 2010): "We find limited evidence that substantial deterioration in CMBS [commercial mortgage-backed securities] loan underwriting occurred prior to the crisis."<ref>Sanders, Anthony B. and An, Xudong, Default of CMBS Loans During the Crisis (November 29, 2010). 46th Annual AREUEA Conference Paper. Available at SSRN: http://ssrn.com/abstract=1717062</ref> Other analysts support the contention that the crisis in commercial real estate and related lending took place ''after'' the crisis in residential real estate. Business journalist Kimberly Amadeo reports: "The first signs of decline in residential real estate occurred in 2006. Three years later, commercial real estate started feeling the effects.<ref>Amadeo, Kimberly, "Commercial Real Estate Lending" in News & Issues-US Economy(About.com, November, 2013), http://useconomy.about.com/od/grossdomesticproduct/tp/Commercial-Real-Estate-Loan-Defaults.htm </ref> Denice A. Gierach, a real estate attorney and CPA, wrote:<blockquote>...most of the commercial real estate loans were good loans destroyed by a really bad economy. In other words, the borrowers did not cause the loans to go bad, it was the economy.<ref>Gierach, Denice A., "Waiting for the other shoe to drop in commercial real estate," (Chicago, IL, The Business Ledger, March 4, 2010)</ref></blockquote> | |||

== | In their book on the financial crisis Business journalists [[Bethany McLean]] and [[Joe Nocera]] argue that the charges against Fannie and Freddie are "completely upside down; Fannie and Freddie raced to get into subprime mortgages because they feared being left behind by their nongovernment competitors."<ref name=devils363>{{cite book|last=Mclean|first=Bethany|title=All the Devils Are Here|year=2010, 2011|publisher=Porfolio/Penguin|location=New York|isbn=9781591843634|pages=363|url=http://book.zi5.me/books/read/762/25}}</ref> | ||

Most early estimates showed that the subprime mortgage boom and the subsequent crash were very much concentrated in the private market, not the public market of Fannie Mae and Freddie Mac.<ref name=konczal/> According to an estimate made by the Federal Reserve in 2008, more than 84 percent of the subprime mortgages came from private lending institutions in 2006.<ref name="Mcclatchy"/> The share of subprime loans insured by Fannie Mae and Freddie Mac also decreased as the bubble got bigger (from a high of insuring 48 percent to insuring 24 percent of all subprime loans in 2006).<ref name="Mcclatchy"/> | |||

= | To make its estimate, the Federal Reserve did not directly analyze the characteristics of the loans (such as downpayment sizes); rather, it assumed that loans carrying interest rates 3% or more higher than normal rates were subprime and loans with lower interest rates were prime. Critics dispute the Federal Reserve's use of interest rates to distinguish prime from subprime loans. They say that subprime loan estimates based on use of the high-interest-rate proxy are distorted because government programs generally promote low-interest rate loans – even when the loans are to borrowers who are clearly subprime.<ref name="Joseph Fried 2012">Joseph Fried, Who Really Drove the Economy Into the Ditch? (New York, NY: Algora Publishing, 2012), 141.</ref> | ||

According to Min, while Fannie and Freddie did buy high-risk mortgage-backed securities, | |||

<Blockquote> they did not buy enough of them to be blamed for the mortgage crisis. Highly respected analysts who have looked at these data in much greater detail than Wallison, Pinto, or myself, including the nonpartisan Government Accountability Office,<ref name=GAO>{{cite web|title=FANNIE MAE AND FREDDIE MAC Analysis of Options for Revising the Housing Enterprises’ Long-term Structures|url=http://www.gao.gov/new.items/d09782.pdf|work=September 2009|publisher=United States Government Accountability Office Report to Congressional Committees|accessdate=14 February 2013}}</ref> the Harvard Joint Center for Housing Studies,<ref name=Harvard>{{cite web|title=Harvard Report Finds Excessive Risk Taking and Lapses in Regulation Led to the Nonprime Mortgage Lending Boom|url=http://www.jchs.harvard.edu/harvard-report-finds-excessive-risk-taking-and-lapses-regulation-led-nonprime-mortgage-lending-boom|work=September 27, 2010|publisher=Joint Center for Housing Studies of Harvard University|accessdate=14 Feb 2013}}</ref> the Financial Crisis Inquiry Commission majority,<ref>{{cite web|title=CONCLUSIONS OF THE FINANCIAL CRISIS INQUIRY COMMISSION|url=http://fcic-static.law.stanford.edu/cdn_media/fcic-reports/fcic_final_report_conclusions.pdf|publisher=FINANCIAL CRISIS INQUIRY COMMISSION|accessdate=14 Feb 2013}}</ref> the Federal Housing Finance Agency,<ref name=FHFA>{{cite web|title=Data on the Risk Characteristics and Performance of Single-Family Mortgages Originated from 2001 through 2008 and Financed in the Secondary Market|url=http://www.fhfa.gov/webfiles/16711/RiskChars9132010.pdf|work=September 13, 2010|publisher=Federal Housing Finance Agency|accessdate=14 feb 2013}}</ref> and virtually all academics, including the University of North Carolina,<ref name=UNC>{{cite web|last=Park|first=Kevin|title=Fannie, Freddie and the Foreclosure Crisis|url=http://www.ccc.unc.edu/FannieFreddie.php|work=Kevin Park,|publisher=UNC Center for Community Capital|accessdate=14 February 2013}}</ref> Glaeser et al at Harvard,<ref name=glaeser>{{cite journal|last=Glaeser|first=Edward L.,|coauthors=Joseph Gyourko, and Albert Saiz|title=Housing supply and housing bubbles.|journal=Journal of Urban Economics|date=June 2008|volume=64|issue=2|pages=198–217|doi=10.1016|url=http://nrs.harvard.edu/urn-3:HUL.InstRepos:2962640|accessdate=14 February 2013}}</ref> and the St. Louis Federal Reserve,<ref name=thomas>{{cite web|last=Thomas|first=Jason|title=Housing Policy, Subprime Markets and Fannie Mae and Freddie Mac: What We Know, What We Think We Know and What We Don’t Know|url=http://research.stlouisfed.org/conferences/gse/Van_Order.pdf|work=November 2010|publisher=stlouisfed.org|accessdate=14 Feb 2013}}</ref> have all rejected the Wallison/Pinto argument that federal affordable housing policies were responsible for the proliferation of actual high-risk mortgages over the past decade.<ref name=Min>{{cite web|last=Min|first=David|title=Why Wallison Is Wrong About the Genesis of the U.S. Housing Crisis|url=http://www.ritholtz.com/blog/2011/07/why-wallison-is-wrong-about-the-genesis-of-the-u-s-housing-crisis/|work=Center for American Progress, July 12, 2011|publisher=americanprogress.org|accessdate=13 February 2013}}</ref></blockquote> | |||

== | Min's contention that Fannie and Freddie did not buy a significant amount of high-risk mortgage backed securities must be evaluated in light of subsequent SEC security fraud charges brought against executives of Fannie Mae and Freddie Mac in December 2011. Significantly, the SEC alleged (and still maintains) that Fannie Mae and Freddie Mac reported as subprime and substandard ''less than 10 percent'' of their actual subprime and substandard loans.<ref>SEC Charges Former Fannie Mae and Freddie Mac Executives with Securities Fraud," Securities and Exchange Commission, December 16, 2011, http://www.sec.gov/news/press/2011/2011-267.htm.</ref> In other words, the substandard loans held in the GSE portfolios may have been 10 times greater than originally reported. According to Peter Wallison of the American Enterprise Institute, that would make the SEC's estimate of GSE substandard loans about $2 trillion - significantly higher than Edward Pinto's estimate.<ref name=trial>{{cite web|last=WALLISON|first=PETER|title=The Financial Crisis on Trial|url=http://online.wsj.com/article/SB10001424052970204791104577108183677635076.html?mod=googlenews_wsj|work=December 21, 2011|publisher=wsj.com|accessdate=21 June 2013}}</ref><ref>Peter J. Wallison and Edward Pinto, "Why the Left is Losing the Argument over the Financial Crisis," (Washington, D.C.: American Enterprise Institute, December 27, 2011)</ref> | ||

The Federal Reserve also estimated that only six percent of higher-priced loans were extended by [[Community Reinvestment Act]]-covered lenders to lower-income borrowers or CRA neighborhoods.<ref name=konczal/><ref name=Kroszner>{{cite web|last=Kroszner|first=Randall S.|title=The Community Reinvestment Act and the Recent Mortgage Crisis|url=http://www.federalreserve.gov/newsevents/speech/kroszner20081203a.htm#f3|work=Speech at the Confronting Concentrated Poverty Policy Forum|publisher=Board of Governors of the Federal Reserve System, Washington, D.C.December 3, 2008|accessdate=13 February 2013}}</ref><ref>{{cite news |title=Fed’s Kroszner: Don’t Blame CRA | |||

|url=http://blogs.wsj.com/economics/2008/12/03/feds-kroszner-defends-community-reinvestment-act/ | |||

|date=12/3/2008 | |||

|publisher=''[[Wall Street Journal]]''}}</ref> (As it did with respect to GSE loans, the Federal Reserve assumed that all CRA loans were prime unless they carried interest rates 3% or more above the normal rate, an assumption disputed by others.)<ref name="Joseph Fried 2012"/> In a 2008 speech, Federal Reserve Governor [[Randall Kroszner]], argued that the CRA could not be responsible for the [[subprime mortgage crisis]], stating that | |||

<blockquote>"first, only a small portion of subprime mortgage originations are related to the CRA. Second, CRA-related loans appear to perform comparably to other types of subprime loans. Taken together… we believe that the available evidence runs counter to the contention that the CRA contributed in any substantive way to the current mortgage crisis"</blockquote> Others, such as [[Federal Deposit Insurance Corporation]] Chairman Sheila Bair,<ref name="bair1208">{{cite web | author=Sheila Bair |coauthors=FDIC Chairman |title=Prepared Remarks: ''Did Low-income Homeownership Go Too Far?'' |url=http://www.fdic.gov/news/news/speeches/archives/2008/chairman/spdec1708.html |date=2008-12-17 |work=Conference before the New America Foundation |publisher=FDIC }}</ref> and Ellen Seidman of the [[New America Foundation]]<ref>{{cite web |url=http://www.prospect.org/cs/articles?article=dont_blame_the_community_reinvestment_act |title=Don't Blame the Community Reinvestment Act | work=The American Prospect |publisher=www.prospect.org|accessdate=2009-08-12 |last=Seidman |first=Ellen }}</ref> also argue that the CRA was not responsible for the crisis. The CRA also only affected one out of the top 25 subprime lenders.<ref name="Mcclatchy"/> According to several economists, Community Reinvestment Act loans outperformed other "subprime" mortgages, and GSE mortgages performed better than private label securitizations.<ref name="Simkovic" /><ref name="Regulation and the Mortgage Crisis">{{citation |url=http://papers.ssrn.com/sol3/papers.cfm?abstract_id=1728260 |title=Regulation and the Mortgage Crisis |year=2011}}</ref> | |||

== | ===Historically low interest rates=== | ||

According to some, such as [[John B. Taylor]] and [[Thomas M. Hoenig]], "excessive risk-taking and the housing boom" were brought on by the Federal Reserve holding "interest rates too low for too long".<ref>[http://rortybomb.wordpress.com/2012/04/06/far-too-low-for-far-too-long-39/ Far Too Low for Far Too Long]| JW Mason| April 6, 2012</ref><ref>[http://www.nytimes.com/2011/08/14/business/kansas-city-fed-president-defies-conventional-wisdom.html?_r=0 Conventional Fed Wisdom, Defied]| By GRETCHEN MORGENSON| 13 August 2011</ref> | |||

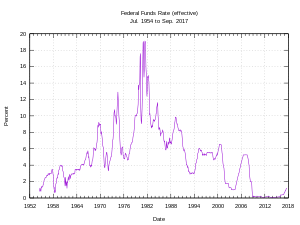

In the wake of the [[Dot-com bubble|dot-com crash]] and the subsequent 2001–2002 recession the Federal Reserve dramatically lowered interest rates to historically low levels, from about 6.5% to just 1%. This spurred easy credit for banks to make loans. By 2006 the rates had moved up to 5.25% which lowered the demand and increased the monthly payments for adjustable rate mortgages. The resulting foreclosures increased supply, dropping housing prices further. Former Federal Reserve Board Chairman Alan Greenspan admitted that the housing bubble was "fundamentally engendered by the decline in real long-term interest rates."<ref name="Greenspan interest rates FT">{{cite news |last=Greenspan |first=Alan |title=A global outlook |work=[[Financial Times]] |date=2007-09-16 |url=http://www.ft.com/cms/s/0/976b7442-6486-11dc-90ea-0000779fd2ac.html }}</ref> | |||

Mortgages had been bundled together and sold on Wall Street to investors and other countries looking for a higher return than the 1% offered by Federal Reserve. The percentage of risky mortgages was increased while rating companies claimed they were all top-rated. Instead of the limited regions suffering the housing drop, it was felt around the world. The Congressmen who had pushed to create subprime loans<ref>Congressman Barney Frank Hearing Before the Committee on Financial Services: US House of Representatives, 108th Congress, first session,9-10-2003 pg 3</ref><ref>Hearing Before the Committee on Banking, Housing, and Urban Affairs: US Senate, 108th Congress, first and second session,2-25-2004 pg 454</ref> now cited Wall Street and their rating companies for misleading these investors.<ref>"A (Sub)Prime Argument for More Regulation" Financial Times of London, pg 11 8-20-2007 quotes Congressman Barney Frank</ref><ref>[http://news.yahoo.com/s/ap/20100428/ap_on_bi_ge/us_financial_overhaulquotes Senator Dodd]</ref> | |||

[[File:Federal funds effective rate 1954 to present.svg|300px|thumb|Historical chart of the effective federal interest rates, known as the Federal Funds Rate. From 2001 to 2006 interest rates were dramatically lowered (due to the [[Dot-com crash]]) but then increased from 2006 to 2007.]] | |||

In the United States, mortgage rates are typically set in relation to 10-year [[treasury bond]] yields, which, in turn, are affected by [[Fed funds rate|Federal Funds rates]]. The Federal Reserve acknowledges the connection between lower interest rates, higher home values, and the increased liquidity the higher home values bring to the overall economy.<ref>{{cite news |last=Greenspan |first=Alan |title=Housing Bubble Bursts in the Market for U.S. Mortgage Bonds |work=[[Bloomberg L.P.|Bloomberg]] |date=2005-12-06 |url=http://www.bloomberg.com/apps/news?pid=10000103&sid=aDSB370ItSJU&refer=us |quote=Froth in housing markets may be spilling over into mortgage markets. }}</ref> A Federal Reserve report reads: | |||

{{quotation|Like other asset prices, house prices are influenced by interest rates, and in some countries, the housing market is a key channel of monetary policy transmission.<ref>{{cite news |title=International Finance Discussion Papers, Number 841, House Prices and Monetary Policy: A Cross-Country Study |publisher=[[Federal Reserve Board]] |date=September 2005 |url=http://www.federalreserve.gov/pubs/ifdp/2005/841/ifdp841.pdf |quote=Like other asset prices, house prices are influenced by interest rates, and in some countries, the housing market is a key channel of monetary policy transmission. }}</ref>}} | |||

== | For this reason, some have criticized then Fed Chairman Alan Greenspan for "engineering" the housing bubble,<ref>{{cite news |title=The American economy: A phoney recovery, Drug addicts get only a temporary high. America's economy, addicted to asset appreciation and debt, is no different |last=Roach |first=Stephen| work=[[The Economist]] |date=2004-02-26 | ||

|url=http://www.economist.com/finance/displayStory.cfm?story_id=2461875 |quote=The Fed, in effect, has become a serial bubble blower. }}</ref><ref>{{cite news |title=There Goes the Neighborhood: Why home prices are about to plummet—and take the recovery with them. | last=Wallace-Wells |first=Benjamin |work=[[Washington Monthly]] |date=April 2004 |url=http://www.washingtonmonthly.com/features/2004/0404.wallace-wells.html}}</ref><ref>{{cite news |title=Morgan Stanley Global Economic Forum: Original Sin |last=Roach |first=Stephen |publisher=[[Morgan Stanley]] |year=2005 |url=http://www.morganstanley.com/GEFdata/digests/20050425-mon.html }} See also [[James Wolcott]]'s [http://jameswolcott.com/archives/2005/04/bubble_trouble.php comments].</ref><ref>{{cite book |title=American Theocracy: The Peril and Politics of Radical Religion, Oil, and Borrowed Money in the 21st Century |last=Phillips |first=Kevin |publisher=Viking |year=2006 |isbn=0-670-03486-X }}</ref><ref>{{cite news |title=Intimations of a Recession | |||

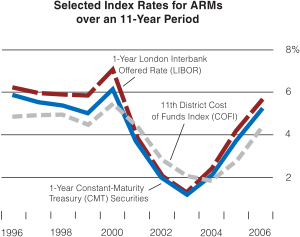

|last=Krugman |first=Paul | work=[[The New York Times]] |date=2006-08-07 |url=http://select.nytimes.com/2006/08/07/opinion/07krugman.html }}</ref><ref>{{cite news |last=Fleckenstein |first=Bill |title=Face it: The housing bust is here |date=2006-08-21 |publisher=[[MSN]] |url=http://articles.moneycentral.msn.com/Investing/ContrarianChronicles/FaceItTheHousingBustIsHere.aspx?page=all }}</ref> saying, e.g., "It was the Federal Reserve-engineered decline in rates that inflated the housing bubble."<ref name="BW burst"/> Between 2000 and 2003, the interest rate on 30-year fixed-rate mortgages fell 2.5 percentage points (from 8% to all-time historical low of about 5.5%). The interest rate on one-year [[adjustable rate mortgage]]s (1/1 ARMs) fell 3 percentage points (from about 7% to about 4%). Richard Fisher, president of the Dallas Fed, said in 2006 that the Fed's low interest-rate policies unintentionally prompted speculation in the housing market, and that the subsequent "substantial correction [is] inflicting real costs to millions of homeowners."<ref name="WJ Fisher Fed rates speculation"/><ref name="Fisher Fed rates"/> | |||

Economist [[Joseph Stiglitz]] argues that Greenspan was compelled to cut rates to maintain growth and employment after the [[Economic policy of the George W. Bush administration|2001 and 2003 tax cuts]] of the Bush administration failed to lift the economy out of the post-[[Dot-com bubble]] recession.<ref>[http://www.realclearpolitics.com/articles/2007/08/how_the_bubble_started.html How the Bubble Started], [[Joseph Stiglitz]], ''Real Clear Politics'', August 9, 2007</ref> | |||

= | A drop in mortgage interest rates reduces the cost of borrowing and should logically result in an increase in prices in a market where most people borrow money to purchase a home (for instance, in the United States), so that average payments remain constant. If one assumes that the housing market is [[Efficient market|efficient]], the expected change in housing prices (relative to interest rates) can be computed mathematically. The calculation in the sidebox shows that a 1 percentage point change in interest rates would theoretically affect home prices by about 10% (given 2005 rates on fixed-rate mortgages). This represents a 10-to-1 multiplier between percentage point changes in interest rates and percentage change in home prices. For interest-only mortgages (at 2005 rates), this yields about a 16% change in principal for a 1% change in interest rates at current rates. Therefore, the 2% drop in long-term interest rates can account for about a 10 × 2% = 20% rise in home prices | ||

if every buyer is using a fixed-rate mortgage (FRM), or about 16 × 3% ≈ 50% if every buyer is using an adjustable rate mortgage (ARM) whose interest rates dropped 3%. | |||

[[Robert Shiller]] shows that the inflation adjusted U.S. home price increase has been about 45% during this period,<ref name="IE2"/> an increase in valuations that is approximately consistent with most buyers financing their purchases using ARMs. In areas of the United States believed to have a housing bubble, price increases have far exceeded the 50% that might be explained by the cost of borrowing using ARMs. For example, in [[San Diego]] area, average mortgage payments grew 50% between 2001 and 2004. When interest rates rise, a reasonable question is how much house prices will fall, and what effect this will have on those holding [[negative equity]], as well as on the [[U.S. economy]] in general. The salient question is whether interest rates are a determining factor in specific markets where there is high | |||

sensitivity to housing affordability. (Thomas Sowell in his book, Housing Boom and Bust, points out that these markets where there is high sensitivity to housing affordability are created by laws that restrict land use and thus its supply. In areas like Houston which has no zoning laws the Fed rate had no effect.) | |||

====Return to higher rates==== | |||

Between 2004 and 2006, the Fed raised interest rates 17 times, increasing them from 1% to 5.25%, before pausing.<ref name="FT Fed rates">{{cite news |title=Fed holds rates for first time in two years |date=2006-08-08 |work=[[Financial Times]] |url=http://www.ft.com/cms/s/09595e76-2562-11db-a12e-0000779e2340.html }}</ref> The Fed paused raising interest rates because of the concern that an accelerating downturn in the housing market could undermine the overall economy, just as the crash of the [[dot-com bubble]] in 2000 contributed to the subsequent recession. However, [[New York University]] economist [[Nouriel Roubini]] asserted that "The Fed should have tightened earlier to avoid a festering of the housing bubble early on."<ref>{{cite news |last=Roubini |first=Nouriel |title=Fed Holds Interest Rates Steady As Slowdown Outweighs Inflation |date=2006-08-09 |work=[[The Wall Street Journal]] |url=http://www.realestatejournal.com/buysell/markettrends/20060809-ip.html?refresh=on |quote=The Fed should have | |||

tightened earlier to avoid a festering of the housing bubble early on. The Fed is facing a nightmare now: the recession will come and easing will not prevent it. }}</ref> | |||

There was a great debate as to whether or not the Fed would lower rates in late 2007. The majority of economists expected the Fed to maintain the Fed funds rate at 5.25 percent through 2008;<ref>{{cite news |title=Poll: Fed to leave U.S. rates at 5.25 percent through end-2008 |date=2007-06-14 |work=[[Reuters]] |url=http://www.reuters.com/article/ousiv/idUSL1441819820070614 | first=Chris | last=Reese}}</ref> however, on September 18, it lowered the rate to 4.75 percent.<ref>{{cite news |title=In bold stroke, Fed cuts base rate half point to 4.75 percent |date=2007-09-17 |work=[[Agence France-Presse|AFP]] |url=http://afp.google.com/article/ALeqM5gUqC8adFVuqJldLoqOnsF3bxEzOA }}</ref> | |||

{| style="float:right; background:ghostwhite; border:1px solid black; width:42%; padding-left:.75em; padding-right:.75em; margin-left:1.5em;" | |||

|- | |||

| | |||

'''Differential relationship between interest rates and affordability.'''<br /> An approximate formula can be obtained that provides the relationship between changes in interest rates and changes in home affordability. The computation proceeds by designating affordability (the monthly mortgage payment) constant, and differentiating the equation for [[Fixed rate mortgage#Monthly payment formula|monthly payments]] | |||

::<math>\textstyle{{\rm monthly}\atop{\rm payment}} = \frac{r}{1-(1+r)^{-N}}{\scriptstyle{{Who}\times\rm Principal}}</math> | |||

with respect to the [[interest rate]] ''r'', then solving for the change in [[:wikt:principal|Principal]]. Using the approximation <math>\scriptstyle(1+r/K)^{NK}\approx e^{Nr}</math> (''K'' → ∞, and ''e'' = 2.718... is the base of the [[natural logarithm]]) for continuously compounded interest, this results in the approximate equation | |||

::<math>\textstyle\frac{\Delta{\rm Principal}}{{\rm Principal}} \approx -\left(1 - \frac{Nre^{-Nr}}{1-e^{-Nr}} \right)\frac{\Delta r}{r}</math> | |||

(fixed-rate loans). For interest-only mortgages, the change in principal yielding the same monthly payment is | |||

::<math>\textstyle\frac{\Delta{\rm Principal}}{{\rm Principal}} \approx -\frac{\Delta r}{r}</math> | |||

(interest-only loans). This calculation shows that a 1 percentage point change in interest rates would theoretically affect home prices by about 10% (given 2005 rates) on fixed-rate mortgages, and about 16% for interest-only mortgages. [[Robert Shiller]] does compare interest rates and overall U.S. home prices over the period 1890–2004 and concludes that interest rates do not explain historic trends for the country.<ref name="IE2"/> | |||

|} | |||

====Regions affected==== | |||

Home price [[capital appreciation|appreciation]] has been non-uniform to such an extent that some economists, including former [[Federal Reserve System|Fed]] [[Chairman of the Federal Reserve|Chairman]] [[Alan Greenspan]], argued{{When|date=May 2011}}the that United States was not experiencing a nationwide housing bubble ''per se'', but a number of local bubbles.<ref>{{cite news |url=http://www.usatoday.com/money/industries/energy/2005-05-20-greenspan_x.htm |title=Greenspan: 'Local bubbles' build in housing sector |date=2005-05-20 |work=[[USA Today]] }}</ref> However, in 2007 Greenspan admitted that there was in fact a bubble in the US housing market, and that "all the froth bubbles add up to an aggregate bubble."<ref name="Greenspan admits bubble FT">{{cite news |title=Greenspan alert on US house prices |date=2007-09-17 |work=[[Financial Times]] |url=http://www.ft.com/cms/s/0/31207860-647f-11dc-90ea-0000779fd2ac.html }}</ref> | |||

Despite greatly relaxed lending standards and low interest rates, many regions of the country saw very little growth during the "bubble period". Out of 20 largest metropolitan areas tracked by the [[Robert Shiller|S&P/Case-Shiller]] [[house price index]], six (Dallas, Cleveland, Detroit, Denver, Atlanta, and Charlotte) saw less than 10% price growth in inflation-adjusted terms in 2001–2006.<ref>{{cite web |url=http://www2.standardandpoors.com/portal/site/sp/en/us/page.topic/indices_csmahp/0,0,0,0,0,0,0,0,0,3,1,0,0,0,0,0.html |title=S&P/Case-Shiller Home Price Indices-historical spreadsheets }}</ref> During the same period, seven metropolitan areas (Tampa, Miami, San Diego, Los Angeles, Las Vegas, Phoenix, and Washington DC) appreciated by more than 80%. | |||

Somewhat paradoxically, as the housing bubble deflates<ref name="top10forecl">{{cite news |url=http://money.cnn.com/2007/08/14/real_estate/California_cities_lead_foreclosure/index.htm |work=[[CNNMoney.com]] |date=2007-08-14 |title=California cities fill top 10 foreclosure list | accessdate=2010-05-26 | first1=Les | last1=Christie}}</ref> some metropolitan areas (such as Denver and Atlanta) have been experiencing high [[foreclosure]] rates, even though they did not see much house appreciation in the first place and therefore did not appear to be contributing to the national bubble. This was also true of some cities in the [[Rust Belt]] such as [[Detroit]]<ref>{{cite news |title=Home prices tumble as consumer confidence sinks |work=[[Reuters]] |date=2007-11-27 |accessdate=2008-03-17 |url=http://www.reuters.com/article/bondsNews/idUSN2748402720071127?sp=true }}</ref> and [[Cleveland]],<ref>{{cite news |title=Cleveland: Foreclosures weigh on market|date=2006-11-21 |work=[[USA Today]] |first=Noelle |last=Knox | |||

|url=http://www.usatoday.com/money/economy/housing/2006-11-21-close-cleveland_x.htm }}</ref> where weak local economies had produced little house price appreciation early in the decade but still saw declining values and increased foreclosures in 2007. As of January 2009 California, Michigan, Ohio and Florida were the states with the highest foreclosure rates. | |||

=='Mania' for home ownership== | |||

Americans' love of their homes is widely known and acknowledged;<ref name="Time magazine cover"> | |||

{{cite news | |||

|title=Home $weet Home |work=[[Time (magazine)|Time]] | |||

|date=2005-06-13 | |||

|url=http://www.time.com/time/magazine/0,9263,7601050613,00.html | |||

}} | |||

</ref> however, many believe that enthusiasm for home ownership is currently high even by American standards, calling the real estate market "frothy",<ref>{{cite news |last=Greenspan |first=Alan |title=Greenspan Calls Home-Price Speculation Unsustainable |work=[[Bloomberg L.P.|Bloomberg]] |date=2005-05-20 |url=http://quote.bloomberg.com/apps/news?pid=10000006&sid=ajYPxb8Ojdio&refer=home# |quote=At a minimum, there's a little froth [in the U.S. housing market]... It's hard not to see that there are a lot of local bubbles. }}</ref> "speculative madness",<ref name="UK Telegraph speculative madness">{{cite news |title=No mercy now, no bail-out later |work=[[The Daily Telegraph]] |date=2006-03-23 |url=http://www.telegraph.co.uk/money/main.jhtml?xml=/money/2006/03/23/ccfed23.xml&menuId=242&sSheet=/money/2006/03/23/ixcoms.html |quote=[T]he American housing boom is now the mother of all bubbles—in sheer volume, if not in | |||

degrees of speculative madness. | location=London | first=Ambrose | last=Evans-Pritchard | accessdate=2010-04-28}}</ref> and a "mania".<ref name="Moyers Morgenson">{{cite episode | title = Episode 06292007 | series = [[Bill Moyers Journal]] | network = [[Public Broadcasting Service|PBS]] | transcripturl = http://www.pbs.org/moyers/journal/06292007/transcript5.html | airdate = 2007-06-29}}</ref> Many observers have commented on this phenomenon<ref>{{cite news |title=The Oracle Speaks |work=[[CNNMoney.com]] |date=2005-05-02 |first=Jason |last=Zweig |url=http://money.cnn.com/2005/05/01/news/fortune500/buffett_talks/ |quote=[Warren Buffett:] Certainly at the high end of the real estate market in some areas, you've seen extraordinary movement... People go crazy in economics periodically, in all kinds of ways... when you get prices increasing faster than the underlying costs, sometimes there can be pretty serious consequences. }}</ref><ref>{{cite news |title=Soros predicts American recession |work=[[The Times]] |date=2006-01-09 |accessdate=2008-03-17 |url=http://www.timesonline.co.uk/tol/sport/football/european_football/article786656.ece |quote=Mr Soros said he believed the US housing bubble, a major factor behind strong American consumption, had reached its peak and was in the process of being deflated. | |||

| location=London |first=Jenny |last=Booth}}</ref><ref>{{cite news |first=Robert |last=Kiyosaki |title=All Booms Bust |publisher=[[Robert Kiyosaki]] |date=2005? |url=http://www.richdad.com/pages/article_dollar_crisis_part1.asp |archiveurl=http://web.archive.org/web/20060423172945/http://www.richdad.com/pages/article_dollar_crisis_part1.asp |archivedate=2006-04-23 |quote=Lately, I have been asked if we are in a real estate bubble. My answer is, 'Duh!' In my opinion, this is the biggest real estate bubble I have ever lived through. Next, I am asked, 'Will the bubble burst?' Again, my answer is, 'Duh! }}</ref>—as evidenced by the cover of the June 13, 2005 issue of ''[[Time Magazine]]''<ref name="Time magazine cover"/> (itself taken as a sign of the bubble's peak<ref name="Forbes Time cover"> | |||

{{cite news | |||

|title=The Pin that Bursts the Housing Bubble |work=[[Forbes]] | |||

|date=2005-07-21 | |||

|url=http://www.forbes.com/investmentnewsletters/2005/07/21/lennar-hovnanian-kb-cz_ags_0721soapbox_inl.html | |||

|accessdate=2008-03-17 | |||

}} | |||

</ref>)—but as a 2007 article in ''[[Forbes]]'' warns, "to realize that America's [[mania]] for home-buying is out of all proportion to sober reality, one needs to look no further than the current subprime lending mess... As interest | |||

rates—and mortgage payments—have started to climb, many of these new owners are having difficulty making ends meet... Those borrowers are much worse off than before they bought."<ref name="Forbes Don't Buy That House">{{cite news |title=Don't Buy That House |work=[[Forbes]] |date=2007-06-26 |url=http://www.forbes.com/2007/06/26/home-ownership-negatives-biz-dream0607_cx_ee_0626house_print.html }}</ref> The boom in housing has also created a boom in the [[real estate]] profession; for example, California has a record half-million real estate licencees—one for every 52 adults living in the state, up 57% in the last five years.<ref>{{cite news |title=New recorad: Nearly a half-million real estate licenses |work=Sacramento Business Journal |date=2006-05-23 |url=http://www.bizjournals.com/sacramento/stories/2006/05/22/daily20.html |quote=To accommodate the demand for real estate licenses, the DRE conducted numerous 'mega-exams' in which thousands of applicants took the real estate license | |||

examination... 'The level of interest in real estate licensure is unprecedented' }}</ref> | |||

The overall U.S. homeownership rate increased from 64 percent in 1994 (about where it was since 1980) to a peak in 2004 with an all-time high of 69.2 percent.<ref name="census_rvh">{{cite news |title=Census Bureau Reports on Residential Vacancies and Homeownership |date=2007-10-26 |publisher=[[U.S. Census Bureau]] |format=PDF |url=http://www.census.gov/hhes/www/housing/hvs/qtr307/q307press.pdf }}</ref> Bush's 2004 campaign slogan "the [[ownership society]]" indicates the strong preference and societal influence of Americans to own the homes they live in, as opposed to renting. However, in many parts of the United States, rent does not cover mortgage costs; the national [[median]] mortgage payment is $1,687 per month, nearly twice the median rent payment of $868 per month, although this ratio can vary significantly from market to market.<ref name="USAT rent">{{cite news |title=For some, renting makes more sense |work=[[USA Today]] |date=2006-08-10 |url=http://www.usatoday.com/money/perfi/housing/2006-08-09-rent-1a-usat_x.htm | first=Noelle | last=Knox | accessdate=2010-04-28}}</ref> | |||

Suspicious Activity Reports pertaining to [[Mortgage fraud]] increased by 1,411 percent between 1997 and 2005. Both borrowers seeking to obtain homes they could not otherwise afford, and industry insiders seeking monetary gain, were implicated.<ref>[http://www.fincen.gov/MortgageLoanFraud.pdf Reported Suspicious Activities<!-- Bot generated title -->]</ref> | |||

===Belief that housing is a good investment=== | |||

Among Americans, home ownership is widely accepted as preferable to renting in many cases, especially when the ownership term is expected to be at least five years. This is partly because the fraction of a fixed-rate [[mortgage loan|mortgage]] used to pay down the [[Debt|principal]] builds equity for the homeowner over time, while the interest portion of the loan payments qualifies for a tax break, whereas, except for the personal tax deduction often available to renters but not to homeowners, money spent on rent does neither. However, when considered as an [[investment]], that is, an [[asset]] that is expected to grow in value over time, as opposed to the utility of shelter that home ownership provides, housing is not a risk-free investment. The popular notion that, unlike stocks, homes do not fall in value is believed to have contributed to the mania for purchasing homes. Stock prices are reported in real time, which means investors witness the volatility. However, homes are usually valued yearly or less often, thereby smoothing out perceptions of volatility. This assertion that property prices rise has been true for the United States as a whole since the [[Great Depression]],<ref name="BW bubble or bunk">{{cite news |title=Housing Bubble—or Bunk? Are home prices soaring unsustainably and due for plunge? A group of experts takes a look—and come to very different conclusions |work=[[Business Week]] |date=2005-06-22 |url=http://www.businessweek.com/bwdaily/dnflash/jun2005/nf20050622_9404_db008.htm}}</ref> and appears to be encouraged by the real estate industry.<ref name="Roubini spin">{{cite news |last=Roubini |first=Nouriel |title=Eight Market Spins About Housing by Perma-Bull Spin-Doctors... And the Reality of the Coming Ugliest Housing Bust Ever... |date=2006-08-26 |work=RGE Monitor |url=http://www.rgemonitor.com/blog/roubini/143257 |quote=A lot of spin is being furiously spinned around–often from folks close to real estate | |||

interests–to minimize the importance of this housing bust, it is worth to point out a number of flawed arguments and misperception that are being peddled around. You will hear many of these arguments over and over again in the financial pages of the media, in sell-side research reports and in innumerous TV programs. So, be prepared to understand this misinformation, myths and spins. }}</ref><ref name="MF bubble back">{{cite news |title=I want my bubble back |work=[[Motley Fool]] |date=2006-06-09 |url=http://www.fool.com/news/commentary/2006/commentary06060918.htm }}</ref> | |||

However, housing prices can move both up and down in local markets, as evidenced by the relatively recent price history in locations such as [[New York City|New York]], [[Los Angeles]], [[Boston]], [[Japan]], [[Seoul]], [[Sydney]], and [[Hong Kong]]; large trends of up and down price fluctuations can be seen in many U.S. cities (see graph). Since 2005, the year-over-year [[median]] sale prices (inflation-adjusted) of single family homes in [[Massachusetts]] fell over 10% in 2006.{{Citation needed|date=April 2010}} Economist [[David Lereah]] formerly of the [[National Association of Realtors]] (NAR) said in August 2006 that "he expects home prices to come down 5% nationally, more in some markets, less in others."<ref name="Lereah hard landing">{{cite news |last=Lereah |first=David |title=Existing home sales drop 4.1% in July, median prices drop in most regions |date=2005-08-24 |work=[[USA Today]] |url=http://www.usatoday.com/money/economy/housing/2006-08-23-july-sales_x.htm }}</ref> Commenting in August 2005 on the perceived low risk of housing as an investment vehicle, Alan Greenspan said, "history has not dealt kindly with the aftermath of protracted periods of low risk premiums."<ref>{{cite news |last=Greenspan |first=Alan |title=Remarks by Chairman Alan Greenspan: Reflections on central banking, At a symposium sponsored by the Federal Reserve Bank of Kansas City, Jackson Hole, Wyoming |date=2005-08-26 |publisher=[[Federal Reserve Board]] |url=http://www.federalreserve.gov/boarddocs/speeches/2005/20050826/default.htm }}</ref> | |||

Compounding the popular expectation that home prices do not fall, it is also widely believed that home values will yield average or better-than-average returns as investments. The investment motive for purchasing homes should not be conflated with the necessity of shelter that housing provides; an economic comparison of the relative costs of owning versus renting the equivalent utility of shelter can be made separately (see boxed text). Over the holding periods of decades, inflation-adjusted house prices have increased less than 1% per year.<ref name="IE2">{{cite book |last=Shiller |first=Robert |title=[[Irrational Exuberance (book)|Irrational Exuberance]] |edition=2d ed. |year=2005 |publisher=[[Princeton University Press]] |isbn=0-691-12335-7 }}</ref><ref name="Barron's BNH1">{{cite news |last=Shiller|first=Robert |title=The Bubble's New Home | work=[[Barron's Magazine|Barron's]] |date=2005-06-20 |url=http://online.barrons.com/article/SB111905372884363176.html |quote=The home-price bubble feels like the stock-market mania in the fall of 1999, just before the stock bubble burst in early 2000, with all the hype, herd investing and absolute confidence in the inevitability of continuing price | |||

appreciation. My blood ran slightly cold at a cocktail party the other night when a recent Yale Medical School graduate told me that she was buying a condo to live in Boston during her year-long internship, so that she could flip it for a profit next year. [[Tulipmania]] reigns. }} Plot of inflation-adjusted home price appreciation in several U.S. cities, 1990–2005: | |||

{| style="margin:auto;" | |||

|- | |||

| [[File:Barrons BubblesNewHome.png|right|140px|thumb|Plot of inflation-adjusted home price appreciation in several U.S. cities, 1990–2005.]] | |||

|}</ref> | |||

[[Robert Shiller]] shows<ref name="IE2"/> that over long periods, inflation adjusted U.S. [[home prices]] increased 0.4% per year from 1890–2004, and 0.7% per year from 1940–2004. [[Piet Eichholtz]] also showed <ref>A long run price index - the herengracht index</ref> comparable results for housing prices on a single street in [[Amsterdam]] (the site of the fabled [[tulip mania]], and where the housing supply is notably limited) over a 350 year period. Such meager returns are dwarfed by investments in the [[stock market|stock]] and [[Bond (finance)|bond]] markets; although, these investments are not heavily leveraged by fair interest loans. If historic trends hold, it is reasonable to expect home prices to only slightly beat inflation over the long term. Furthermore, one way to assess the quality of any investment is to compute its [[Housing bubble#Housing ownership and rent measures|price-to-earnings (P/E) ratio]], which for houses can be defined as the price of the house divided by the potential annual rental income, minus expenses including [[property taxes]], maintenance, insurance, and condominium fees. For many | |||

locations, this computation yields a P/E ratio of about 30–40, which is considered by economists to be high for both the housing and the stock markets;<ref name="IE2"/> historical [[Housing bubble#Housing ownership and rent measures|price-to-rent ratios]] are 11–12.<ref name="Fortune PR ratio"/> For comparison, just before the [[Dot-com bubble|dot-com crash]] the P/E ratio of the [[S&P 500]] was 45, while in 2005–2007 around 17.<ref name="SPPE20050027">{{cite web |title=S&P 500 Index Level Fundamentals |url=http://www2.standardandpoors.com/portal/site/sp/en/us/page.topic/indices_500/2,3,2,2,0,0,0,0,0,5,7,0,0,0,0,0.html }}</ref> In a 2007 article comparing the cost and risks of renting to buying using a [http://www.nytimes.com/2007/04/10/business/2007_BUYRENT_GRAPHIC.html buy vs. rent calculator], the ''[[New York Times]]'' concluded, | |||

{{quotation|Homeownership, [realtors] argue, is a way to achieve the American dream, save on taxes and earn a solid investment return all at the same time. ... [I]t's now clear that people who chose renting over buying in the last two years made the right move. In much of the country ... recent home buyers have faced higher monthly costs than renters and have lost money on their investment in the meantime. It's almost as if they have thrown money away, an insult once reserved for renters.<ref name="NYT advice: Rent">{{cite news |title=A Word of Advice During a Housing Slump: Rent |work=[[The New York Times]] |date=2007-04-11 |url=http://www.nytimes.com/2007/04/11/realestate/11leonhardt.html | first=David | last=Leonhardt | accessdate=2010-04-28}}</ref>}} | |||

A 2007 ''[[Forbes]]'' article titled "Don't Buy That House" invokes similar arguments and concludes that for now, "resist the pressure [to buy]. There may be no place like home, but there's no reason you can't rent it."<ref name="Forbes Don't Buy That House"/> | |||

{| style="float:right;" | |||

|- | |||

|<!-- Image with inadequate rationale removed: [[File:Lereah BookCover 2005.jpg|right|135px|thumb|[[National Association of Realtors|NAR]] chief economist [[David Lereah]]'s book<ref name="Lereah 2005"/> in February 2005.]] --> | |||

|<!-- Image with inadequate rationale removed: [[File:LereahNotBust.jpg|right|135px|thumb|[[National Association of Realtors|NAR]] chief economist [[David Lereah]]'s book<ref name="Lereah 2006"/> in February 2006.]] --> | |||

|} | |||

===Promotion in the media=== | |||

In late 2005 and into 2006, there were an abundance of television programs promoting real estate investment and [[Flipping Houses|flipping]].<ref>{{cite news |title=TV's Hot Properties: Real Estate Reality Shows |date=2005-12-28 |work=[[The Washington Post]] |url=http://www.washingtonpost.com/wp-dyn/content/article/2005/12/27/AR2005122701018_pf.html | first=Teresa | last=Wiltz | accessdate=2010-04-28}}</ref><ref>Reality TV programs about ''flipping'' include: | |||

* [[HGTV]]'s ''[[House Hunters]]'', ''What You Get for the Money'', ''[[Designed to Sell]]'' and ''[[Buy Me]]''. | |||

* [[BBC America]]'s ''[[Location, Location, Location]]''. | |||

* [[Planet Green (TV channel)|Discovery Home]]'s ''[[Flip That House]]''. | |||

* [[A&E Network|A&E]]'s ''[[Flip This House]]'' and ''[[Sell This House]]''. | |||

* [[Bravo (US TV channel)|Bravo]]'s ''[[Million Dollar Listing]]'', "a six-episode original series chronicling the high-stakes, cutthroat world of real estate in a thriving market." | |||

* [[Fine Living]] programs{{Citation needed|date=March 2008}} | |||

* [[The Learning Channel]]'s ''[[Property Ladder (TV series)|Property Ladder]]'' and ''[[The Adam Carolla Project]]'' in which he "guts his childhood home with the goal of flipping it for more than $1 million."</ref> | |||

In addition to the numerous television shows, book stores in cities throughout the United States could be seen showing large displays of books touting real-estate investment, such as NAR chief economist David Lereah's book ''Are You Missing the Real Estate Boom?'', subtitled ''Why Home Values and Other Real Estate Investments Will Climb Through The End of The Decade - And How to Profit From Them'', published in February 2005.<ref name="Lereah 2005">{{cite book |last=Lereah |first=David |title=Are You Missing the Real Estate Boom? |year=2005 |publisher=Currency/Doubleday |isbn=0-385-51434-4 }}</ref> One year later, Lereah retitled his book ''Why the Real Estate Boom Will Not Bust - And How You Can Profit from It''.<ref name="Lereah 2006">{{cite book |last=Lereah |first=David |title=Why the Real Estate Boom Will Not Bust - And How You Can Profit from It |year=2005 |publisher=Currency/Doubleday |isbn=0-385-51435-2 }}</ref> | |||

However, following [[Federal Reserve]] chairman [[Ben Bernanke]]'s comments on the "downturn of the housing market" in August 2006,<ref>{{cite news |title=For Whom the Housing Bell Tolls | date=2006-08-10 |work=[[Barron's Magazine|Barron's]] |url=http://online.barrons.com/public/article/SB115515894570031399-T3ogIr6mEOKDEd_HeplVcWwl6uQ_20070812.html }}</ref> Lereah said in an [[NBC]] interview that "we've had a boom marketplace: you've got to correct because booms cannot sustain itself forever {{sic}}."<ref name="Lereah NBC">{{cite news |title=Bubble Bursting |author=Michael Okwu |work=[[Today (NBC Program)|The Today Show]] |publisher=[[NBC]] }} The video of the report is available at [http://housingpanic.blogspot.com/2006/08/today-show-report-from-few-weeks-ago.html an entry of 2006-08-19] on the blog ''Housing Panic''.</ref> Commenting on the phenomenon of shifting NAR accounts of the national housing market (see David Lereah's comments<ref name="Lereah NBC"/><ref name="Lereah | |||

speculation">{{cite news |last=Lereah |first=David |title=Average price of home tops $200,000 amid sales frenzy |work=[[Reuters]] |date=2005-05-25 |url=http://www.washingtontimes.com/business/20050525-121926-7231r.htm |quote=There's a speculative element in home buying now. }}</ref><ref name="Lereah pants down">{{cite news |title=Public remarks from NAR chief economist David Lereah |date=2006-04-27 |url=http://globaleconomicanalysis.blogspot.com/2006/04/new-gold-standard.html }}</ref>), the [[Motley Fool]] reported, "There's nothing funnier or more satisfying ... than watching the National Association of Realtors (NAR) change its tune these days. ... the NAR is full of it and will spin the numbers any way it can to keep up the pleasant fiction that all is well."<ref name="MF bubble back"/> | |||

Upon leaving the NAR in May 2007, Lereah explained to [[Robert Siegel]] of [[National Public Radio]] that using the word "boom" in the title was actually his publisher's idea, and "a poor choice of titles".<ref>{{cite news |title=A Real Estate Bull Has a Change of Heart |date=2007-05-10 |publisher=[[National Public Radio]] |work=[[All Things Considered]] |url=http://www.npr.org/templates/story/story.php?storyId=10118254&ft=1&f=1018 }}</ref> | |||

===Speculative fever=== | |||

[[File:US derivatives and US wealth vs total world wealth 1995-2007.gif|thumb|none|600px|Total US derivatives and total US wealth 1995–2007 compared to total world wealth in the year 2000]] | |||

The graph above shows the total notional value of derivatives relative to US Wealth measures. It is important to note for the casual observer that, in many cases, notional values of derivatives carry little meaning. Often the parties cannot easily agree on terms to close a derivative contract. The common solution has been to create an equal and opposite contract, often with a different party, in order to net payments ([[Derivatives market#Netting]]), thus eliminating all but the counterparty risk of the contract, but doubling the nominal value of outstanding contracts. | |||

As [[median]] home prices began to rise dramatically in 2000–2001 following the fall in interest rates, speculative purchases of homes also increased.<ref>{{cite news |title=Steep Rise in Prices for Homes Adds to Worry About a Bubble |date=2005-05-25 |work=[[The New York Times]] |url=http://www.nytimes.com/2005/05/25/business/25home.html |quote='There's clearly speculative excess going on', said Joshua Shapiro, the chief United States economist at MFR Inc., an economic research group in New York. 'A lot of people view real estate as a can't lose.' | first=David | last=Leonhardt | accessdate=2010-04-28}}</ref> ''[[Fortune magazine|Fortune]]'' magazine's article on housing speculation in 2005 said, "America was awash in a stark, raving frenzy that looked every bit as crazy as dot-com stocks."<ref name="Fortune frenzy">{{cite news |title=Lowering the Boom? Speculators Gone Mild |date=2006-03-15 |work=[[Fortune (magazine)|Fortune]] |url=http://money.cnn.com/magazines/fortune/fortune_archive/2006/03/20/8371785/index.htm | quote=America was awash in a stark, | |||

raving frenzy that looked every bit as crazy as dot-com stocks. | first=Eugenia | last=Levenson}}</ref> In a 2006 interview in ''[[BusinessWeek]]'' magazine, Yale economist [[Robert Shiller]] said of the impact of speculators on long term valuations, "I worry about a big fall because prices today are being supported by a [[speculative fever]],"<ref name="jitters">{{cite news |first=Maria |last=Bartiromo |title=Jitters On The Home Front |date=2006-03-06 |work=[[Business Week]] |url=http://www.businessweek.com/magazine/content/06_10/b3974141.htm |accessdate=2008-03-17 }}</ref> and former NAR chief economist David Lereah said in 2005 that "[t]here's a speculative element in home buying now."<ref name="Lereah speculation"/><sup>[[Wikipedia:Footnotes|[broken footnote]]]</sup> Speculation in some local markets has been greater than others, and any correction in valuations is expected to be strongly related to the percentage amount of speculative purchases.<ref name="Lereah pants down"/><ref>{{cite news |author=[[June Fletcher]] |title=Is There Still Profit to Be Made From Buying Fixer-Upper Homes? |work=[[The Wall Street Journal]] |date=2006-03-17 |url=http://www.realestatejournal.com/columnists/housetalk/20060317-fletcher.html }}</ref><ref name="WeekStd bubble trouble">{{cite news |first=Andrew |last=Laperriere |title=Housing Bubble Trouble: Have we been living beyond our means? |work=[[The Weekly Standard]] |date=2006-04-10 |url=http://www.weeklystandard.com/Content/Public/Articles/000/000/012/053ajgwr.asp }}</ref> In the same ''[[BusinessWeek]]'' interview, Angelo Mozilo, CEO of mortgage lender [[Countrywide Financial]], said in March 2006: {{quotation|In areas where you have had heavy speculation, you could have 30% [home price declines]... A year or a year and half from now, you will have seen a slow deterioration of home values and a substantial deterioration in those areas where there has been speculative excess.<ref name="jitters"/>}} | |||

The chief economist for the [[National Association of Home Builders]], David Seiders, said that California, Las Vegas, Florida and the Washington, D.C., area "have the largest potential for a price slowdown" because the rising prices in those markets were fed by speculators who bought homes intending to "flip" or sell them for a quick profit.<ref>{{cite news |last=Seiders |first=David | |||

|title=Housing cooling off: Could chill economy |date=2006-03-06 |work=[[San Diego Union Tribune]] |url=http://www.signonsandiego.com/news/business/20060306-1130-housingslowdown.html }}</ref> | |||

Dallas Fed president Richard Fisher said in 2006 that the Fed held its target rate at 1 percent "longer than it should have been" and unintentionally prompted speculation in the housing market.<ref name="WJ Fisher Fed rates speculation">{{cite news |title=Official Says Bad Data Fueled Rate Cuts, Housing Speculation |date=2006-11-06 |work=[[The Wall Street Journal]] |url=http://www.realestatejournal.com/buysell/mortgages/20061106-ip.html?mod=RSS_Real_Estate_Journal&rejrss=frontpage |quote=In retrospect, the real Fed funds rate turned out to be lower than what was deemed appropriate at the time and was held lower longer than it should have been... In this case, poor data led to a policy action that amplified speculative activity in the housing and other markets... Toda... the housing market is undergoing a substantial | |||

correction and inflicting real costs to millions of homeowners across the country. It is complicating the [Fed's] task of achieving... sustainable noninflationary growth. }}</ref><ref name="Fisher Fed rates">{{cite news |title=Fed's Bies, Fisher See Inflation Rate Beginning to Come Down |date=2006-11-03 |work=[[Bloomberg L.P.|Bloomberg]] |url=http://www.bloomberg.com/apps/news?pid=20601103&sid=ad4ao57rKiy0&refer=news }}</ref> | |||

Various real estate investment advisors openly advocated the use of no money down property flipping, which led to the demise of many speculators who followed this strategy such as [[Casey Serin]].<ref>{{cite news |title=10 mistakes that made flipping a flop |date=2006-10-22 |work=[[USA Today]] |first=Noelle |last=Knox |url=http://www.usatoday.com/money/economy/housing/2006-10-22-young-flipper-usat_x.htm |accessdate=2008-03-17 }}</ref><ref>{{cite news |title= Russ Whitney Wants You to Be Rich |first=Randall |last=Patterson |work=[[The New York Times]] |date=2007-03-18 |url=http://query.nytimes.com/gst/fullpage.html?res=9F07E0DB1E31F93BA25750C0A9619C8B63&pagewanted=all |accessdate=2008-03-17 }}</ref> | |||

===Buying and selling above normal multiples=== | |||

<!---another "rule of thumb" that was exceeded is the average mulitple of home price in a given area to average earnings. this "should" be 3:1. In San Diego it reached 10:1. Don't have ref for this----> | |||

Home prices, as a multiple of annual rent, have been 15 since World War II. In the bubble, prices reached a multiple of 26. In 2008, prices had fallen to a multiple of 22.<ref>{{cite book | author = Zuckerman, Mortimer B. |title = Editorial:Obama's Problem No. 1 | publisher = US News and World Report | date = November 17–24, 2008}}</ref> | |||

In some areas houses were selling at multiples of replacement costs, especially when prices were correctly adjusted for depreciation.<ref name="Glaeser2004">{{Cite journal | |||

| last1 = Glaeser | |||

| first1 = Edward L. | |||

| author1-link = | |||

| title = Housing Supply , The National Bureau of Economic Research, NBER Reporter: Research Summary Spring 2004 | |||

| year = 2004 | |||

| url = http://www.nber.org/reporter/spring04/glaeser.html | |||

| postscript = <!--None--> | |||

}}</ref><ref name="Lincoln Institute of Land Policy">{{Cite web | |||

| last1 = Wisconsin School of Business & The Lincoln Institute of Land Policy | |||

| first1 = | |||

| authorlink1 = | |||

| title = Land Prices for 46 Metro Areas | |||

| year = Updated Quarterly | |||

| url = http://www.lincolninst.edu/subcenters/land-values/metro-area-land-prices.asp | |||

| postscript = <!--None--> | |||

}}</ref> Cost per square foot indexes still show wide variability from city to city, therefore it may be that new houses can be built more cheaply in some areas than asking prices for existing homes.<ref>{{Cite journal | |||

| last1 = | |||

| first1 = | |||

| author1-link = | |||

| title = Most Expensive Housing Markets, CNN Money | |||

| year = 2005 | |||

| url = http://money.cnn.com/pf/features/lists/hpci_data/index.html | |||

| postscript = <!--None-->}}</ref> | |||

<ref>{{Cite journal | |||

| last1 = Quinn | |||

| first1 = W. Eddins | |||

| author1-link = | |||

| title = RPX Monthly Housing Market Report ,Radar Logic | |||

| year = 2009 | |||

| url = http://www.radarlogic.com/research/RPXMonthlyHousingMarketReportforSeptember2009.pdf | |||

| postscript = <!--None--> | |||

}}See: Exhibit 6</ref> | |||

<ref>{{Cite journal | |||

| last1 = | |||

| first1 = | |||

| author1-link = | |||

| title = Top 20 Most Expensive Cities , Househunt.com | |||

| year = 2009 | |||

| url = http://www.househunt.com/most-expensive/ | |||

| postscript = <!--None--> | |||

}}</ref> | |||

<ref>{{Cite journal | |||

| last1 = | |||

| first1 = | |||

| author1-link = | |||

| title = How Much Will Your New House Cost? , About.com: Architecture | |||

| year = | |||

| url = http://architecture.about.com/cs/buildyourhouse/a/costs.htm | |||

| postscript = <!--None--> | |||

}}</ref> | |||

Possible factors of this variation from city to city are housing supply constraints, both regulatory and geographical. Regulatory constraints such as urban growth boundaries serve to reduce the amount of developable land and thus increase prices for new housing construction. Geographic constraints (water bodies, wetlands, and slopes) cannot be ignored either. It is debatable which type of constraint contributes more to price fluctuations. Some argue that the latter, by inherently increasing the value of land in a defined area (because the amount of usable land is less), give homeowners and developers incentive to support regulations to further protect the value of their property.<ref>[http://econjwatch.org/articles/dropping-the-geographic-constraints-variable-makes-only-a-minor-difference-reply-to-cox/ Huang, Haifung and Yao Tang, "Dropping the Geographic-Constraint Variable Makes Only a Minor Difference: Reply to Cox," ''Econ Journal Watch 8(1):'' 28-32, January 2011.]</ref> | |||