Burrows–Abadi–Needham logic: Difference between revisions

No edit summary |

en>Yobot m WP:CHECKWIKI error fixes - Replaced special characters in sortkey using AWB (9095) |

||

| Line 1: | Line 1: | ||

{{Multiple issues|talk=December 2012| | |||

{{lead too short|date=December 2012}} | |||

{{cleanup|reason=the article includes only brief general explanation before moving into technical detail|date=December 2012}} | |||

{{More footnotes|date=December 2012}} | |||

}} | |||

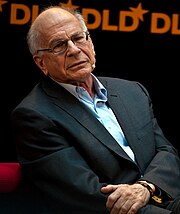

[[File:Daniel KAHNEMAN.jpg|thumb|180px|[[Daniel Kahneman]], who won a [[Nobel Memorial Prize in Economic Sciences|Nobel Memorial Prize in Economics]] for his work developing Prospect theory.]] | |||

'''Prospect theory''' is a [[Behavioral economics|behavioral economic theory]] that describes the way people choose between [[probabilistic]] alternatives that involve [[risk]], where the probabilities of outcomes are known. The theory states that people make decisions based on the potential value of losses and [[Gain (finance)|gains]] rather than the final outcome, and that people evaluate these losses and gains using certain [[heuristics in judgment and decision making|heuristics]]. The model is [[descriptive]]: it tries to model real-life choices, rather than [[optimal decision]]s. | |||

The theory was developed by [[Daniel Kahneman]] and [[Amos Tversky]] in 1979 as a [[psychology|psychologically]] more accurate description of decision making, comparing to the [[expected utility hypothesis|expected utility theory]]. In the original formulation the term ''prospect'' referred to a [[lottery]]{{citation needed|date=November 2011}}. | |||

The paper "Prospect Theory: An Analysis of Decision under Risk"<ref>http://www.princeton.edu/~kahneman/docs/Publications/prospect_theory.pdf</ref> has been called a "seminal paper in [[behavioral economics]]".<ref name=rationality>{{cite journal|coauthors=Eldar Shafir and Robyn A. LeBoeuf|title=Rationality|journal=Annual Review of Psychology|date=February 2002|volume=53|pages=491–517|doi=10.1146/annurev.psych.53.100901.135213|url=http://www.annualreviews.org/doi/abs/10.1146/annurev.psych.53.100901.135213|accessdate=April 23, 2012|pmid=11752494}}</ref> | |||

==Model== | |||

[[File:Valuefun.jpg|right|250px]] | |||

The theory describes the decision processes in two stages: editing and evaluation. | |||

During editing, outcomes of a decision are ordered according to certain [[heuristics in judgment and decision making|heuristic]]. In particular, people decide which outcomes they consider equivalent, set a [[reference point]] and then consider lesser outcomes as losses and greater ones as gains. The editing phase aims to alleviate any [[Framing effect (psychology)|Framing effects]].<ref>Kahneman, Daniel, and Amos Tversky. "Rational Choice and the Framing of Decisions." The Journal of Business 2nd ser. 59.4 (1986): 251-78</ref> It also aims to resolve isolation effects stemming from individuals' propensity to often isolate consecutive probabilities instead of treating them together. In the subsequent evaluation phase, people behave as if they would compute a value ([[utility]]), based on the potential outcomes and their respective probabilities, and then choose the alternative having a higher utility. | |||

Under [[Expected utility hypothesis|Expected Utility Theory]], a change in risk preference would be considered as a violation of [[axioms]] and thus the predicted outcome would be wrong. However, Fishburn & Kochenberger (1979)<ref>Fishburn, Peter C., and Gary A. Kochenberger. "Two-Piece Von Neumann-Morgenstern Utility Functions." Decision Sciences 10.4 (1979): 503-18. Wiley</ref> proved the commonness of riskseeking in choices involving negative outcomes. A great advantage of Prospect Theory is that it does not assume people to behave constantly the same, but to behave accordingly to their preferences when facing gains or losses- thus getting rid of Reflection effects. | |||

The formula that Kahneman and Tversky assume for the evaluation phase is (in its simplest form) given by | |||

:<math>U = \sum_{i=1}^{n} w(p_i)v(x_i)</math> | |||

where <math>U</math> is the overall or expected utility of the outcomes to the individual making the decision, <math>x_1,x_2,\ldots,x_n</math> are the potential outcomes and <math>p_1,p_2,\dots,p_n</math> their respective probabilities. <math>\scriptstyle v</math> is a so-called value function that assigns a value to an outcome. The value function (sketched in the Figure) that passes through the reference point is s-shaped and asymmetrical. Losses hurt more than gains feel good ([[loss aversion]]). This differs greatly from [[expected utility theory]], in which a rational agent is indifferent to the reference point. In expected utility theory, the individual only cares about absolute wealth, not relative wealth in any given situation. The function <math>\scriptstyle w</math> is a probability weighting function and expresses that people tend to overreact to small probability events, but underreact to medium and large probabilities. | |||

To see how Prospect Theory (PT) can be applied in an example, consider the decision to buy insurance. Assuming the probability of the insured risk is 1%, the potential loss is $1,000 and the premium is $15. If we apply PT, we first need to set a reference point. This could be the current wealth or the worst case (losing $1,000). If we set the frame to the current wealth, the decision would be either to | |||

1. Pay $15 for sure, which yields a PT-utility of <math>\scriptstyle v(-15)</math>, | |||

OR | |||

2. Enter a lottery with possible outcomes of $0 (probability 99%) or -$1,000 (probability 1%), which yields a PT-utility of <math>\scriptstyle w(0.01) \times v(-1000)+w(0.99) \times v(0)=w(0.01) \times v(-1000)</math>. | |||

These expressions can be computed numerically. For typical value and weighting functions, the latter expression could be larger due to the convexity of <math>\scriptstyle v</math> in losses, and hence the insurance looks unattractive. If we set the frame to −$1,000, both alternatives are set in gains. The concavity of the value function in gains can then lead to a preference for buying the insurance. | |||

In this example, a strong overweighting of small probabilities undo the effect of the convexity of <math>\scriptstyle v</math> in losses: the potential outcome of losing $1,000 is overweighted. | |||

The interplay of overweighting of small probabilities and concavity-convexity of the value function leads to the so-called ''fourfold pattern of risk attitudes'': risk-averse behavior when gains have moderate probabilities and losses have small probabilities; risk-seeking behavior when losses have moderate probabilities and gains have small probabilities. | |||

Below is an example of the fourfold pattern of risk attitudes. The first item in quadrant shows an example prospect (e.g. 95% chance to win $10,000 is high probability and a gain). The second item in the quadrant shows the focal emotion that the prospect is likely to evoke. The third item indicates how most people would behave given each of the prospects (either Risk Averse or Risk Seeking). The fourth item states expected attitudes of an potential defendant and plaintiff in discussions of settling a civil suit.<ref>Kahneman, Daniel. Thinking, fast and slow. Farrar, Straus and Giroux, 2011. (p317)</ref> | |||

{| class="wikitable" | |||

|- | |||

! Example !! Gains !! Losses | |||

|- | |||

| High Probability (Certainty Effect) || 95% chance to win $10,000. Fear of disappointment. RISK AVERSE. Accept unfavorable settlement || 95% chance to lose $10,000. Hope to avoid loss. RISK SEEKING. Reject favorable settlement. | |||

|- | |||

| Low Probability (Possibility Effect) || 5% chance to win $10,000. Hope of large gain. RISK SEEKING. Reject favorable settlement || 5% chance to lose $10,000. Fear of large loss. RISK AVERSE. Accept unfavorable settlement | |||

|} | |||

See Kahneman and Tversky's related work on conflict resolution for more information on how Prospect theory influences negotiation: "Conflict resolution: A cognitive perspective" (No. 38). Stanford Center on Conflict and Negotiation, Stanford University. | |||

==Applications== | |||

Some behaviors observed in [[economics]], like the [[disposition effect]] or the reversing of [[risk aversion]]/[[risk seeking]] in case of gains or losses (termed the ''reflection effect''), can also be explained by referring to the prospect theory. | |||

The [[pseudocertainty effect]] is the observation that people may be risk-averse or risk-acceptant depending on the amounts involved and on whether the gamble relates to becoming better off or worse off. This is a possible explanation for why the same person may buy both an [[insurance]] policy and a [[lottery]] ticket. | |||

An important implication of prospect theory is that the way economic agents subjectively [[framing (economics)|frame]] an outcome or transaction in their mind affects the utility they expect or receive. This aspect has been widely used in [[behavioral economics]] and [[mental accounting]]. Framing and prospect theory has been applied to a diverse range of situations which appear inconsistent with standard economic rationality: the [[equity premium puzzle]], the excess returns puzzle and long swings/PPP puzzle of exchange rates through the endogenous prospect theory of Imperfect Knowledge Economics, the [[status quo bias]], various gambling and betting puzzles, [[intertemporal consumption]], and the [[endowment effect]]. | |||

Another possible implication for economics is that [[utility]] might be reference based, in contrast with additive utility functions underlying much of [[neo-classical economics]]. This means people consider not only the value they receive, but also the value received by others. This hypothesis is consistent with psychological research into [[happiness]], which finds subjective measures of wellbeing are relatively stable over time, even in the face of large increases in the standard of living (Easterlin, 1974; Frank, 1997). | |||

Military historian John A. Lynn argues that prospect theory provides an intriguing if not completely verifiable framework of analysis for understanding [[Louis XIV]]'s [[foreign policy]] nearer to the end of his reign (Lynn, pp. 43–44). | |||

==Limits and extensions== | |||

The original version of prospect theory gave rise to violations of first-order [[stochastic dominance]]. That is, prospect A might be preferred to prospect B even if the probability of receiving a value x or greater is at least as high under prospect B as it is under prospect A for all values of x, and is greater for some value of x. Later theoretical improvements overcame this problem, but at the cost of introducing [[intransitivity]] in preferences. A revised version, called [[cumulative prospect theory]] overcame this problem by using a probability weighting function derived from [[Rank-dependent expected utility]] theory. Cumulative prospect theory can also be used for infinitely many or even continuous outcomes (for example, if the outcome can be any [[real number]]). | |||

==See also== | |||

{{portal|Logic}} | |||

* [[Decision theory]] | |||

* [[Endowment effect]] | |||

* [[Loss aversion]] | |||

* [[Roman Frydman]] | |||

* [[Description-experience gap]] | |||

==Notes== | |||

{{reflist}} | |||

==References== | |||

* [[Richard Easterlin|Easterlin, Richard A.]] "Does Economic Growth Improve the Human Lot?" in Paul A. David and Melvin W. Reder, eds., ''Nations and Households in Economic Growth: Essays in Honor of [[Moses Abramovitz]]'', New York: Academic Press, Inc., 1974. | |||

* [[Robert H. Frank|Frank, Robert H.]] "The Frame of Reference as a [[Public Good]]". ''The Economic Journal''. Vol. 107, November 1977: 1832–47. | |||

* [[Daniel Kahneman|Kahneman, Daniel]]. ''[[Thinking, Fast and Slow]]''. New York: Farrar, Straus and Giroux, 2011. | |||

* Kahneman, Daniel, and [[Amos Tversky]]. "[http://www.princeton.edu/~kahneman/docs/Publications/prospect_theory.pdf Prospect Theory: An Analysis of Decision Under Risk]". ''[[Econometrica]]''. XLVII (1979): 263-291. | |||

* Lynn, John A. ''The Wars of [[Louis XIV of France|Louis XIV]] 1667-1714''. United Kingdom: Pearson Education Ltd., 1999. | |||

* McDermott, Rose, [[James H. Fowler]], and Oleg Smirnov. "[http://www.ssrn.com/abstract=1008034 On the Evolutionary Origin of Prospect Theory Preferences]". ''Journal of Politics''. April 2008. | |||

* Post, Thierry, Martijn J. Van den Assem, Guido Baltussen, and [[Richard Thaler]]. "[http://www.ssrn.com/abstract=636508 Deal or No Deal? Decision Making Under Risk in a Large-Payoff Game Show]". ''[[American Economic Review]]''. March 2008. | |||

==External links== | |||

* [http://www.econport.org/econport/request?page=man_ru_advanced_prospect An introduction to Prospect Theory] | |||

* [http://prospect-theory.behaviouralfinance.net/ Prospect Theory] | |||

{{DEFAULTSORT:Prospect Theory}} | |||

[[Category:Behavioral finance]] | |||

[[Category:Behavioral economics]] | |||

[[Category:Economics of uncertainty]] | |||

[[Category:Consumer behaviour]] | |||

[[Category:Marketing]] | |||

[[Category:Finance theories]] | |||

[[Category:Decision theory]] | |||

[[Category:1979 introductions]] | |||

[[Category:Framing (social sciences)]] | |||

[[Category:Prospect theory| ]] | |||

Revision as of 23:38, 18 April 2013

Prospect theory is a behavioral economic theory that describes the way people choose between probabilistic alternatives that involve risk, where the probabilities of outcomes are known. The theory states that people make decisions based on the potential value of losses and gains rather than the final outcome, and that people evaluate these losses and gains using certain heuristics. The model is descriptive: it tries to model real-life choices, rather than optimal decisions. The theory was developed by Daniel Kahneman and Amos Tversky in 1979 as a psychologically more accurate description of decision making, comparing to the expected utility theory. In the original formulation the term prospect referred to a lotteryPotter or Ceramic Artist Truman Bedell from Rexton, has interests which include ceramics, best property developers in singapore developers in singapore and scrabble. Was especially enthused after visiting Alejandro de Humboldt National Park..

The paper "Prospect Theory: An Analysis of Decision under Risk"[1] has been called a "seminal paper in behavioral economics".[2]

Model

The theory describes the decision processes in two stages: editing and evaluation. During editing, outcomes of a decision are ordered according to certain heuristic. In particular, people decide which outcomes they consider equivalent, set a reference point and then consider lesser outcomes as losses and greater ones as gains. The editing phase aims to alleviate any Framing effects.[3] It also aims to resolve isolation effects stemming from individuals' propensity to often isolate consecutive probabilities instead of treating them together. In the subsequent evaluation phase, people behave as if they would compute a value (utility), based on the potential outcomes and their respective probabilities, and then choose the alternative having a higher utility.

Under Expected Utility Theory, a change in risk preference would be considered as a violation of axioms and thus the predicted outcome would be wrong. However, Fishburn & Kochenberger (1979)[4] proved the commonness of riskseeking in choices involving negative outcomes. A great advantage of Prospect Theory is that it does not assume people to behave constantly the same, but to behave accordingly to their preferences when facing gains or losses- thus getting rid of Reflection effects.

The formula that Kahneman and Tversky assume for the evaluation phase is (in its simplest form) given by

where is the overall or expected utility of the outcomes to the individual making the decision, are the potential outcomes and their respective probabilities. is a so-called value function that assigns a value to an outcome. The value function (sketched in the Figure) that passes through the reference point is s-shaped and asymmetrical. Losses hurt more than gains feel good (loss aversion). This differs greatly from expected utility theory, in which a rational agent is indifferent to the reference point. In expected utility theory, the individual only cares about absolute wealth, not relative wealth in any given situation. The function is a probability weighting function and expresses that people tend to overreact to small probability events, but underreact to medium and large probabilities.

To see how Prospect Theory (PT) can be applied in an example, consider the decision to buy insurance. Assuming the probability of the insured risk is 1%, the potential loss is $1,000 and the premium is $15. If we apply PT, we first need to set a reference point. This could be the current wealth or the worst case (losing $1,000). If we set the frame to the current wealth, the decision would be either to

1. Pay $15 for sure, which yields a PT-utility of ,

OR

2. Enter a lottery with possible outcomes of $0 (probability 99%) or -$1,000 (probability 1%), which yields a PT-utility of .

These expressions can be computed numerically. For typical value and weighting functions, the latter expression could be larger due to the convexity of in losses, and hence the insurance looks unattractive. If we set the frame to −$1,000, both alternatives are set in gains. The concavity of the value function in gains can then lead to a preference for buying the insurance.

In this example, a strong overweighting of small probabilities undo the effect of the convexity of in losses: the potential outcome of losing $1,000 is overweighted.

The interplay of overweighting of small probabilities and concavity-convexity of the value function leads to the so-called fourfold pattern of risk attitudes: risk-averse behavior when gains have moderate probabilities and losses have small probabilities; risk-seeking behavior when losses have moderate probabilities and gains have small probabilities.

Below is an example of the fourfold pattern of risk attitudes. The first item in quadrant shows an example prospect (e.g. 95% chance to win $10,000 is high probability and a gain). The second item in the quadrant shows the focal emotion that the prospect is likely to evoke. The third item indicates how most people would behave given each of the prospects (either Risk Averse or Risk Seeking). The fourth item states expected attitudes of an potential defendant and plaintiff in discussions of settling a civil suit.[5]

| Example | Gains | Losses |

|---|---|---|

| High Probability (Certainty Effect) | 95% chance to win $10,000. Fear of disappointment. RISK AVERSE. Accept unfavorable settlement | 95% chance to lose $10,000. Hope to avoid loss. RISK SEEKING. Reject favorable settlement. |

| Low Probability (Possibility Effect) | 5% chance to win $10,000. Hope of large gain. RISK SEEKING. Reject favorable settlement | 5% chance to lose $10,000. Fear of large loss. RISK AVERSE. Accept unfavorable settlement |

See Kahneman and Tversky's related work on conflict resolution for more information on how Prospect theory influences negotiation: "Conflict resolution: A cognitive perspective" (No. 38). Stanford Center on Conflict and Negotiation, Stanford University.

Applications

Some behaviors observed in economics, like the disposition effect or the reversing of risk aversion/risk seeking in case of gains or losses (termed the reflection effect), can also be explained by referring to the prospect theory.

The pseudocertainty effect is the observation that people may be risk-averse or risk-acceptant depending on the amounts involved and on whether the gamble relates to becoming better off or worse off. This is a possible explanation for why the same person may buy both an insurance policy and a lottery ticket.

An important implication of prospect theory is that the way economic agents subjectively frame an outcome or transaction in their mind affects the utility they expect or receive. This aspect has been widely used in behavioral economics and mental accounting. Framing and prospect theory has been applied to a diverse range of situations which appear inconsistent with standard economic rationality: the equity premium puzzle, the excess returns puzzle and long swings/PPP puzzle of exchange rates through the endogenous prospect theory of Imperfect Knowledge Economics, the status quo bias, various gambling and betting puzzles, intertemporal consumption, and the endowment effect.

Another possible implication for economics is that utility might be reference based, in contrast with additive utility functions underlying much of neo-classical economics. This means people consider not only the value they receive, but also the value received by others. This hypothesis is consistent with psychological research into happiness, which finds subjective measures of wellbeing are relatively stable over time, even in the face of large increases in the standard of living (Easterlin, 1974; Frank, 1997).

Military historian John A. Lynn argues that prospect theory provides an intriguing if not completely verifiable framework of analysis for understanding Louis XIV's foreign policy nearer to the end of his reign (Lynn, pp. 43–44).

Limits and extensions

The original version of prospect theory gave rise to violations of first-order stochastic dominance. That is, prospect A might be preferred to prospect B even if the probability of receiving a value x or greater is at least as high under prospect B as it is under prospect A for all values of x, and is greater for some value of x. Later theoretical improvements overcame this problem, but at the cost of introducing intransitivity in preferences. A revised version, called cumulative prospect theory overcame this problem by using a probability weighting function derived from Rank-dependent expected utility theory. Cumulative prospect theory can also be used for infinitely many or even continuous outcomes (for example, if the outcome can be any real number).

See also

Sportspersons Hyslop from Nicolet, usually spends time with pastimes for example martial arts, property developers condominium in singapore singapore and hot rods. Maintains a trip site and has lots to write about after touring Gulf of Porto: Calanche of Piana.

Notes

43 year old Petroleum Engineer Harry from Deep River, usually spends time with hobbies and interests like renting movies, property developers in singapore new condominium and vehicle racing. Constantly enjoys going to destinations like Camino Real de Tierra Adentro.

References

- Easterlin, Richard A. "Does Economic Growth Improve the Human Lot?" in Paul A. David and Melvin W. Reder, eds., Nations and Households in Economic Growth: Essays in Honor of Moses Abramovitz, New York: Academic Press, Inc., 1974.

- Frank, Robert H. "The Frame of Reference as a Public Good". The Economic Journal. Vol. 107, November 1977: 1832–47.

- Kahneman, Daniel. Thinking, Fast and Slow. New York: Farrar, Straus and Giroux, 2011.

- Kahneman, Daniel, and Amos Tversky. "Prospect Theory: An Analysis of Decision Under Risk". Econometrica. XLVII (1979): 263-291.

- Lynn, John A. The Wars of Louis XIV 1667-1714. United Kingdom: Pearson Education Ltd., 1999.

- McDermott, Rose, James H. Fowler, and Oleg Smirnov. "On the Evolutionary Origin of Prospect Theory Preferences". Journal of Politics. April 2008.

- Post, Thierry, Martijn J. Van den Assem, Guido Baltussen, and Richard Thaler. "Deal or No Deal? Decision Making Under Risk in a Large-Payoff Game Show". American Economic Review. March 2008.

External links

- ↑ http://www.princeton.edu/~kahneman/docs/Publications/prospect_theory.pdf

- ↑ One of the biggest reasons investing in a Singapore new launch is an effective things is as a result of it is doable to be lent massive quantities of money at very low interest rates that you should utilize to purchase it. Then, if property values continue to go up, then you'll get a really high return on funding (ROI). Simply make sure you purchase one of the higher properties, reminiscent of the ones at Fernvale the Riverbank or any Singapore landed property Get Earnings by means of Renting

In its statement, the singapore property listing - website link, government claimed that the majority citizens buying their first residence won't be hurt by the new measures. Some concessions can even be prolonged to chose teams of consumers, similar to married couples with a minimum of one Singaporean partner who are purchasing their second property so long as they intend to promote their first residential property. Lower the LTV limit on housing loans granted by monetary establishments regulated by MAS from 70% to 60% for property purchasers who are individuals with a number of outstanding housing loans on the time of the brand new housing purchase. Singapore Property Measures - 30 August 2010 The most popular seek for the number of bedrooms in Singapore is 4, followed by 2 and three. Lush Acres EC @ Sengkang

Discover out more about real estate funding in the area, together with info on international funding incentives and property possession. Many Singaporeans have been investing in property across the causeway in recent years, attracted by comparatively low prices. However, those who need to exit their investments quickly are likely to face significant challenges when trying to sell their property – and could finally be stuck with a property they can't sell. Career improvement programmes, in-house valuation, auctions and administrative help, venture advertising and marketing, skilled talks and traisning are continuously planned for the sales associates to help them obtain better outcomes for his or her shoppers while at Knight Frank Singapore. No change Present Rules

Extending the tax exemption would help. The exemption, which may be as a lot as $2 million per family, covers individuals who negotiate a principal reduction on their existing mortgage, sell their house short (i.e., for lower than the excellent loans), or take part in a foreclosure course of. An extension of theexemption would seem like a common-sense means to assist stabilize the housing market, but the political turmoil around the fiscal-cliff negotiations means widespread sense could not win out. Home Minority Chief Nancy Pelosi (D-Calif.) believes that the mortgage relief provision will be on the table during the grand-cut price talks, in response to communications director Nadeam Elshami. Buying or promoting of blue mild bulbs is unlawful.

A vendor's stamp duty has been launched on industrial property for the primary time, at rates ranging from 5 per cent to 15 per cent. The Authorities might be trying to reassure the market that they aren't in opposition to foreigners and PRs investing in Singapore's property market. They imposed these measures because of extenuating components available in the market." The sale of new dual-key EC models will even be restricted to multi-generational households only. The models have two separate entrances, permitting grandparents, for example, to dwell separately. The vendor's stamp obligation takes effect right this moment and applies to industrial property and plots which might be offered inside three years of the date of buy. JLL named Best Performing Property Brand for second year running

The data offered is for normal info purposes only and isn't supposed to be personalised investment or monetary advice. Motley Fool Singapore contributor Stanley Lim would not personal shares in any corporations talked about. Singapore private home costs increased by 1.eight% within the fourth quarter of 2012, up from 0.6% within the earlier quarter. Resale prices of government-built HDB residences which are usually bought by Singaporeans, elevated by 2.5%, quarter on quarter, the quickest acquire in five quarters. And industrial property, prices are actually double the levels of three years ago. No withholding tax in the event you sell your property. All your local information regarding vital HDB policies, condominium launches, land growth, commercial property and more

There are various methods to go about discovering the precise property. Some local newspapers (together with the Straits Instances ) have categorised property sections and many local property brokers have websites. Now there are some specifics to consider when buying a 'new launch' rental. Intended use of the unit Every sale begins with 10 p.c low cost for finish of season sale; changes to 20 % discount storewide; follows by additional reduction of fiftyand ends with last discount of 70 % or extra. Typically there is even a warehouse sale or transferring out sale with huge mark-down of costs for stock clearance. Deborah Regulation from Expat Realtor shares her property market update, plus prime rental residences and houses at the moment available to lease Esparina EC @ Sengkang - ↑ Kahneman, Daniel, and Amos Tversky. "Rational Choice and the Framing of Decisions." The Journal of Business 2nd ser. 59.4 (1986): 251-78

- ↑ Fishburn, Peter C., and Gary A. Kochenberger. "Two-Piece Von Neumann-Morgenstern Utility Functions." Decision Sciences 10.4 (1979): 503-18. Wiley

- ↑ Kahneman, Daniel. Thinking, fast and slow. Farrar, Straus and Giroux, 2011. (p317)