Main Page: Difference between revisions

No edit summary |

No edit summary |

||

| Line 1: | Line 1: | ||

{{ | {{General relativity sidebar |fundamentals}} | ||

In physics, the '''world line''' of an object is the unique path of that object as it travels through 4-[[dimension]]al [[spacetime]]. The concept of "world line" is distinguished from the concept of "orbit" or "trajectory" (such as an ''orbit in space'' or a ''trajectory'' of a truck on a road map) by the ''time'' dimension, and typically encompasses a large area of spacetime wherein [[perception|perceptually]] straight paths are recalculated to show their (relatively) more absolute position states — to reveal the nature of [[special relativity]] or [[gravitation]]al interactions. The idea of world lines originates in [[physics]] and was pioneered by [[Hermann Minkowski]]. The term is now most often used in relativity theories (i.e., [[special relativity]] and [[general relativity]]). | |||

However, world lines are a general way of representing the course of events. The use of it is not bound to any specific theory. Thus in general usage, a world line is the sequential path of personal human events (with ''time'' and ''place'' as dimensions) that marks the history of a person<ref>[[George Gamow]] (1970) ''My World Line: An Informal Autobiography'', [[Viking Press]], ISBN 0-670-50376-2</ref> — perhaps starting at the time and place of one's birth until one's death. The log book of a ship is a description of the ship's world line, as long as it contains a time tag attached to every position. The world line allows one to calculate the speed of the ship, given a measure of distance (a so-called metric) appropriate for the curved surface of the [[Earth]]. | |||

==Usage in physics== | |||

In [[physics]], a world line of an object (approximated as a point in space, e.g., a particle or observer) is the sequence of [[spacetime]] events corresponding to the history of the object. A world line is a special type of curve in spacetime. Below an equivalent definition will be explained: A world line is a time-like curve in spacetime. Each point of a world line is an event that can be labeled with the time and the spatial position of the object at that time. | |||

For example, the ''orbit'' of the Earth in space is approximately a circle, a three-dimensional (closed) curve in space: the Earth returns every year to the same point in space. However, it arrives there at a different (later) time. The ''world line'' of the Earth is [[helix|helical]] in spacetime (a curve in a four-dimensional space) and does not return to the same point. | |||

Spacetime is the collection of points called [[event (relativity)|events]], together with a continuous and smooth coordinate system identifying the events. Each event can be labeled by four numbers: a time coordinate and three space coordinates; thus spacetime is a four-dimensional space. The mathematical term for spacetime is a four-dimensional [[manifold]]. The concept may be applied as well to a higher-dimensional space. For easy visualizations of four dimensions, two space coordinates are often suppressed. The event is then represented by a point in a [[Minkowski diagram]], which is a plane usually plotted with the time coordinate, say <math>t</math>, upwards and the space coordinate, say <math>x</math> horizontally. | |||

As expressed by F.R. Harvey | |||

:''' | :A curve M in [spacetime] is called a ''worldline of a particle'' if its tangent is future timelike at each point. The arclength parameter is called [[proper time]] and usually denoted τ. The length of M is called the ''proper time'' of the worldline or particle. If the worldline M is a line segment, then the particle is said to be in [[free fall]].<ref>F. Reese Harvey (1990) ''Spinors and calibrations'', pages 62,3, [[Academic Press]], ISBN 0-12-329650-1</ref> | ||

A world line traces out the path of a single point in spacetime. A [[world sheet]] is the analogous two-dimensional surface traced out by a one-dimensional line (like a string) traveling through spacetime. The world sheet of an open string (with loose ends) is a strip; that of a closed string (a loop) is a volume. | |||

Once the object is not approximated as a mere point but has extended volume, it traces out not a ''world line'' but rather a [[world tube]]. | |||

==World lines as a tool to describe events== | |||

[[Image:Brane-wlwswv.png|300px|right|thumb|World line, worldsheet, and world volume, as they are derived from [[elementary particle|particles]], [[string theory|strings]], and [[Membrane (M-theory)|brane]]s.]] | |||

A one-dimensional ''line'' or ''curve'' can be represented by the coordinates as a function of one parameter. Each value of the parameter corresponds to a point in spacetime and varying the parameter traces out a line. So in mathematical terms a curve is defined by four coordinate functions <math>x^a(\tau),\; a=0,1,2,3</math> (where <math>x^{0}</math> usually denotes the time coordinate) depending on one parameter <math>\tau</math>. A coordinate grid in spacetime is the set of curves one obtains if three out of four coordinate functions are set to a constant. | |||

Sometimes, the term '''world line''' is loosely used for ''any'' curve in spacetime. This terminology causes confusions. More properly, a '''world line''' is a curve in spacetime which traces out the ''(time) history'' of a particle, observer or small object. One usually takes the [[proper time]] of an object or an observer as the curve parameter <math>\tau</math> along the world line. | |||

===Trivial examples of spacetime curves=== | |||

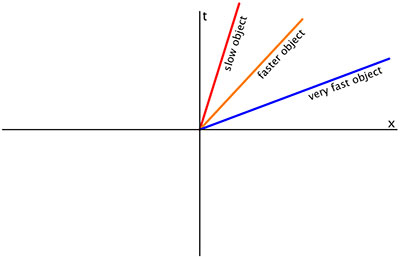

[[Image:Worldlines1.jpg|frame|Three different world lines representing travel at different constant speeds. ''t'' is time and ''x'' distance.]] | |||

A curve that consists of a horizontal line segment (a line at constant coordinate time), may represent a rod in spacetime and would not be a world line in the proper sense. The parameter traces the length of the rod. | |||

A line at constant space coordinate (a vertical line in the convention adopted above) may represent a particle at rest (or a stationary observer). A tilted line represents a particle with a constant coordinate speed (constant change in space coordinate with increasing time coordinate). The more the line is tilted from the vertical, the larger the speed. | |||

Two world lines that start out separately and then intersect, signify a ''collision'' or "encounter." Two world lines starting at the same event in spacetime, each following its own path afterwards, may represent the decay of a particle into two others or the emission of one particle by another. | |||

World lines of a particle and an observer may be interconnected with the world line of a photon (the path of light) and form a diagram which depicts the emission of a photon by a particle which is subsequently observed by the observer (or absorbed by another particle). | |||

:<math> | ===Tangent vector to a world line, four-velocity=== | ||

The four coordinate functions <math>x^a(\tau),\; a=0,1,2,3</math> | |||

defining a world line, are real functions of a real variable <math>\tau</math> and can simply be differentiated in the usual calculus. Without the existence of a metric (this is important to realize) one can speak of the difference between a point <math>p</math> on the curve at the parameter value <math>\tau_0</math> and a point on the curve a little (parameter <math>\tau_0+\Delta\tau</math>) farther away. In the limit <math>\Delta\tau\rightarrow 0</math>, this difference divided by <math>\Delta\tau</math> defines a vector, the '''tangent vector''' of the world line at the point <math>p</math>. It is a four-dimensional vector, defined in the point <math>p</math>. It is associated with the normal 3-dimensional velocity of the object (but it is not the same) and therefore called '''four-velocity''' <math>\vec{v}</math>, or in components: | |||

:<math>\vec{v} = (v^0,v^1,v^2,v^3) = \left( \frac{dx^0}{d\tau}\;,\frac{dx^1}{d\tau}\;, \frac{dx^2}{d\tau}\;, \frac{dx^3}{d\tau} \right)</math> | |||

where the derivatives are taken at the point <math>p</math>, so at <math>\tau=\tau_0</math>. | |||

The | All curves through point p have a tangent vector, not only world lines. The sum of two vectors is again a tangent vector to some other curve and the same holds for multiplying by a scalar. Therefore all tangent vectors in a point p span a [[linear space]], called the [[tangent space]] at point p. For example, taking a 2-dimensional space, like the (curved) surface of the Earth, its tangent space at a specific point would be the flat approximation of the curved space. | ||

==World lines in special relativity== | |||

So far a world line (and the concept of tangent vectors) has been described without a means of quantifying the interval between events. The basic mathematics is as follows: The theory of [[special relativity]] puts some constraints on possible world lines. In special relativity the description of [[spacetime]] is limited to ''special'' coordinate systems that do not accelerate (and so do not rotate either), called [[inertial frame of reference|inertial coordinate system]]s. In such coordinate systems, the [[speed of light]] is a constant. The structure of spacetime is determined by a [[bilinear form]] η which gives a [[real number]] for each pair of events. The bilinear form is sometimes called a ''spacetime metric'', but since distinct events sometimes result in a zero value, unlike metrics in [[metric space]]s of mathematics, the bilinear form is ''not'' a mathematical metric on spacetime. | |||

World lines of particles/objects at constant speed are called [[geodesic]]s. In special relativity these are straight lines in Minkowski space. | |||

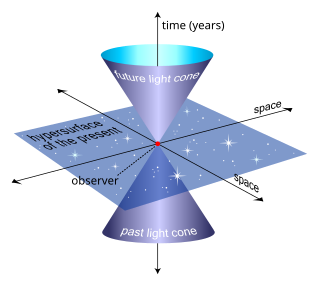

Often the time units are chosen such that the speed of light is represented by lines at a fixed angle, usually at 45 degrees, forming a cone with the vertical (time) axis. In general, curves in spacetime can be of three types: | |||

* '''light-like''' curves, having at each point the speed of light. They form a cone in spacetime, dividing it into two parts. The cone is three-dimensional in spacetime, appears as a line in drawings with two dimensions suppressed, and as a cone in drawings with one spatial dimension suppressed. | |||

[[Image:World line2.svg|right|thumb|320px|An example of a [[light cone]], the three-dimensional surface of all possible light rays arriving at and departing from a point in spacetime. Here, it is depicted with one spatial dimension suppressed.]] | |||

* '''time-like''' curves, with a speed less than the speed of light. These curves must fall within a cone defined by light-like curves. In our definition above: '''world lines are time-like curves in spacetime'''. | |||

* '''space-like''' curves falling outside the light cone. Such curves may describe, for example, the length of a physical object. The circumference of a cylinder and the length of a rod are space-like curves. | |||

At a given event on a world line, spacetime ([[Minkowski space]]) is divided into three parts. | |||

* The '''future''' of the given event is formed by all events that can be reached through time-like curves lying within the future light cone. | |||

* The '''past''' of the given event is formed by all events that can influence the event (that is, which can be connected by world lines within the past [[light cone]] to the given event). | |||

* The '''lightcone''' at the given event is formed by all events that can be connected through light rays with the event. When we observe the sky at night, we basically see only the past [[light cone]] within the entire spacetime. | |||

* '''Elsewhere''' is the region between the two light cones. Points in an observer's '''elsewhere''' are inaccessible to her/him; only points in the past can send signals to the observer. In ordinary laboratory experience, using common units and methods of measurement, it may seem that we look at the present, but in fact there is always a delay time for light to propagate. For example, we see the [[Sun]] as it was about 8 minutes ago, not as it is "right now." Unlike the '''present''' in Galilean/Newtonian theory, the '''elsewhere''' is thick; it is not a 3-dimensional volume but is instead a 4-dimensional spacetime region. | |||

** Included in "elsewhere" is the '''simultaneous hyperplane''', which is defined for a given observer by a [[space]] which is [[hyperbolic-orthogonal]] to her/his world line. It is really three-dimensional, though it would be a 2-plane in the diagram because we had to throw away one dimension to make an intelligible picture. Although the light cones are the same for all observers at a given spacetime event, different observers, with differing velocities but coincident at the event (point) in the spacetime, have world lines that cross each other at an angle determined by their relative velocities, and thus they have different simultaneous hyperplanes. | |||

** The '''present''' often means the single spacetime event being considered. | |||

===Simultaneous hyperplane=== | |||

Since a world line <math>\scriptstyle w(\tau) \isin R^4</math> determines a velocity 4-vector <math>\scriptstyle v = \frac {dw}{d\tau}</math> that is time-like, the Minkowski form <math>\scriptstyle \eta(v,x)</math> determines a linear function <math>\scriptstyle R^4 \rarr R</math> by <math>\scriptstyle x \mapsto \eta( v , x ) .</math> Let ''N'' be the [[kernel (linear algebra)|null space]] of this linear functional. Then ''N'' is called the '''simultaneous hyperplane''' with respect to ''v''. The [[relativity of simultaneity]] is a statement that ''N'' depends on ''v''. Indeed, ''N'' is the [[orthogonal complement]] of ''v'' with respect to η. | |||

When two world lines ''u'' and ''w'' are related by <math>\scriptstyle \frac {du}{d\tau} = \frac {dw}{d\tau}, </math> then they share the same simultaneous hyperplane. This hyperplane exists mathematically, but physical relations in relativity involve the movement of information by light. For instance, the traditional electro-static force described by [[Coulomb's law]] may be pictured in a simultaneous hyperplane, but relativistic relations of charge and force involve [[retarded potential]]s. | |||

==World lines in general relativity== | |||

The use of world lines in [[general relativity]] is basically the same as in special relativity, with the difference that [[spacetime]] can be [[curvature|curved]]. A [[metric tensor|metric]] exists and its dynamics are determined by the [[Einstein field equations]] and are dependent on the mass distribution in spacetime. Again the metric defines [[lightlike]] (null), [[spacelike]] and [[timelike]] curves. Also, in general relativity, world lines are [[timelike]] curves in spacetime, where [[timelike]] curves fall within the lightcone. However, a lightcone is not necessarily inclined at 45 degrees to the time axis. However, this is an artifact of the chosen coordinate system, and reflects the coordinate freedom ([[diffeomorphism invariance]]) of general relativity. Any [[timelike]] curve admits a [[Proper frame|comoving observer]] whose "time axis" corresponds to that curve, and, since no observer is privileged, we can always find a local coordinate system in which lightcones are inclined at 45 degrees to the time axis. See also for example [[Eddington-Finkelstein coordinates]]. | |||

World lines of free-falling particles or objects (such as planets around the Sun or an astronaut in space) are called [[geodesic]]s. | |||

=== | ==World lines in literature== | ||

A popular description of human world lines was given by [[J. C. Fields]] at the [[University of Toronto]] in the early days of relativity. As described by Toronto lawyer Norman Robertson: | |||

:I remember [Fields] lecturing at one of the Saturday evening lectures at the [[Royal Canadian Institute]]. It was advertised to be a "Mathematical Fantasy" — and it was! The substance of the exercise was as follows: He postulated that, commencing with his birth, every human being had some kind of spiritual aura with a long filament or thread attached, that travelled behind him throughout his life. He then proceeded in imagination to describe the complicated entanglement every individual became involved in his relationship to other individuals, comparing the simple entanglements of youth to those complicated knots that develop in later life.<ref>[[Gilbert de Beauregard Robinson]] (1979) ''The Mathematics Department in the University of Toronto'', p. 19, [[University of Toronto Press]] ISBN 0-7727-1600-5</ref> | |||

Because they oversimplify world lines, which traverse four-dimensional spacetime, into one-dimensional timelines, almost all purported science-fiction stories about [[time travel]] are actually wishful fantasy stories. Some device or superpowered person is generally portrayed as departing from one point in time, and with little or no subjective lag, arriving at some other point in time — but at the same literally geographic point in space, typically inside a workshop or near some historic site. However, in reality the planet, its solar system, and its galaxy would all be at vastly different spatial positions on arrival. Thus, the time travel mechanism would also have to provide instantaneous teleportation, with infinitely accurate and simultaneous adjustment of final 3D location, linear momentum, and angular momentum. | |||

World lines appeared in [[Jeffrey Rowland]]'s webcomic ''Wigu Adventures'' as part of the "Magical Adventures in Space" side story line, in which Topato Potato and Sheriff Pony accidentally delete a world line relating to the initial creation of Earth from [[asteroid]]s, causing the Earth to never have existed. According to this webcomic, calculating the exact coordinates of a world line is "embarrassingly simple", and the deletion of the world line specified is executed by making a call and entering the coordinates of the world line, and pressing 3.<ref>{{cite web|title=Wigu Adventures|chapter=Day 6 (The Multiverse, The Pool, and Elves)|url=http://www.wigucomics.com/adventures/index.php?comic=498|publisher=[[TopatoCo]]}}</ref> | |||

Author [[Oliver Franklin]] published a [[science fiction]] work in 2008 entitled ''World Lines'' in which he related a simplified explanation of the hypothesis for laymen.<ref name=Franklin>{{Cite book|title=World Lines |author=Oliver Franklin |isbn=1-906557-00-4 |year=2008 |publisher=Epic Press}}</ref> | |||

In the short story ''[[Life-Line]]'', author [[Robert A. Heinlein]] describes the world line of a person:<ref>{{Cite web|title=Technovelgy: Chronovitameter |url=http://www.technovelgy.com/ct/content.asp?Bnum=1851 |accessdate= 8 September 2010}}</ref> | |||

:He stepped up to one of the reporters. "Suppose we take you as an example. Your name is Rogers, is it not? Very well, Rogers, you are a space-time event having duration four ways. You are not quite six feet tall, you are about twenty inches wide and perhaps ten inches thick. In time, there stretches behind you more of this space-time event, reaching to perhaps nineteen-sixteen, of which we see a cross-section here at right angles to the time axis, and as thick as the present. At the far end is a baby, smelling of sour milk and drooling its breakfast on its bib. At the other end lies, perhaps, an old man someplace in the nineteen-eighties. | |||

: | :"Imagine this space-time event that we call Rogers as a long pink worm, continuous through the years, one end in his mother's womb, and the other at the grave..." | ||

Heinlein's ''[[Methuselah's Children]]'' uses the term, as does [[James Blish]]'s ''[[The Quincunx of Time]]'' (expanded from "Beep"). | |||

The | |||

A [[visual novel]] named [[Steins;Gate]], produced by [[5pb.]], tells a story based on the shifting of world lines. Its series of works under the name ''[[hypothetical science ADV]]'' also utilized the concept. | |||

==See also== | |||

* Specific types of world lines | |||

# | ** [[Geodesic]]s | ||

** [[Closed timelike curve]]s | |||

** [[Causal structure#Curves|Causal structure]], curves that represent a variety of different types of world line | |||

* [[Feynman Diagram]] | |||

* [[Time geography]] | |||

=== | ==References== | ||

{{Reflist}} | |||

*{{Citation|author=Minkowski, Hermann|year=1909|title=[[s:de:Raum und Zeit (Minkowski)|Raum und Zeit]]|journal=Physikalische Zeitschrift|volume=10|pages=75–88}} | |||

:*Various English translations on Wikisource: [[s:Space and Time|Space and Time]] | |||

* [[Ludwik Silberstein]] (1914) ''Theory of Relativity'', p 130, [[Macmillan and Company]]. | |||

==External links== | |||

*[http://www.bbc.co.uk/dna/h2g2/A3086039 World lines] article on [[h2g2]]. | |||

{{Use dmy dates|date=September 2010}} | |||

* [http://richardhaskell.com/files/Special%20Relativity%20and%20Maxwells%20Equations.pdf in depth text on world lines and special relativity] | |||

{{Relativity}} | |||

{{DEFAULTSORT:World Line}} | |||

[[Category:Theory of relativity]] | |||

[[Category:Minkowski spacetime]] | |||

[[Category:Time]] | |||

{{DEFAULTSORT: | |||

[[Category: | |||

[[Category: | |||

[[Category:Time | |||

Revision as of 08:35, 10 August 2014

Template:General relativity sidebar

In physics, the world line of an object is the unique path of that object as it travels through 4-dimensional spacetime. The concept of "world line" is distinguished from the concept of "orbit" or "trajectory" (such as an orbit in space or a trajectory of a truck on a road map) by the time dimension, and typically encompasses a large area of spacetime wherein perceptually straight paths are recalculated to show their (relatively) more absolute position states — to reveal the nature of special relativity or gravitational interactions. The idea of world lines originates in physics and was pioneered by Hermann Minkowski. The term is now most often used in relativity theories (i.e., special relativity and general relativity).

However, world lines are a general way of representing the course of events. The use of it is not bound to any specific theory. Thus in general usage, a world line is the sequential path of personal human events (with time and place as dimensions) that marks the history of a person[1] — perhaps starting at the time and place of one's birth until one's death. The log book of a ship is a description of the ship's world line, as long as it contains a time tag attached to every position. The world line allows one to calculate the speed of the ship, given a measure of distance (a so-called metric) appropriate for the curved surface of the Earth.

Usage in physics

In physics, a world line of an object (approximated as a point in space, e.g., a particle or observer) is the sequence of spacetime events corresponding to the history of the object. A world line is a special type of curve in spacetime. Below an equivalent definition will be explained: A world line is a time-like curve in spacetime. Each point of a world line is an event that can be labeled with the time and the spatial position of the object at that time.

For example, the orbit of the Earth in space is approximately a circle, a three-dimensional (closed) curve in space: the Earth returns every year to the same point in space. However, it arrives there at a different (later) time. The world line of the Earth is helical in spacetime (a curve in a four-dimensional space) and does not return to the same point.

Spacetime is the collection of points called events, together with a continuous and smooth coordinate system identifying the events. Each event can be labeled by four numbers: a time coordinate and three space coordinates; thus spacetime is a four-dimensional space. The mathematical term for spacetime is a four-dimensional manifold. The concept may be applied as well to a higher-dimensional space. For easy visualizations of four dimensions, two space coordinates are often suppressed. The event is then represented by a point in a Minkowski diagram, which is a plane usually plotted with the time coordinate, say , upwards and the space coordinate, say horizontally. As expressed by F.R. Harvey

- A curve M in [spacetime] is called a worldline of a particle if its tangent is future timelike at each point. The arclength parameter is called proper time and usually denoted τ. The length of M is called the proper time of the worldline or particle. If the worldline M is a line segment, then the particle is said to be in free fall.[2]

A world line traces out the path of a single point in spacetime. A world sheet is the analogous two-dimensional surface traced out by a one-dimensional line (like a string) traveling through spacetime. The world sheet of an open string (with loose ends) is a strip; that of a closed string (a loop) is a volume.

Once the object is not approximated as a mere point but has extended volume, it traces out not a world line but rather a world tube.

World lines as a tool to describe events

A one-dimensional line or curve can be represented by the coordinates as a function of one parameter. Each value of the parameter corresponds to a point in spacetime and varying the parameter traces out a line. So in mathematical terms a curve is defined by four coordinate functions (where usually denotes the time coordinate) depending on one parameter . A coordinate grid in spacetime is the set of curves one obtains if three out of four coordinate functions are set to a constant.

Sometimes, the term world line is loosely used for any curve in spacetime. This terminology causes confusions. More properly, a world line is a curve in spacetime which traces out the (time) history of a particle, observer or small object. One usually takes the proper time of an object or an observer as the curve parameter along the world line.

Trivial examples of spacetime curves

A curve that consists of a horizontal line segment (a line at constant coordinate time), may represent a rod in spacetime and would not be a world line in the proper sense. The parameter traces the length of the rod.

A line at constant space coordinate (a vertical line in the convention adopted above) may represent a particle at rest (or a stationary observer). A tilted line represents a particle with a constant coordinate speed (constant change in space coordinate with increasing time coordinate). The more the line is tilted from the vertical, the larger the speed.

Two world lines that start out separately and then intersect, signify a collision or "encounter." Two world lines starting at the same event in spacetime, each following its own path afterwards, may represent the decay of a particle into two others or the emission of one particle by another.

World lines of a particle and an observer may be interconnected with the world line of a photon (the path of light) and form a diagram which depicts the emission of a photon by a particle which is subsequently observed by the observer (or absorbed by another particle).

Tangent vector to a world line, four-velocity

The four coordinate functions defining a world line, are real functions of a real variable and can simply be differentiated in the usual calculus. Without the existence of a metric (this is important to realize) one can speak of the difference between a point on the curve at the parameter value and a point on the curve a little (parameter ) farther away. In the limit , this difference divided by defines a vector, the tangent vector of the world line at the point . It is a four-dimensional vector, defined in the point . It is associated with the normal 3-dimensional velocity of the object (but it is not the same) and therefore called four-velocity , or in components:

where the derivatives are taken at the point , so at .

All curves through point p have a tangent vector, not only world lines. The sum of two vectors is again a tangent vector to some other curve and the same holds for multiplying by a scalar. Therefore all tangent vectors in a point p span a linear space, called the tangent space at point p. For example, taking a 2-dimensional space, like the (curved) surface of the Earth, its tangent space at a specific point would be the flat approximation of the curved space.

World lines in special relativity

So far a world line (and the concept of tangent vectors) has been described without a means of quantifying the interval between events. The basic mathematics is as follows: The theory of special relativity puts some constraints on possible world lines. In special relativity the description of spacetime is limited to special coordinate systems that do not accelerate (and so do not rotate either), called inertial coordinate systems. In such coordinate systems, the speed of light is a constant. The structure of spacetime is determined by a bilinear form η which gives a real number for each pair of events. The bilinear form is sometimes called a spacetime metric, but since distinct events sometimes result in a zero value, unlike metrics in metric spaces of mathematics, the bilinear form is not a mathematical metric on spacetime.

World lines of particles/objects at constant speed are called geodesics. In special relativity these are straight lines in Minkowski space.

Often the time units are chosen such that the speed of light is represented by lines at a fixed angle, usually at 45 degrees, forming a cone with the vertical (time) axis. In general, curves in spacetime can be of three types:

- light-like curves, having at each point the speed of light. They form a cone in spacetime, dividing it into two parts. The cone is three-dimensional in spacetime, appears as a line in drawings with two dimensions suppressed, and as a cone in drawings with one spatial dimension suppressed.

- time-like curves, with a speed less than the speed of light. These curves must fall within a cone defined by light-like curves. In our definition above: world lines are time-like curves in spacetime.

- space-like curves falling outside the light cone. Such curves may describe, for example, the length of a physical object. The circumference of a cylinder and the length of a rod are space-like curves.

At a given event on a world line, spacetime (Minkowski space) is divided into three parts.

- The future of the given event is formed by all events that can be reached through time-like curves lying within the future light cone.

- The past of the given event is formed by all events that can influence the event (that is, which can be connected by world lines within the past light cone to the given event).

- The lightcone at the given event is formed by all events that can be connected through light rays with the event. When we observe the sky at night, we basically see only the past light cone within the entire spacetime.

- Elsewhere is the region between the two light cones. Points in an observer's elsewhere are inaccessible to her/him; only points in the past can send signals to the observer. In ordinary laboratory experience, using common units and methods of measurement, it may seem that we look at the present, but in fact there is always a delay time for light to propagate. For example, we see the Sun as it was about 8 minutes ago, not as it is "right now." Unlike the present in Galilean/Newtonian theory, the elsewhere is thick; it is not a 3-dimensional volume but is instead a 4-dimensional spacetime region.

- Included in "elsewhere" is the simultaneous hyperplane, which is defined for a given observer by a space which is hyperbolic-orthogonal to her/his world line. It is really three-dimensional, though it would be a 2-plane in the diagram because we had to throw away one dimension to make an intelligible picture. Although the light cones are the same for all observers at a given spacetime event, different observers, with differing velocities but coincident at the event (point) in the spacetime, have world lines that cross each other at an angle determined by their relative velocities, and thus they have different simultaneous hyperplanes.

- The present often means the single spacetime event being considered.

Simultaneous hyperplane

Since a world line determines a velocity 4-vector that is time-like, the Minkowski form determines a linear function by Let N be the null space of this linear functional. Then N is called the simultaneous hyperplane with respect to v. The relativity of simultaneity is a statement that N depends on v. Indeed, N is the orthogonal complement of v with respect to η. When two world lines u and w are related by then they share the same simultaneous hyperplane. This hyperplane exists mathematically, but physical relations in relativity involve the movement of information by light. For instance, the traditional electro-static force described by Coulomb's law may be pictured in a simultaneous hyperplane, but relativistic relations of charge and force involve retarded potentials.

World lines in general relativity

The use of world lines in general relativity is basically the same as in special relativity, with the difference that spacetime can be curved. A metric exists and its dynamics are determined by the Einstein field equations and are dependent on the mass distribution in spacetime. Again the metric defines lightlike (null), spacelike and timelike curves. Also, in general relativity, world lines are timelike curves in spacetime, where timelike curves fall within the lightcone. However, a lightcone is not necessarily inclined at 45 degrees to the time axis. However, this is an artifact of the chosen coordinate system, and reflects the coordinate freedom (diffeomorphism invariance) of general relativity. Any timelike curve admits a comoving observer whose "time axis" corresponds to that curve, and, since no observer is privileged, we can always find a local coordinate system in which lightcones are inclined at 45 degrees to the time axis. See also for example Eddington-Finkelstein coordinates.

World lines of free-falling particles or objects (such as planets around the Sun or an astronaut in space) are called geodesics.

World lines in literature

A popular description of human world lines was given by J. C. Fields at the University of Toronto in the early days of relativity. As described by Toronto lawyer Norman Robertson:

- I remember [Fields] lecturing at one of the Saturday evening lectures at the Royal Canadian Institute. It was advertised to be a "Mathematical Fantasy" — and it was! The substance of the exercise was as follows: He postulated that, commencing with his birth, every human being had some kind of spiritual aura with a long filament or thread attached, that travelled behind him throughout his life. He then proceeded in imagination to describe the complicated entanglement every individual became involved in his relationship to other individuals, comparing the simple entanglements of youth to those complicated knots that develop in later life.[3]

Because they oversimplify world lines, which traverse four-dimensional spacetime, into one-dimensional timelines, almost all purported science-fiction stories about time travel are actually wishful fantasy stories. Some device or superpowered person is generally portrayed as departing from one point in time, and with little or no subjective lag, arriving at some other point in time — but at the same literally geographic point in space, typically inside a workshop or near some historic site. However, in reality the planet, its solar system, and its galaxy would all be at vastly different spatial positions on arrival. Thus, the time travel mechanism would also have to provide instantaneous teleportation, with infinitely accurate and simultaneous adjustment of final 3D location, linear momentum, and angular momentum.

World lines appeared in Jeffrey Rowland's webcomic Wigu Adventures as part of the "Magical Adventures in Space" side story line, in which Topato Potato and Sheriff Pony accidentally delete a world line relating to the initial creation of Earth from asteroids, causing the Earth to never have existed. According to this webcomic, calculating the exact coordinates of a world line is "embarrassingly simple", and the deletion of the world line specified is executed by making a call and entering the coordinates of the world line, and pressing 3.[4]

Author Oliver Franklin published a science fiction work in 2008 entitled World Lines in which he related a simplified explanation of the hypothesis for laymen.[5]

In the short story Life-Line, author Robert A. Heinlein describes the world line of a person:[6]

- He stepped up to one of the reporters. "Suppose we take you as an example. Your name is Rogers, is it not? Very well, Rogers, you are a space-time event having duration four ways. You are not quite six feet tall, you are about twenty inches wide and perhaps ten inches thick. In time, there stretches behind you more of this space-time event, reaching to perhaps nineteen-sixteen, of which we see a cross-section here at right angles to the time axis, and as thick as the present. At the far end is a baby, smelling of sour milk and drooling its breakfast on its bib. At the other end lies, perhaps, an old man someplace in the nineteen-eighties.

- "Imagine this space-time event that we call Rogers as a long pink worm, continuous through the years, one end in his mother's womb, and the other at the grave..."

Heinlein's Methuselah's Children uses the term, as does James Blish's The Quincunx of Time (expanded from "Beep").

A visual novel named Steins;Gate, produced by 5pb., tells a story based on the shifting of world lines. Its series of works under the name hypothetical science ADV also utilized the concept.

See also

- Specific types of world lines

- Geodesics

- Closed timelike curves

- Causal structure, curves that represent a variety of different types of world line

- Feynman Diagram

- Time geography

References

43 year old Petroleum Engineer Harry from Deep River, usually spends time with hobbies and interests like renting movies, property developers in singapore new condominium and vehicle racing. Constantly enjoys going to destinations like Camino Real de Tierra Adentro.

- Many property agents need to declare for the PIC grant in Singapore. However, not all of them know find out how to do the correct process for getting this PIC scheme from the IRAS. There are a number of steps that you need to do before your software can be approved.

Naturally, you will have to pay a safety deposit and that is usually one month rent for annually of the settlement. That is the place your good religion deposit will likely be taken into account and will kind part or all of your security deposit. Anticipate to have a proportionate amount deducted out of your deposit if something is discovered to be damaged if you move out. It's best to you'll want to test the inventory drawn up by the owner, which can detail all objects in the property and their condition. If you happen to fail to notice any harm not already mentioned within the inventory before transferring in, you danger having to pay for it yourself.

In case you are in search of an actual estate or Singapore property agent on-line, you simply should belief your intuition. It's because you do not know which agent is nice and which agent will not be. Carry out research on several brokers by looking out the internet. As soon as if you end up positive that a selected agent is dependable and reliable, you can choose to utilize his partnerise in finding you a home in Singapore. Most of the time, a property agent is taken into account to be good if he or she locations the contact data on his website. This may mean that the agent does not mind you calling them and asking them any questions relating to new properties in singapore in Singapore. After chatting with them you too can see them in their office after taking an appointment.

Have handed an trade examination i.e Widespread Examination for House Brokers (CEHA) or Actual Property Agency (REA) examination, or equal; Exclusive brokers are extra keen to share listing information thus making certain the widest doable coverage inside the real estate community via Multiple Listings and Networking. Accepting a severe provide is simpler since your agent is totally conscious of all advertising activity related with your property. This reduces your having to check with a number of agents for some other offers. Price control is easily achieved. Paint work in good restore-discuss with your Property Marketing consultant if main works are still to be done. Softening in residential property prices proceed, led by 2.8 per cent decline within the index for Remainder of Central Region

Once you place down the one per cent choice price to carry down a non-public property, it's important to accept its situation as it is whenever you move in – faulty air-con, choked rest room and all. Get round this by asking your agent to incorporate a ultimate inspection clause within the possibility-to-buy letter. HDB flat patrons routinely take pleasure in this security net. "There's a ultimate inspection of the property two days before the completion of all HDB transactions. If the air-con is defective, you can request the seller to repair it," says Kelvin.

15.6.1 As the agent is an intermediary, generally, as soon as the principal and third party are introduced right into a contractual relationship, the agent drops out of the image, subject to any problems with remuneration or indemnification that he could have against the principal, and extra exceptionally, against the third occasion. Generally, agents are entitled to be indemnified for all liabilities reasonably incurred within the execution of the brokers´ authority.

To achieve the very best outcomes, you must be always updated on market situations, including past transaction information and reliable projections. You could review and examine comparable homes that are currently available in the market, especially these which have been sold or not bought up to now six months. You'll be able to see a pattern of such report by clicking here It's essential to defend yourself in opposition to unscrupulous patrons. They are often very skilled in using highly unethical and manipulative techniques to try and lure you into a lure. That you must also protect your self, your loved ones, and personal belongings as you'll be serving many strangers in your home. Sign a listing itemizing of all of the objects provided by the proprietor, together with their situation. HSR Prime Recruiter 2010

- Various English translations on Wikisource: Space and Time

- Ludwik Silberstein (1914) Theory of Relativity, p 130, Macmillan and Company.

External links

- World lines article on h2g2.

30 year-old Entertainer or Range Artist Wesley from Drumheller, really loves vehicle, property developers properties for sale in singapore singapore and horse racing. Finds inspiration by traveling to Works of Antoni Gaudí.

- ↑ George Gamow (1970) My World Line: An Informal Autobiography, Viking Press, ISBN 0-670-50376-2

- ↑ F. Reese Harvey (1990) Spinors and calibrations, pages 62,3, Academic Press, ISBN 0-12-329650-1

- ↑ Gilbert de Beauregard Robinson (1979) The Mathematics Department in the University of Toronto, p. 19, University of Toronto Press ISBN 0-7727-1600-5

- ↑ Template:Cite web

- ↑ 20 year-old Real Estate Agent Rusty from Saint-Paul, has hobbies and interests which includes monopoly, property developers in singapore and poker. Will soon undertake a contiki trip that may include going to the Lower Valley of the Omo.

My blog: http://www.primaboinca.com/view_profile.php?userid=5889534 - ↑ Template:Cite web